10 key points to cover when pitching to investors

As the founder of a start up business with high growth ambition, at some point in the not-too-distant future, you’ll need to raise seed capital. This money will allow you to take your start up to the next level.

Whilst there are a number of ways to do that - such as approaching individual business angels, angel networks, or early stage VCs - there’s one thing you’ll need to deliver to each: a compelling investor pitch.

Even if you're using an online equity crowdfunding platform (like GrowthFunders) to raise capital, you will find yourself with opportunities for pitching to investors 'face-to-face'. Trust me, you should grab these opportunities with both hands.

Whether you’re comfortable presenting or not isn’t the only obstacle you may be facing; perhaps more importantly, if you’ve never put a pitch together before, how do you know what investors want to hear?

This is especially important when you take into consideration time restraints, which differ, situation to situation. Sometimes, you may have 30 minutes or more with which to deliver your presentation; other times, you could be limited to just a 10 minute elevator pitch.

What information do you keep and what do you cut out? And perhaps even more worrying, what if you cut out the wrong stuff…?

Worry not – we’re here to tell you the 10 key points to cover in a successful investor pitch.

What to include in your pitch, regardless of the time limit on your presentation:

-

First thing’s first...Introductions

Introduce yourself and your business, as succinctly as possible. The amount of time you have to pitch will determine how much detail you can go into. If the investors / panel want to know more about you at this stage, they will ask you, so make sure you do have the information to hand.

-

Problem

Address a problem in the marketplace and show evidence that this problem both exists and is in desperate need of a solution.

-

Solution

Outline your solution, making sure that you highlight the “uniqueness” of your service or product. This is where you need to demostrate that your solution offers something different - something that cutomers need, want, and will buy.

-

Successes

Include your successes so far. Let the investor(s) know what stage you’re at currently and the achievements you’ve made along the way. This could include the awarding of patents, members signed up, social media following, orders placed – anything that shows that your business is gaining traction.

-

Target market

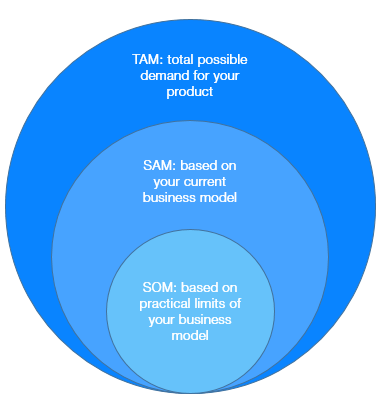

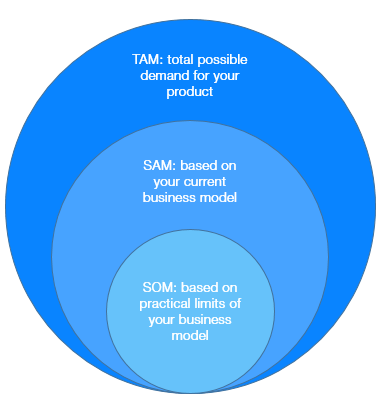

Not everyone will want your product or service, so show that you know who your target market is – which specific type of person are you targeting? There are three levels of target markets represented by the acronyms: TAM, SAM, SOM

-

TAM or Total Available Market is the total market demand for a product or service.

-

SAM or Serviceable Available Market is the segment of the TAM targeted by your products and services which is within your geographical reach.

-

SOM or Serviceable Obtainable Market is the portion of SAM that you can capture.

-

Your competition

Every business in existence has competition, be it direct or indirect. This is a great opportunity for you to give evidence of your market research. Be aware that saying you don’t have any competition at all will put a red flag up for many investors.

-

Revenue model

Explain how your business generates money. Investors want to know how you either already do, or intend to, make money and the gross margins you are forecasting. To find out more about revenue models, click here.

-

Financial projections

This is your chance to reinforce the story you’ve just told, but with more detail around the numbers. Make sure that you state how much capital you need to raise as well as the equity stake that is on offer. Other essential information you should show at this point is your pre-money and post-money valuations, your predicted burn rate, and the runway this seed round will allow you.

-

Introduce your team

Include founders, advisers, and Non Execs - briefly outlining their experience and credentials. Most investors invest in the team rather than the idea or product; they will always back an "A grade" team with a "B grade" product rather than the other way around. Make sure you can demostrate the strengths and experiece of your team.

-

Exit strategy

How you intend to exit your business and the proposed time frame gives potential investors an insight into when they could start to see a return on their investment. You can read more about the different types of exit strategies here.

Conclusion

Remember – all pitching opportunities are different. They often vary in both length and number of attendees, amongst other things, each of which may throw up their own obstacles for you. The trick (apart from practising until you’re perfect) is to make sure that you have the key points and essential elements of your investor pitch covered.

%20(3)%20(2).jpg)