Navigating high earner tax: how to minimise your tax liability in the UK

High earner tax is the additional tax paid by individuals who earn above £50,270 annually in the UK.

If you are a high earner or an experienced investor, understanding the strategies available to assist with reducing your tax burden can play a crucial role in protecting your income.

Navigating the complexities of high earner tax can help you make informed decisions and, ultimately, minimise your overall tax liability.

Understanding high earner tax

High earner tax is imposed on individuals who earn above a certain income threshold in the UK.

In the 2023/24 tax year, the threshold for the higher rate of income tax is currently set at £50,270.

The higher rate tax band is currently set at 40% for annual income above £50,270, and this rises to 45% for annual income above £125,140.

Additionally, high earners may also be subject to other types of taxes and allowances, such as the annual allowance for pension contributions, and the tapering of the annual tax-free personal allowance for individuals with an annual income above £100,000.

Does the high earner tax apply to all types of income?

It’s important to note that high earner tax is not limited to a specific type of income.

Whether you earn your income from employment, self-employment, rental properties, investments, or any other source, if your total income exceeds the threshold, you will be subject to the higher rates of tax.

The high earner tax applies to all types of income if the total amount earned within a single tax year exceeds the threshold set by the Government, so it is important to remain up-to-date with current tax regulations.

Why are more individuals paying the highest rates of tax in 2023?

Currently, the UK is in the midst of a sharp tax-raising drive. Some of the thresholds at which an individual becomes subject to tax – or to an increased rate of tax – have been reduced.

For example, the additional rate income tax band in the 2023/24 tax year has been reduced from £150,000 to £125,140, resulting in more individuals becoming subject to the top tax band in the UK.

The share of adults paying higher rates has increased significantly over recent decades. In the 1991/92 tax year, just 3.5% of UK adults paid the 40% higher rate of income tax. By 2022/23, 11% were paying higher rates, with that figure set to reach 14% by 2027/28.

Additionally, other thresholds have been frozen until 2028 and – when in the midst of a rapid inflationary environment and a long-term trend of rising house prices – static thresholds can be used up at an increasing rate.

The combined effect of frozen and reduced thresholds is expected to see 2.5 million more UK taxpayers brought into the higher and additional income tax bands by 2027/28, with 2.1 million more people expected to pay higher-rate tax and 0.4 million more expected to become subject to additional-rate tax.

As a result, it is important for high earners to be aware of this trend and take proactive steps to manage their tax liability.

How to minimise high earner tax: some of the most popular routes

As a high earner, there are a number of strategies you can adopt to reduce your income tax liability whilst aiming to preserve and grow your capital.

Some of the main routes that high earners in the UK can opt for to maximise tax efficiency include the following:

- The Enterprise Investment Scheme (EIS)

- The Seed Enterprise Investment Scheme (SEIS)

- Venture Capital Trusts (VCTs)

- Individual Savings Accounts (ISAs)

By implementing these strategies, you are able to effectively reduce your high earner tax liability and retain a greater proportion of your income, while simultaneously targeting superior investment returns and further growing your wealth.

Utilising tax efficient investments as a high earner

Investing via certain tax efficient vehicles in the UK, such as the Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS), and Venture Capital Trusts (VCTs), can help to reduce your overall tax liability.

If you hold investments or assets that have appreciated in value or generate an income stream, careful tax planning can help minimise the associated tax liabilities. Utilising the tax allowances, exemptions, and reliefs offered by tax efficient investment schemes can help individuals optimise their tax position.

Minimising your tax bill with the EIS and SEIS

As a high earner, schemes such as the EIS and SEIS can have particular appeal, not only due to the fact that significant tax advantages can be accessed but also the potential for market-beating investment returns.

Both part of the UK Government's Venture Capital Schemes, the EIS and SEIS can help high earners minimise several of their tax bills. At the same time, the schemes target competitive investment returns, focus on supporting young, innovative UK enterprise, and offer the ability to invest in startups that aim to deliver significant positive environmental, economic and social impact.

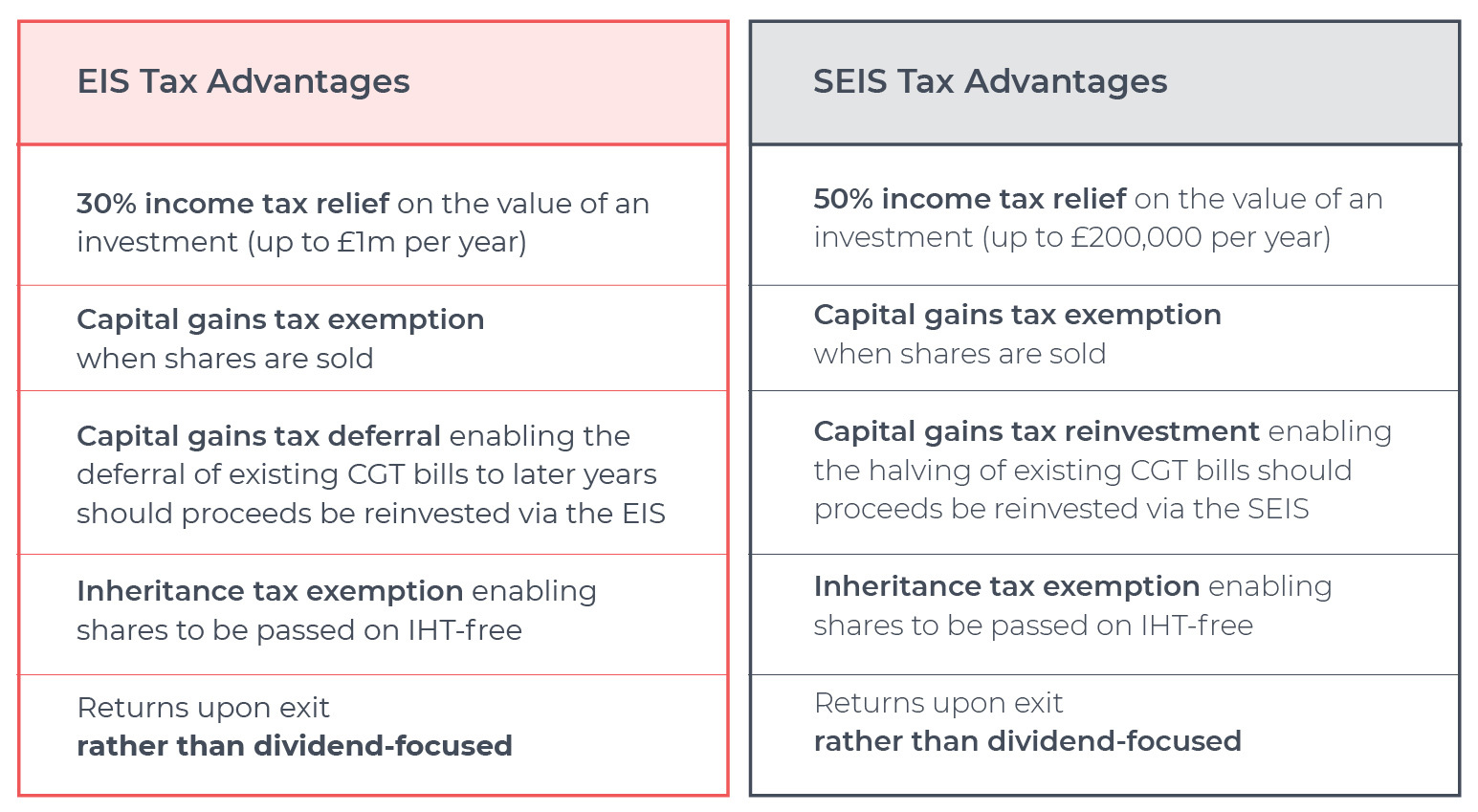

Specifically, the EIS offers investors up to 30% income tax relief and the SEIS offers investors up to 50% income tax relief – should shares be held for at least three years. Additionally, the schemes both offer capital gains tax advantages, and shares exempt from inheritance tax.

Exploring Venture Capital Trusts

Another of the Government’s Venture Capital Schemes, Venture Capital Trusts (VCTs) are listed investment vehicles that invest in a portfolio of unlisted early-stage companies.

VCTs are classed as slightly less risky than EIS and SEIS investments, largely due to being traded publicly and therefore generally being a more liquid investment.

However, as a result, the range of tax reliefs offered by VCTs isn’t quite as generous as those offered by the EIS and SEIS. Additionally, the returns VCTs target are generally not as considerable as those of the EIS and SEIS, and VCTs also require additional, regular fund fees – unlike most individual EIS and SEIS investments.

The appeal of ISAs

One of the UK’s most popular investment routes, Individual Savings Accounts (ISAs) are a favoured option. They enable individuals to save and invest without incurring income tax, dividend tax, or capital gains tax on their investment returns.

As of the 2023 tax year, the maximum annual contribution into an ISA is £20,000. Whilst this dies offer potential to incur significant tax-free investment returns, the annual allowances for the EIS and SEIS are much more generous, standing at £2m and £200k respectively.

Seeking professional investment advice

Consulting with a tax advisor or financial planner who specialises in tax on high earners can provide valuable insights and personalised strategies for reducing your tax liability.

Seeking professional advice can be crucial for managing high earner tax and making informed investment decisions. The following outlines just some of the benefits that consulting with a tax advisor or financial planner can provide for investors:

- Expert guidance: A tax advisor or financial planner who specialises in high earner tax and can guide investors through the complexities of tax laws, allowances, and reliefs. They may provide projections of your tax liability, help optimise your tax position – ensuring you don’t pay more tax than you need to – and ensure compliance with UK tax legislation.

- Personalised strategies: Each investor’s financial circumstances and goals are unique. A professional can create a tailored tax plan based on your adjusted net income, risk tolerance, and objectives. They may explore tax-efficient investment opportunities, discuss how to maximise contributions to pensions, and suggest tax-efficient vehicles like ISAs to ensure individual investment strategies are as tax-efficient as possible.

Consulting with a professional ensures you receive personalised tax planning, understand the tax implications of your decisions, and stay compliant with HMRC regulations. Seeking expert advice can help you understand and subsequently minimise your tax obligations as a high earner.

Is the high earner tax the same in every country?

High earner tax is not the same in every country. Each country has its own tax system and sets its own tax rates. The specific rules and rates for high earners vary from country to country.

In the UK, high earners are subject to a higher rate of income tax. Currently, individuals earning over £50,270 per year fall into the higher rate tax bracket, which means they pay a higher percentage of their income in taxes compared to those in lower income brackets.

In the US, high earners may be subject to both federal and state income taxes. The federal tax rates for high earners are progressive, meaning that the more you earn, the higher percentage of your income you will pay in taxes. Additionally, some states have their own higher tax rates for high earners.

Other countries may have a flat tax rate, where all individuals, regardless of their income level, pay the same percentage of their income in taxes, and other countries may have a tiered tax system, where the tax rate increases as income levels rise.

It’s important for high earners to be aware of the tax laws in their country and consult with a tax professional to ensure compliance and explore opportunities for tax planning and optimisation.

What other taxes do high earners in the UK need to pay?

In addition to the standard income tax that all individuals are subject to, high earners may also need to pay other taxes that are specific to their income bracket. It's important to be aware of these additional taxes and plan accordingly.

As previously mentioned, one of the main taxes that high earners need to pay is the higher rate of income tax. In the UK, individuals with an income above a certain threshold are subject to a higher tax rate. As of the 2023/24 tax year, this threshold is set at £50,270. Any income earned above this threshold is taxed at a higher rate of 40%.

Furthermore, high earners may eventually become subject to the additional rate of income tax. This tax is applicable to individuals with an annual income above £125,140. Any income earned above this threshold is taxed at a rate of 45%.

Apart from income tax, high earners may also need to pay capital gains tax. This is applicable when you sell or dispose of certain assets that have increased in value. The rate at which capital gains tax is charged depends on your income tax band, and also the type of asset disposed of.

For high earners, the CGT rate is 20% for most assets and 28% for residential property or carried interest.

Furthermore, high earners may need to consider inheritance tax (IHT), which is charged at a rate of 40% on estates exceeding a value of £325,000 as of the 2023/24 tax year. This threshold is frozen until at least 2028, meaning that rising house prices and growing incomes are likely to erode this IHT-free threshold at an increasing rate.

Minimising tax liabilities as a high earner

The tightening of the additional rate income tax band in the 2023/24 tax year has made it even more crucial for high earners in the UK to take proactive steps to manage their tax liabilities.

With the right guidance and investment tools, high earners in the UK can effectively navigate the complexities of higher and additional tax rates and ultimately minimise their tax burden.

It's important for high earners to consult with a professional tax advisor to ensure they are taking full advantage of available tax reduction strategies. Understanding the different tax rules which high earners in the UK are often subject to can be a complex task, but with a solid understanding of the rates, rules, and optimal strategies, high earners can minimise their tax liability and maximise their income.

Additionally, conducting your own research into investment schemes and tax efficient routes for high earners - ensuring you contemplate the wide range of options available to mitigate your tax liabilities - can be particularly beneficial. Exploring GCV's free guide 'How to Reduce Your Income Tax Bill as a High Earner' could be a helpful place to begin.

%20(3)%20(2).jpg)