Weekly Briefing: BoE Governor suggests signs of economic upturn, Chancellor hints at launch of ‘British ISA’ & panel assembled to drive pension funds into startups

In this week’s briefing, we take a look at Bank of England (BoE) Governor Andrew Bailey and Prime Minister Rishi Sunak’s recent comments on the strength of the UK’s economic growth, Chancellor Jeremy Hunt’s comments on the prospect of a ‘British ISA’, the assembly of an ‘expert panel’ to help drive forward the Mansion House reforms, and more.

UK Economy

BoE Governor, Prime Minister And Chancellor Claim Economic Growth Is Strengthening After Recession

- Figures released today (Thursday 15th February) by the Office for National Statistics (ONS) revealed the UK entered a recession at the end of 2023.

- GDP fell by a larger-than-expected 0.3% in the three months to December 2023, after economists in a Reuters poll had estimated a 0.1% decline.

- Before the figures were released, it was highly anticipated that they would point to a technical recession, but both BoE Governor Andrew Bailey and Prime Minister Rishi Sunak played down the anticipated news.

- Speaking at Loughborough University before the news, the Governor stated that if there proved to have been two successive quarters of contracting GDP at the end of last year, the fall would be “very shallow.”

- He continued on to say: “What I would put more weight on actually is the indicators we have seen since then have shown some signs of upturn.”

- Meanwhile, also before the figures were officially released, Prime Minister Rishi Sunak told reporters: “At the start of this year I really believe the economy has turned a corner and we are heading in the right direction. You can see inflation has come down from 11% to 4%, mortgage rates are starting to come down, and wages have been rising consistently now.”

- In the aftermath of the release, Chancellor Jeremy Hunt has reiterated that there are "signs the British economy is turning a corner", saying: "we must stick to the plan – cutting taxes on work and business to build a stronger economy."

Investing

Chancellor Hints At Launch Of 'British ISA' In Spring Budget

- Chancellor Jeremy Hunt has hinted that news of a much-speculated British ISA could be coming in the Spring Budget.

- The ISA would allow for tax-free investment into UK company shares in an effort to revive the country’s stock market.

- Talk of a British ISA first started in the lead-up to the Chancellor’s November 2023 Autumn Budget – when the Government was said to be looking at ways of simplifying and streamlining the ISA market.

- When asked at an annual dinner hosted by TheCityUK whether he would consider a British ISA, Hunt replied: “So there’s a certain category of questions that I’m not really able to answer [...] those are things that might appear in the budget. And that is one of them.”

- He continued: “Do I want to do things that mean that more UK capital is invested in our most promising companies? Absolutely. I think that something like a British ISA could be very good at that.”

'Expert Panel' Assembled To Drive Pension Funds Into Startups

- An expert panel has been assembled by the British Private Equity and Venture Capital Association (BVCA) to determine the challenges associated with implementing Chancellor Jeremy Hunt’s Mansion House reforms and the best approaches for resolving them.

- The panel includes executives from Legal & General and pension firm NEST, and is chaired by IQ Capital Managing Partner Kerry Baldwin.

- Last year, the Chancellor announced the Mansion House reforms to spur more investment into UK businesses using funds from pension providers.

- The launch of the panel follows a commitment from 10 top pension managers to invest at least 5% of their managed assets into growth companies – this was called the ‘Mansion House Compact.’

- Baldwin said: “I’m looking forward to working with colleagues in the pensions industry to understand how we can ensure UK savers can enjoy returns and investment diversification generated by backing promising homegrown businesses.”

- The Chancellor has shown support for the panel, saying: “Seeing industry leaders from our pension funds and growth investors come together to tackle the barriers to greater private investment is good for savers and good for business, and I look forward to seeing the results of the panel’s work.”

Property

House Price Rises Were The Highest For A Year In January, According To Halifax

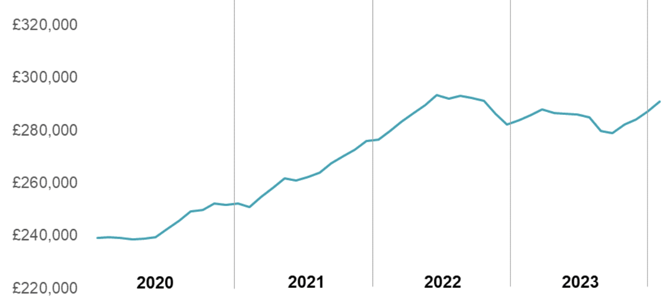

- Halifax’s latest House Price Index showed the pace of annual growth at 2.5% – the highest rate since January 2023.

- The average house price in January was £291,029, up 1.3% or £3,785 when compared with December last year.

- Kim Kinnaird, Director of Halifax Mortgages, said: “The recent reduction of mortgage rates from lenders as competition picks up, alongside fading inflationary pressures and a still-resilient labour market has contributed to increased confidence among buyers and sellers. This has resulted in a positive start to 2024’s housing market.”

- Northern Ireland recorded the strongest growth across all nations or regions within the UK, with house prices increasing by 5.3% on an annual basis.

- Scotland and Wales (4%), the North West (3.2%), Yorkshire and Humber (2.8%), the North East (2%) and the East Midlands (0.5%) also recorded house price increases over the last year.

Average UK House Price: January 2020 to January 2024

Source: Halifax, S&P Global.

A Final Note

The hint of a British ISA from the Chancellor is very interesting, particularly as the focus of late seems to have been on simplifying the tax-free product’s offerings. We’ll be eagerly awaiting the Spring Budget to see what comes of this and any other potential tax incentives for investors.

In addition, whilst there’s news of gloomy data regarding the end of last year’s economic growth, it’s promising to hear from both the BoE Governor and Prime Minister that the beginning of 2024 has already likely seen an upturn.

At GCV, we remain committed to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decisions when choosing where to allocate their capital.

If you would like to find out more about a number of tax-efficient investment strategies available to UK investors, discover our range of downloadable resources here.

%20(3)%20(2).jpg)