We are opening our doors for investment!

Growth and Expansion

GrowthCapitalVentures, the financial services and technology firm behind GrowthFunders, is expanding. The business operates in the rapidly-growing alternative finance sector. Now, GrowthCapitalVentures is set to use its own crowdfunding platform to raise capital and fund further expansion.

Formed in July 2013, GrowthCapitalVentures launched its first platform, an equity crowdfunding and co-investment marketplace, GrowthFunders, earlier this year. In just a short space of time, the platform has 90 businesses in the pipeline, who will be looking to raise in excess of £20million over the course of the next 18 months and an investor base that is growing day-by-day.

Streamlining the fundraising and investment process

GrowthFunders works to streamline both the fundraising and investment processes, which it does by enabling entrepreneurs to raise capital online and investors to invest directly into businesses.

Craig Peterson, Chief Operating Officer at Growth Capital Ventures, said: “The financial services market is changing beyond all recognition and growing at a rapid pace. The growth of financial technology – or FinTech, as it’s known has been huge in the last year and it is growing faster in the UK than in any other market in the world.

Advances in technology mean that new and disruptive businesses are now entering the financial services marketplace with something worthwhile to offer: innovative, streamlined and cost-effective solutions that are changing the face of the funding and investment marketplace.”

Alternative Finance Sector - A £1BN Marketplace

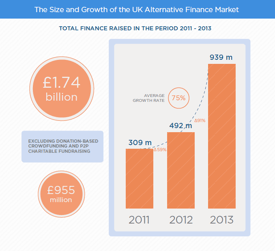

Norman Peterson, Chief Executive Officer at Growth Capital Ventures, added: “Increasingly, we’re seeing the importance of the role that alternative finance is playing in helping businesses access the money they need in order to grow, which impacts not only on themselves, but the economy as a whole. In fact, over the course of the past decade, the UK alternative finance market has more than tripled in size from £309 million in 2011 to £939 million in 2013.

Norman Peterson, Chief Executive Officer at Growth Capital Ventures, added: “Increasingly, we’re seeing the importance of the role that alternative finance is playing in helping businesses access the money they need in order to grow, which impacts not only on themselves, but the economy as a whole. In fact, over the course of the past decade, the UK alternative finance market has more than tripled in size from £309 million in 2011 to £939 million in 2013.

The sector also boasts delivery of an accumulated £1.74 billion in funding for growing SMEs the last 3 years. Alternative finance and the FinTech sector are providing businesses and investors with better value; a better way to raise capital and a better way to make direct, tax-efficient investments.”

Target Fund Raise - £150,000

On the 1st September, Growth Capital Ventures aims to raise £150,000 which will allow the firm to build upon the launch of GrowthFunders with the introduction of further platforms, which will focus upon infrastructure investment and peer to peer lending.

GrowthFunders was launched to match ambitious entrepreneurs with unique business ideas to a range of investors to create and grow innovative businesses. The site allows entrepreneurs to garner support and raise capital online from a wide range of investors, including angel networks and early stage venture capitalists (VCs).

GrowthFunders also opens up access to this growing asset class to a wider audience of suitably-qualified online angels, often referred to as the crowd, who can now experience investing alongside more experienced investors.

GrowthFunders has a wealth of experience behind it. The co-founders, Craig and Norman Peterson, are approved persons with the Financial Conduct Authority and have supported entrepreneurs raising capital, acting as mentors and providing strategic advice to a range of businesses.

Note: The GrowthCapitalVentures funding round closes on Sunday 12th October 2014.

Risk Warning

Investing in unlisted businesses (particularly start-ups and early stage) is a high risk / high return investment strategy and carries significant risks including; illiquidity, loss of capital, rarity of dividends and dilution. It should only form part a balanced investment portfolio and is targeted at investors who are sufficiently sophisticated to understand the risks involved and are capable of making their own investment decisions.

For more information please view our Risk Policy.

This page of the GrowthFunders platform has been reviewed as a financial promotion by Linear Investments Limited, which is authorised and regulated by the Financial Conduct Authority FRN: 537389. No offers of investment are made on this page, as any investment can only be made on the basis of the information provided in the pitch section by the companies concerned. Linear Investments Limited takes no responsibility for the information, recommendations or opinions made by the companies.

Investment opportunities presented on this platform are not available to retail investors.

%20(3)%20(2).jpg)