Weekly Briefing: Spring Budget outcomes, VC returns outstrip all other types of PE & North East leads housing market rebound

In this week’s briefing we will be discussing some of the most important outcomes affecting investors from today’s Spring Budget – dubbed a “Budget for long-term growth”.

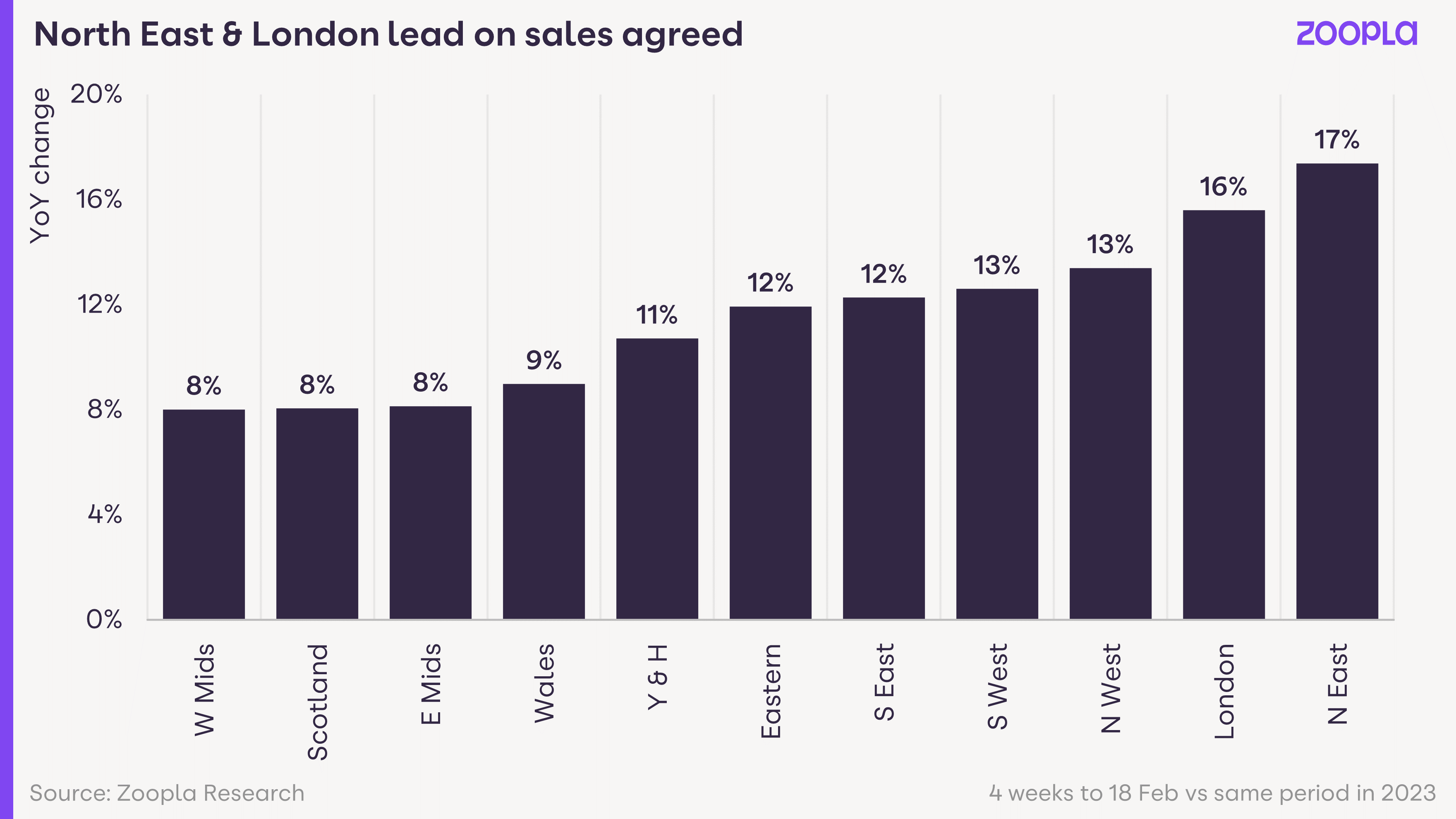

Alongside that we’ll cover additional recent stories including Zoopla’s latest data on how the North East is leading the UK property market rebound and research showcasing the superior performance of venture capital (VC) returns when compared with other forms of private equity (PE) investment.

Spring Budget

Inflation And Growth Update

- Chancellor Jeremy Hunt began his Spring Budget with an update on inflation and the Office for Budget Responsibility’s (OBR) latest growth figures.

- Hunt stated that inflation is expected to fall below the 2% target in “just a few months […] nearly a whole year earlier than forecast in the Autumn Statement.”

- It was reiterated that this is more than the Prime Minister’s pledge to half inflation, which was at 11.1% when Hunt and Rishi Sunak took office in 2022.

- The Chancellor also delivered new figures from the OBR that show the economy is expected to grow 0.8% in 2024 and 1.9% in 2025, 0.5% higher than in the OBR’s Autumn forecast.

Another Cut To National Insurance Announced

- Following a 2p cut announced in the Autumn Statement, Hunt announced a further 2p cut to National Insurance, taking it from 10% to 8% this April.

- This means the average worker on a £35,000 full-time salary will save around £450 per year.

Confirmation Of British ISA With Increased ISA Allowance

- There has been speculation of a British ISA since before Chancellor Jeremy Hunt’s November 2023 Autumn Statement, with its introduction confirmed in the Spring Budget as Hunt stated the new product is to “encourage more people to invest in UK assets”.

- The British ISA will allow an additional tax-free £5,000 – on top of the £20,000 annual ISA allowance – for investors investing into UK equities.

More Plans To Encourage Investment

- In the Spring Budget’s accompanying document, it states that ‘in 2024, the year of the SME, the Government continues to back UK SMEs as the lifeblood of the economy and the beating heart of local communities.'

- The Chancellor announced a package of support ‘to establish the UK as a world leader in fast-growing industries over the next five years.’

- This included over £1 billion in new tax reliefs for creative industries, £270 million in automotive and aerospace R&D projects focusing, and a £120 million top-up for the Green Industries Growth Accelerator.

- Support for SMEs to invest and grow was also announced in the form of a £200 million extension of the Growth Guarantee Fund – which will help 11,000 small businesses access the finance they need – and an increase in the VAT registration threshold from £85,000 to £90,000, taking around 28,000 small businesses out of paying VAT altogether.

- For UK VC investors, Hunt’s vocal emphasis on injecting revenue into Britain’s “fast-growing” SMEs can come as a much-appreciated source of optimism.

Venture Capital

VC Returns Outstrip All Other Types Of PE According To New Research

- Research from Growthdeck has shown that UK VC investment returns outstrip returns on all other PE investments.

- According to the research, VC fund returns since 2001 have returned on average 2.13x investors’ initial investment, compared to an average of 1.78x across all PE funds investing in large, mid-size or smaller companies.

- Investments by VC funds into tech companies that have been able to scale-up more rapidly than a traditional company is likely a major contributing factor to their market-beating returns.

- Simon Emary, Head of Portfolio at Growthdeck, said: “Venture capital has really proven its value to investors over the past two decades. Previously it had been about picking the right VC funds, but this data show that the category, on average, has outperformed. Being able to access investment in the fastest-growing companies – like tech and fintech – has delivered very substantial returns. Tech-focused VC funds have funded and benefitted from the most explosive growth phases of virtually every household-name tech business of the last 20 years. That’s just as true in the UK as in the US.”

Property

- Zoopla’s February 2024 House Price Index (HPI) shows that all measures of sales activity have continued to improve as pent-up demand returns to the housing market.

- Buyer demand is 11% higher than a year ago, whilst the number of sales agreed is 15% higher than a year ago, with Zoopla suggesting this is evidence of greater buyer confidence.

- The North East (+17%) and London (+16%) have led this rebound in sales.

- According to the HPI, growing confidence amongst sellers is also boosting the number of homes for sale – which is up 21% on a year ago – and more supply is increasing choice for would-be buyers, thus supporting sales.

- Richard Donnell, Executive Research Director at Zoopa, said: “The housing market has proved very resilient to higher mortgage rates and cost of living pressures. More sales and more sellers shows growing confidence amongst households and evidence that 4-5% mortgage rates are not a barrier to improving market conditions.”

A Final Note

Today’s Spring Budget was an interesting one, with the confirmation of much-speculated policies and reforms such as a cut to National Insurance and the formation of a British ISA. It’s clear from the Budget that the Government continues to place an emphasis on the importance of SMEs and investment into the UK for economic growth.

It’s crucial to note one speculated change that didn’t come to fruition however – a cut to, or the abolition of, Inheritance Tax (IHT). Therefore, it continues to be particularly prudent for investors to be considering IHT-free tax incentives such as the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) to help protect their wealth in the future.

At GCV, we remain committed to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decisions when choosing where to allocate their capital.

If you would like to find out more about a number of tax-efficient investment strategies available to UK investors, discover our range of downloadable resources here.

%20(3)%20(2).jpg)