COVID-19: The impact on threat intelligence

As yet more regions experience a resurgence in COVID-19 outbreaks, we look towards global threat intelligence provider and GCV portfolio company, Intelligence Fusion, to understand the security industry’s response to the pandemic, and how the organisation has continued to ensure both people and businesses remain protected.

What is Intelligence Fusion?

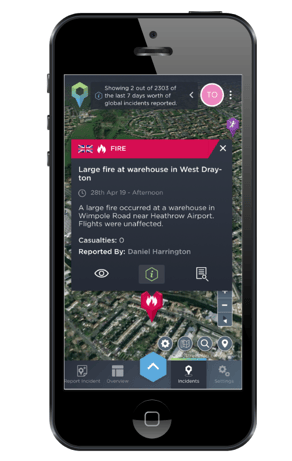

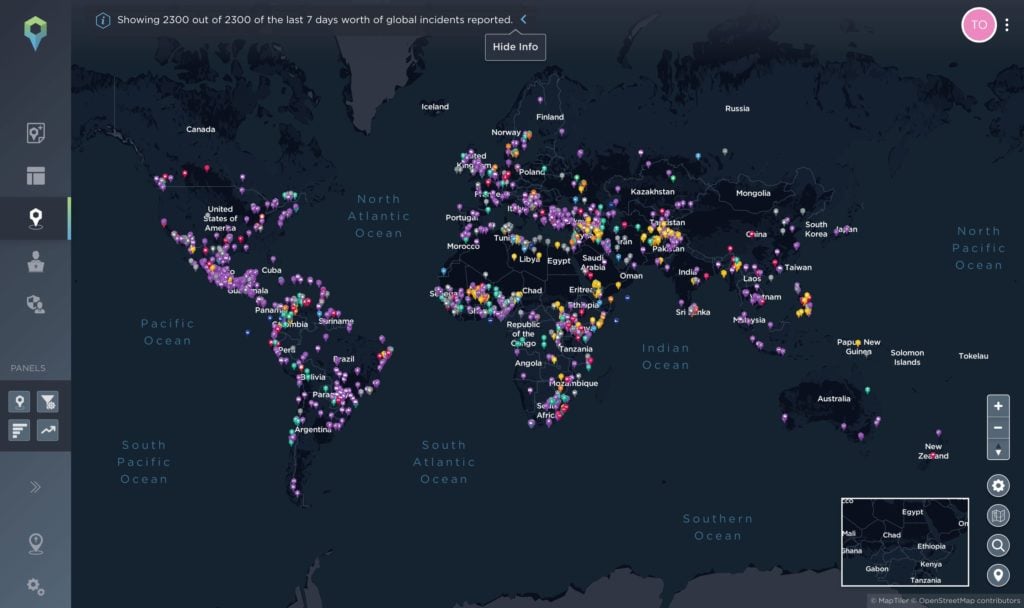

Established in 2015, Intelligence Fusion delivers enhanced threat intelligence and situational awareness to security teams around the globe using state of the art software.

Its platform now supports some of the world’s leading brands with real time data and insights with the primary goal of helping to protect people, assets and reputation.

Founded by Michael McCabe, a former British Army Intelligence Operator, Intelligence Fusion utilises a military intelligence doctrine to put tried and tested open source collection methods into action.

The company’s award winning threat intelligence platform has been providing clients operating in a host of different industries with over 12,500 new incidents every month, including updates on:

- Criminality

- Terrorism

- Travel Disruption

- Maritime Security

- Political Unrest

- Protests and Demonstrations

- Aviation Security

- Trafficking

- Border Security

Empowering businesses with cutting edge software, and enabling clients to hand-pick the tools and features most important to them, Intelligence Fusion’s custom solutions has helped streamline the operations, increase the productivity and ultimately future proof the intelligence unit of some of the world’s most complex global security teams.

Reacting to the pandemic

Due to the nature of the industry in which Intelligence Fusion operates, to survive and succeed companies must be agile. From the fast-changing security landscape to the ever-evolving technology sector, in order to continue being one step ahead of the competition, it is crucial that firms react and adapt to new challenges quickly.

As COVID-19 began to spread across the globe, IF’s reporting on the pandemic became vital to its clients. The main focus was to provide organisations with a complete and comprehensive picture of the impact COVID-19 would have on their business in both the short and long term.

In reporting on the new and ongoing cases of the disease, IF also kept businesses up to date with political developments, travel information, the wider societal and economic impacts that emerged as a consequence of the pandemic.

From a rise in hate crime and targeted theft of key workers’ homes, to the increase in illegal raves and the vandalism of workplaces during lockdown, the survival of many of IF’s clients depended on the quick, accurate, widespread data provided by the platform.

Though in some cases the pandemic’s effects meant company budgets, spending and the procurement of new suppliers were put on hold until businesses were in a more stable position, the heightened security risk as a result of COVID-19 saw the team witness a sharp increase in demand for IF’s threat intelligence software.

To combat this rise, alongside a busy intra-pandemic period, Intelligence Fusion provided a range of free resources in order to support as many businesses as possible during this time.

Free resources included a host of webinars on how businesses could best respond and recover from the pandemic, as well as a free and interactive COVID-19 map which displays the last 250 coronavirus-related incidents.

Laura Brown, Chief Commercial Officer at Intelligence Fusion, commented:

“Now more than ever, businesses need to understand not just what is happening in the here and now, but how things could develop in the short, medium and long term. COVID-19 requires drastic measures to contain its spread, which is going to have a significant impact on the global economy.”

“We’ve already witnessed devastating impacts to some industries, however what we are seeing is those organisations who plan and exercise against different threats perform better in live situations. “

12 month progress

Now with a team that consists of over 17 different nationalities, boasts over 30 years industry experience and collects data on more than 12,500 incidents a month, Intelligence Fusion has forced exceptional year-on-year growth since the platform was founded in 2015, with some significant milestones being noticed in the past 12 months:

Ex Microsoft Director Announced as New Chairman

Amidst a period of significant expansion across the country, IF announced a new chair to the board, Robert Hayes. Robert’s valued expertise within cyber security, and strategic risk assessment enabled him to become a trusted advisor to the UK Ministry of Defence, before he was hand-selected by Bill Gates to become a Senior Fellow of the Microsoft Institute of Advanced Technology.

IF Receives North East Business Innovation Award

After being nominated for the award in March of 2019, IF championed the sub-regional heat round held at Ramside Hall Hotel, before advancing through to the Grand Final where the company’s “ambitious vision and impressive potential for growth,” saw it crowned the ultimate winner of the 2019 innovation category for the North East region.

£600,000 Investment Bolsters Workforce

A £600,000 investment from the Finance Durham Fund allowed IF to build an in-house technology team and employ a host of intelligence analysts, contributing to the doubling of the company’s workforce in 12 months and increasing capacity for 24/7 operational coverage.

8-Year Deal Secured with Oil Industry Giant

IF secured an 8-year deal worth over £675,000 this year with one of the world’s largest oil and gas corporations. In a transaction that marks IF’s entrance into the energy sector, threat intelligence software has been rolled out across the client’s international security function.

Future plans

Following an eventful past year of sustained growth and significant company milestones, the eye-opening impact of a global pandemic has highlighted the critical need for reliable intelligence and situational awareness across every industry.

This insight has provided Intelligence Fusion with a greater opportunity to assist and support organisations that are dependent on the company’s data, and will help to further develop the technology IF needs to continue to consistently provide high-quality security solutions to its clients.

With an expanding client base that includes G4S, Spotify and Kimberly-Clark, the organisation now aims to extend its capacity across every department to keep up with demand.

Laura added:

“Intelligence Fusion continues to grow, with a planned expansion across all departments in the next six to eight months. The firm’s main focus will be on evolving its datamining technology and automating the collection of information.”

“Alongside this the company looks to grow its crowdsourced intelligence capability which will allow it to tap into the collective intelligence of the public at large and provide more local context to its users, enhancing our system further.”

GCV continues to work closely Intelligence Fusion after providing intensive support in the build of the company’s core software through venture builder G-Labs, and facilitating investments that resulted in a total of more than £1.1 million in growth capital through the G-Ventures private investor network.

%20(3)%20(2).jpg)