Claiming tax relief on EIS eligible investments

Bringing together ambitious, innovative businesses and smart, switched-on investors is a terrific feeling.

One of the most exciting recent developments in investing has been the emergence of platforms that enable everyday investors to invest alongside experienced and institutional investors.

The co-investment model should appeal to first-time investors; the presence of investment from experienced investors provides reassurance that the investment has been scrutinised professionally.

Just like investment itself, tax incentives that encourage investment are still perceived by some as being the preserve of multi-millionaires. In fact, nothing could be further from the truth.

We’re particular fans of the Enterprise Investment Scheme (EIS) (and it's sister, the Seed Enterprise Investment Scheme - SEIS) - as the tax incentives available are extremely generous.

What do EIS-eligible investments offer me?

The EIS offers direct tax incentives to all investors. Whether you are investing £100 or £100,000, the most immediately appealing of these incentives is that you are entitled to claim tax relief to the value of 30% of your investment (provided you have paid sufficient income tax to claim this).

This means if you invest £500, you can claim back £150 provided you have paid sufficient income tax.

Although this relief is restricted, you can invest up to £1,000,000 in a financial year, so the restriction is unlikely to affect too many people.

What's more, this relief will be relinquished if you hold your investment for less than three years.

However, companies that qualify for the EIS must be relatively early-stage, and you should therefore view your investment as a longer-term commitment.

This income tax relief outlined here is just the first of five separate tax incentives available through EIS-eligible investments (you can find out about the others by downloading your free EIS e-guide.

How will I know if an investment is EIS eligible?

Reputable investment platforms are very much aware of the appeal of the EIS.

At GrowthFunders, we work with investee businesses to make them aware that achieving EIS eligibility makes it easier for them to secure the investment they need.

We then work with HMRC to confirm individual companies’ EIS eligibility.

Once EIS eligibility is confirmed and the opportunity ‘goes live’ this will be clearly identified on the listing.

How do I claim my tax relief?

Once you have confirmed your investment, you will be notified when the opportunity successfully closes (at which point your financial commitment will be required).

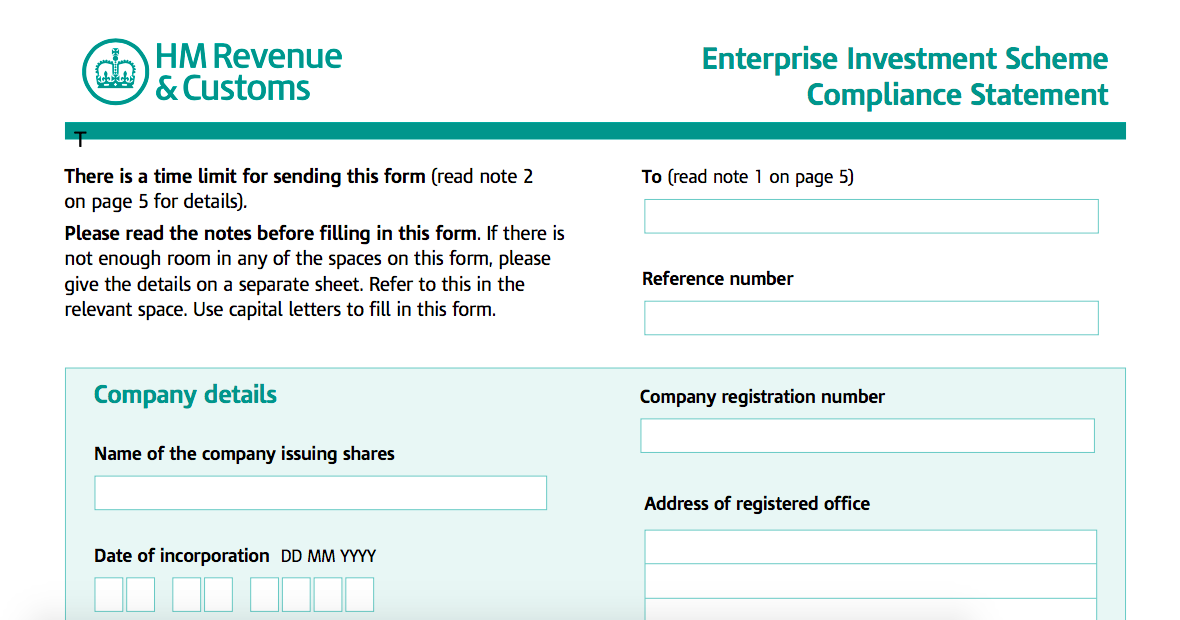

After this process is complete, you will receive an EIS3 form from the organisation appointed to act on behalf of the investee business. It is possible that this form could take up to two years to arrive, but it is typically much sooner than this.

How you proceed to claim your tax relief will depend on how your income tax is administered.

If you complete a self-assessment tax return, your EIS investment should be documented as part of the Additional Information document (SA101). You’ll find a field for your EIS investment on page Ai2, Item 2 of the Other tax reliefs section.

- If you receive your EIS3 certificate before the end of the financial year, you should simply document it on your tax return at the end of that financial year and your tax bill will be reduced accordingly.

- If you receive it after the end of the financial year, it is more likely that you will be paid the amount owed by cheque or bank transfer.

If you are paid through the PAYE system and your tax liability is calculated on your behalf, you can complete the form that accompanies your EIS3 certificate and submit this to your local tax office.

- If the date of your EIS3 certificate is within the current tax year, your tax code should be adjusted to reflect your reduced liability.

- If the date is within a previous tax year, it is more likely that you will be paid the amount owed by cheque or bank transfer.

Either way, the date of issue of your EIS3 certificate will determine when you can claim your tax relief. If it was dated 21st November 2016, you could claim tax relief in either the 2015/16 or 2016/17 financial year, or a combination of the two.

Tax efficient investing with EIS

The tax incentives available from investing in EIS opportunities are generous, and accessing them is not onerous. From making your investment through to claiming the tax reliefs themselves, the whole process can be carried out relatively quickly and stress-free.

However, we're always on hand if you have any questions and are happy to help. We're huge advocates of the Enterprise Investment Scheme for both investors and investees and always do as much as possible to make the entire investment process as easy as it can be.

%20(3)%20(2).jpg)