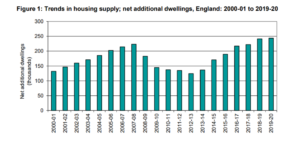

UK housebuilding reaches highest level in 33 years

Newly released figures show the delivery of new homes hit its highest level in over three decades last year. Now the UK Government is suggesting housebuilding could prove crucial to a post-Covid economic recovery, with SME housebuilders being highlighted in particular.

The report, commissioned by the Ministry of Housing, Communities & Local Government, found that 243,770 new homes were delivered in 2019/20 – the highest figure recorded in a single year since 1987.

Alongside last year’s reassuring figures, 2019/20 also marked the seventh consecutive year in which the number of new homes delivered has increased.

Of the new residences, over 1,700 student accommodation units and 2,140 communal dwellings were added last year, whilst a further 27,000 new homes were made available through government ‘change of use’ rulings.

SME housebuilders and the innovative finance firms that back them have been praised especially for financing and delivering many of these new homes, with new-builds accounting for 90% of the homes delivered from 2019 to 2020.

And at a time where it’s been calculated that 300,000 new homes a year are needed to tackle the UK’s current housing shortage, the accelerated development of new-builds has been labelled as essential.

In a bid to target the shortage head-on, the UK Government has allocated more than £3.9 billion to a range of nationwide schemes over the past decade including the Housing Infrastructure Fund and widely successful Help to Buy Scheme.

House Building key to post-Covid recovery

Throughout the Covid-19 pandemic the Government has been vocal on their support of the housebuilding industry, claiming it will be crucial to “Building back better” post-pandemic.

In June planning permissions across the country were extended to ensure residential construction could continue, whilst development rights and change of use legislation was updated to fuel the growth of the sector.

Chris Pincher, Housing Minister at the Ministry of Housing, Communities and Local Government, said:

“Last year we delivered more than 240,000 new homes across England, which is more than at any point in the last 30 years. But we are not going to rest on our laurels. We are determined to not only build more homes but to build them in a way that is sustainable, faster.”

Reflecting on the nation’s need for the continued development of the housing sector throughout the pandemic, the Minister reinforced upcoming government plans to boost the housebuilding sector, adding:

“Last month we announced reforms to give greater flexibility for buildings and land in town centres to change use. We must allow new homes to be built from the regeneration of vacant and redundant buildings alongside our efforts to build new homes, making it easier for homes to be extended upwards.”

Read More: What’s in store for the housing market?

The future of housebuilding

In adapting to the challenges faced by Covid-19, the house building & property sectors have innovated new, more efficient ways to operate when faced with pressures never before felt in the industry.

From improved planning and productivity systems on-site, to new, innovative tech that’s been incorporated into showhome viewings (such as the 3D virtual homes tours offered by North-East housebuilder & GCV portfolio company Homes by Carlton), housebuilders across the country are likely to continue adopting lockdown-born innovations in the future.

The sector is also set to receive a more considerable financial report from the Government, with a £20bn investment package for the National Home Building Fund being announced in the recent Spending Review. The new investment aims to fund the delivery of 860,000 new homes.

Alongside this funding package, the Ministry of Housing is set to receive almost 10bn in the 2021/22 financial year with the primary goal of developing additional new-builds and supporting SME housebuilders.

Using finance sourced from the National Home Building Fund, a future priority for the sector is developing and utilising modern methods of construction throughout the UK.

With a focus on pioneering the latest housebuilding technology and processes, constructive methods such as modular house manufacturing (specialised by GCV portfolio company CoreHaus) have been targeted to spearhead the next wave of industry innovations and deliver high-quality homes quickly, economically and sustainably.

As a whole, the future of the UK housebuilding sector and its £19.2bn annual economic contribution relies on the continued innovations and development of SMEs operating throughout the industry.

From regional housebuilders to modern construction specialists and the innovative financing solutions that support them, companies operating throughout the UK housebuilding industry have a key role to play in the nation’s economic bounceback as the sector’s 33 year high shows no signs of slowing down.

%20(3)%20(2).jpg)