How could modular housing play a role in addressing the UK’s housing crisis?

The UK's housing crisis has been a major issue for several years, with 8.4 million people in England alone living in unaffordable, insecure, or inadequate homes, as reported by the National Housing Federation in 2020.

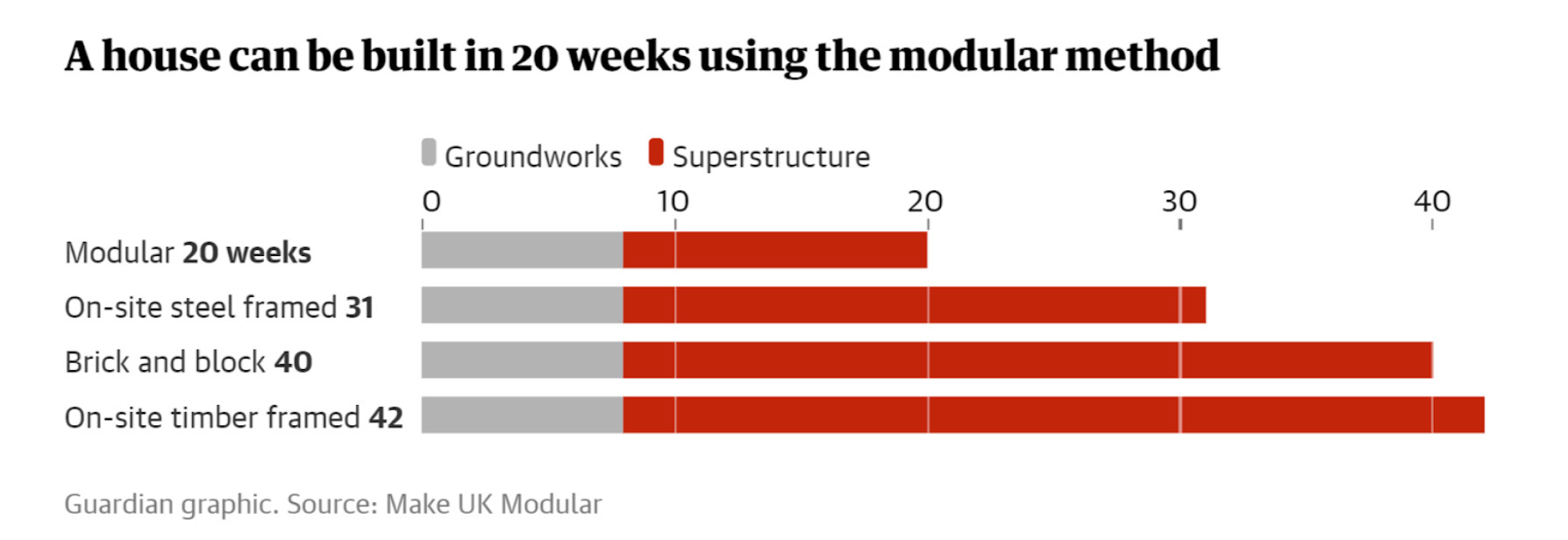

Modular housing is one solution that has emerged in recent years with the potential to provide high-quality homes quickly and affordably, whereby prefabricated units are constructed off-site and assembled quickly and efficiently on-site.

Although the UK's modular housing industry is relatively new compared to countries like Japan and Germany, it is quickly gaining traction. According to the industry group Make UK Modular, the industry has the ability to build 20,000 modular homes by 2025, a fifth of the 100,000 annual housing shortfall in the UK.

As of 2022, 3,300 modular homes have been built in the UK – representing one in 60 of every new home constructed.

The UK government has set a target of 300,000 new homes to be built per year by 2025, and while official figures show that around 204,500 were built in the 12 months to March 2022, it is clear that there is still a significant shortfall.

Modular housing has the potential to address this shortage by providing a faster and more affordable method to build homes at scale.

Furthermore, modular homes can offer significant benefits in terms of energy efficiency. This category of home can fall into the top energy performance bracket and potentially result in savings of around £800 per year on energy bills for the average household.

This, combined with the speed and affordability of modular housing, makes it increasingly suited to the current housing demands in the UK.

Modular buildings have a lower carbon footprint than traditional methods of construction because the homes are built off-site, which can allow for greater control over the construction process and reduced waste.

Additionally, there are fewer deliveries to the site, subsequently cutting emissions, and residents living nearby are also less affected by any noise, pollution or disruption.

Marc Vlessing, the founder of Pocket Living, a London-based affordable housing company, says the eco credentials associated with this method of construction are likely to be a key driver of demand.

As residents understand this more, I believe they will press local authorities to ensure more homes in their neighbourhood are delivered in this way.

Headquartered in the North of England, modular housebuilder, CoreHaus, is one company leading the way in this industry. With a focus on sustainability and high-quality design, CoreHaus is contributing to the Government's targets for the levels of modular homes to be built over coming years.

As modular housing continues to gain traction in the UK, companies like CoreHaus are poised to benefit from this growing industry and provide much-needed relief for the country's housing crisis.

Ultimately, modular housing can be an attractive investment opportunity for those looking to invest in the UK property market. The fast construction times and lower costs associated with modular housing make it an appealing option for developers, and the growing demand for affordable housing in the UK means that there is significant potential for growth in the industry.

Importantly, as the industry continues to expand, it has the potential to provide much-needed relief for the millions of people in the UK who are living in unaffordable, insecure, or inadequate homes.

%20(3)%20(2).jpg)