Why 2022 is proving a popular year for EIS investors

First introduced in 1994 with the goal of stimulating the growth of the UK’s innovative SME sector, since then the Enterprise Investment Scheme (EIS) has gone on to support an incredible 36,720 early-stage businesses, raising over £25bn of investment during that period.

And recent figures released by HMRC suggest this number is set to continue on its impressive growth path.

With 3,455 EIS applications approved in the 2021/22 tax year alone (up 12% from 2020/21), and a record £15.7 billion invested in UK venture capital in the first half of 2022 (up £1.1 billion from the previous year), the EIS has proven a popular route in an active VC environment as of late, and it isn't difficult to see why.

What is an EIS investment?

The Enterprise investment scheme is a government-backed initiative that offers investors the opportunity to benefit from a host of generous tax reliefs (including income tax relief of up to 30% on the value of your investment) alongside potentially high returns in exchange for their investment into a qualifying early-stage company.

EIS investments often appeal to experienced investors and high earners, being a form of tax-efficient investing. This means individuals can use the EIS tax reliefs to shield their capital from tax cuts, offset cuts to pension allowances and limit the effect of other forms of financial restrictions that can erode capital savings.

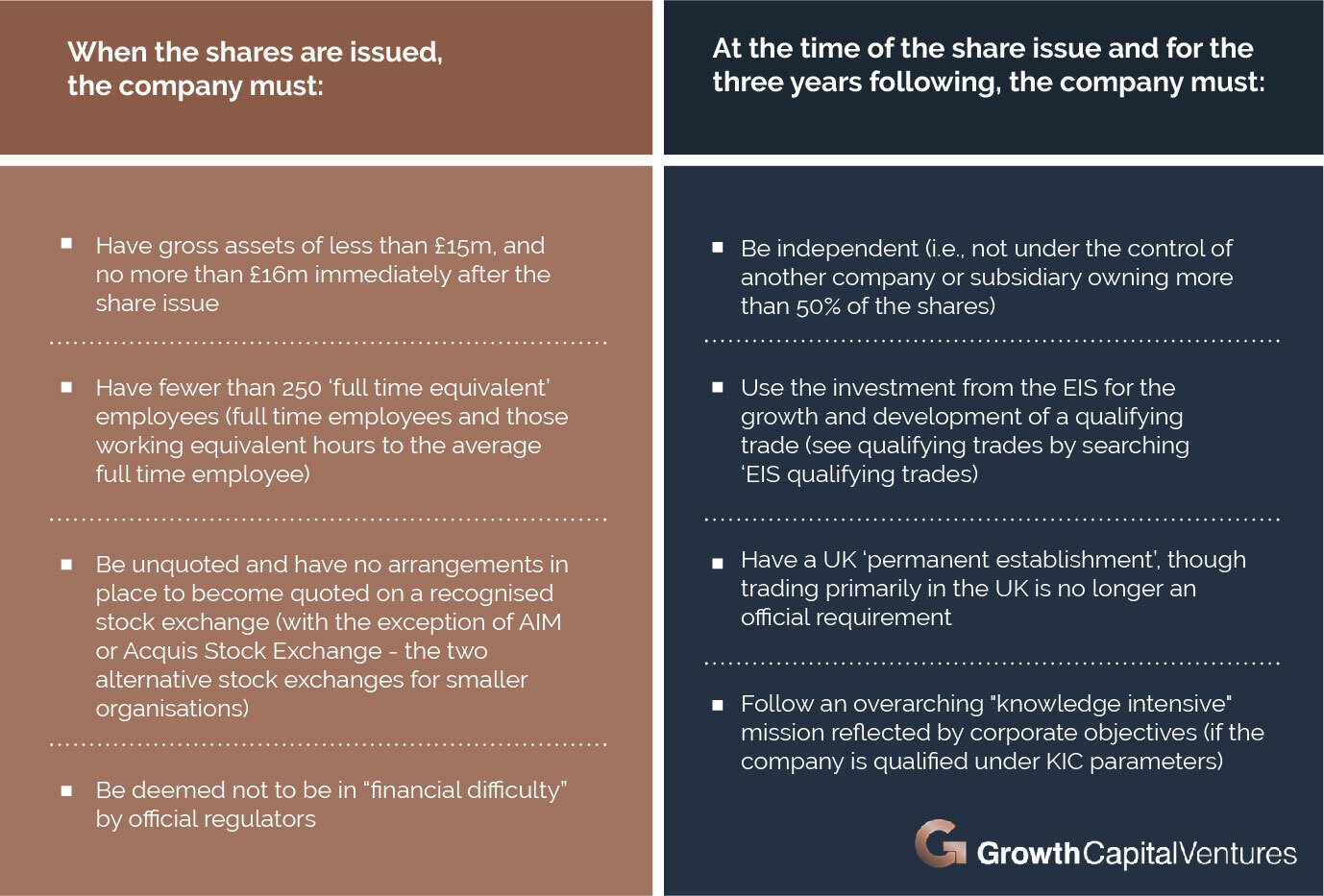

To qualify for the Enterprise Investment Scheme, companies must fulfil a number of strict requirements that ensure the suitability and potential growth of the company:

EIS-eligible investments are also often into knowledge-intensive companies (KICs) due to the scheme’s favourable raising options - the EIS permitting £10m of investment into a KIC company per year instead of £5m for non-KIC organisations, and £20m over the company’s lifetime as opposed to £12m.

To be classed as a KIC, a company must be carrying out research, significant development or innovation at the time they are issuing shares and thus provide a wider positive social, economic or environmental impact, making EIS investments particularly attractive to impact investors.

Not only can EIS investments often provide a wider social good, but the financial returns associated with the scheme can be potentially very favourable.

This is not only due to the Enterprise Investment Scheme’s requirement for companies to be classified to have 'high growth potential' before investment takes place but also because of the host of generous tax reliefs the EIS offers investors.

What tax reliefs does the EIS offer?

When answering the question of “What is an EIS investment?”, the generous tax reliefs offered by the scheme are what most investors commonly associate it with.

The tax reliefs available when investing in an EIS-eligible business include:

- Income tax relief of up to 30% - this is applicable on a maximum annual investment of £1 million, or £2 million if at least £1 million is invested into knowledge-intensive companies

- No capital gains tax when selling EIS shares - if you have held the shares for at least three years and received income tax relief in full on all of your subscriptions for the EIS shares

- Capital gains deferral - if you use a gain from the sale of any asset to make an investment into an EIS-eligible company, you do not have to pay the capital gains tax immediately

- Inheritance tax-free - after you have held your EIS investment for two years, it becomes inheritance tax-free

- Loss relief - if your EIS investment is realised at a loss, it can be offset against the same or the previous year’s income tax, or the same year’s capital gains tax

These EIS tax reliefs, and their aforementioned ability to shield capital from financial cuts, are what makes the scheme particularly attractive to high net-worth individuals in particular (with just related one example being the proposed rise in capital gains tax from 18% to 20%, which some financial analysts suggest could arrive as early as next year).

And whilst the EIS tax reliefs are widely agreed as being especially generous, it is worth highlighting that even more agreeable perks are offered by the ‘little brother of the EIS’, the Seed Enterprise Investment Scheme (SEIS).

The Seed Enterprise Scheme is targeted at startups explicitly (unlike the EIS which is aimed at more established early-stage companies) and offers extremely generous tax reliefs including up to 50% income tax relief, with these higher rates reflecting the relatively higher risk associated with investing in startups.

A popular year for EIS investing

As the dust appears to be settling after a hectic few years for businesses and individuals alike, tax-efficient investment tools targeting early-stage SMEs - such as the EIS - have proven crucial as of late

In the wake of 2019 dominated by Brexit headlines and 2020/21 consumed by the coronavirus pandemic, the significance of innovative startups and adaptive early-stage SMEs to the UK economy has never been better highlighted.

Making up 99.9% of the business population, accounting for three-fifths of employment and contributing to more than half of the annual turnover in the private sector, SMEs are a crucial component in the British business landscape.

And in a period in which the UK has been heavily reliant on the innovation and flexibility of the early stage, the processes put in place to back startups and scale-ups financially have been increasingly pivotal - this theme is no more apparent than in the tech sector.

Having generated more venture capital funding in the first 5 months of 2022 (£12.4 billion) than all of 2021 combined (£12 billion), the investor demand for UK tech startups has far outstripped what many economists predicted.

When combining this heightened level of early-stage innovation in the wake of the pandemic, with the strong willingness for growth 2021/22's EIS application figures suggest, it isn't difficult to see why.

As the potential for startups and scaleups to access innovation, growth and long-term positive impact in this period has increased, so too has interest in the schemes put in place to help investors access those benefits - such as the EIS.

Approaching the close of an encouraging year for UK venture capital investment, and with government and industry, data suggest this trend shows no sign of slowing down, investors can rest assured that the UK venture capital space - and the EIS's position within it - is in a strong position heading toward 2023.

%20(3)%20(2).jpg)