As the UK needs more homes, should you become a property developer?

Being a property developer doesn’t mean you have to be on a building site in a hard hat and a high vis jacket. Of course, this is an option, and one which can be both profitable and exciting - but there are more ways you can be a ‘property developer’, make a difference and profit from the comfort of your own home or office.

Something that's being talked about more and more, I want to take a look here at the housing requirement in the UK and how smaller property developers and investors can do their bit to tackle the crisis, impacting on the market and making a profit in the process.

Why does the UK need more homes?

The 2017 Budget stated that - unsurprisingly - as a society we’re suffering a housing crisis and have shortage of homes, with a target of 300,000 homes per year aiming to be built by 2020.

But why are we in a position that we need more homes?

A decline in housebuilding

There are a whole host of reasons, but one of the most obvious is since the ‘crash’ in 2009 there have been fewer housebuilders completing fewer developments. Many of the smaller housebuilders couldn’t fulfil the developments they were part way through or had planned at the time, and many went into liquidation or ceased trading.

The larger housebuilders, although they continued to build, didn’t do so as fast as the population increased. This increase has been due to more people moving to the country to live and work - and the population as a whole living longer.

An ageing population

Our health level as a population is increasing, and this improvement in health as a whole means that people are living longer.

As a result - and due to provisions such as home care and availability of housing alterations - people are staying longer in their own homes, meaning there is a shortage of homes which would previously have become available on the market.

And whilst the age aspect is obviously a positive one - we all want our elderly relatives to live longer - it really is having a direct impact on younger generations. The last UK census was the first in a century that showed the average household size hadn't fallen in size. Alongside this, it detailed how the number of households with more than two adults had increased.

How are property developers and the Government going to meet the housing need?

In addition to the larger private developers building houses, the Government backed help to buy schemes, and shared ownership schemes, the 2017 Budget introduced some investment into housebuilding designed to stimulate growth in the lower end of the private housebuilding market. This has the focus of encouraging smaller property developers and construction firms to do their bit to meet the government targets and provide more homes.

The property white paper released in 2017, and analysed by Jordan in Q4 2017, was fundamental in highlighting the changes that are to be supported and encouraged in the housebuilding landscape this year and for the future. The paper reported that between 2008 and 2015 there had been a 40% decrease in contributions from smaller housebuilders.

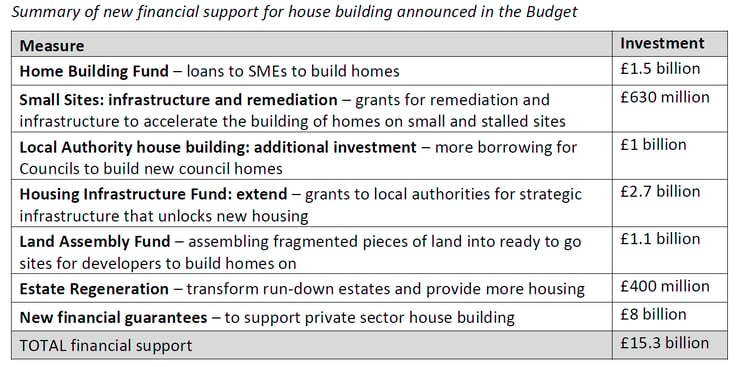

As a result, in the 2017 Budget the Government provided details of a £15 billion housebuilding support package, with £1.5 billion of this made available to SME builders through the Home Building Fund. The Home Building Fund is designed to help smaller builders make a greater contribution to meeting the Government homebuilding targets.

In addition, the Government also indicated that it will invest at least £44 billion of capital over the next five years to support housebuilding, with £2.7 billion invested to more than double the Housing Infrastructure Fund and a further £400 million for estate regeneration.

So whilst it's clear we need more homes for a variety of reasons - or more accurately, we need more of the right homes in the right locations - and there's government support available, it's a crisis that needs to be tackled together. It's not just about one or two national housebuilders doing more or a handful of new small housebuilders entering the market. There's a distinct requirement for everyone, from large corporates down to individual investors, to play a role.

What actually is a property developer?

As I previously covered in my ‘8 questions you need to ask before becoming a property developer’ piece, on a general level, the description of a property developer is essentially someone who develops property for financial gain. This will often be by buying a property low, enhancing it and selling it for an immediate profit, or by buying a property with the intention of letting it for the long term, for a continued period of return.

The post highlighted some top facts and considerations to take into account before embarking upon the journey of becoming a property developer. And for anyone interested in becoming a property developer, it can make for a very useful introductory read.

But on the assumption you know that's the right path for you to head down - and you're now looking to do your bit for the housing crisis, whilst aiming for a positive profit - how do you get started?

Getting involved with residential property developments

So, you understand the country's housing needs and you’ve read the information above. You've had your questions answered and you're ready to get involved as, or with, a property developer.

For many, the easiest way for this to happen is rather than purchase a property - or a piece of land upon which property can be developed - is to make an investment into a property development opportunity in more of a passive way. You don't need to roll up your sleeves and be on-site and the capital requirements are considerably lower.

Generally targeting an average return of 1.5x multiple of money, the return periods can be enviable, too - anywhere from as soon as 18 months.

Couple this with the fact residential property development opportunities allow a range of investors to be involved in the project, it can bring a considerable amount of confidence to you as an investor. This alone is something that, understandably, a lot of new investors simply don't have, purely because the lack the experience of the property market.

A live residential property development opportunity

Carlton SPV 1 Chilton Limited (“SPV1”), a special purpose vehicle, has been setup to develop 14 luxury family homes in County Durham. GCV is seeking to raise £0.4 million of investment alongside the senior debt to finance the project, and is targeting a 1.5x multiple of money return at a period of between 18 and 22 months.

To view the online campaign for more information or to pledge your investment click here.

Becoming a property developer

We've talked a lot about the merits of investing into property. It's a considerably varied asset class and one we're passionate about. I truly believe that with the right education and guidance, anyone can become involved in property.

For some, that will undoubtedly be through a popular opportunity - they'll buy a house to let or they'll invest into a property fund with the aim of selling their shares for a gain. These are undoubtedly some of the most popular ways to become involved.

For many more, however, the focus will be from a property development point of view; investing into property in a way that sees property be built overtime and returns generated upon their sale.

Yet regardless of your approach (and whether you're classing yourself as a property developer or a property investor), the reality is that a positive approach to the sector can not only help you generate a profit, but it can directly impact on the UK's housing crisis.

%20(3)%20(2).jpg)