How to boost UK housebuilding: Government spending and financial innovation

Housing is a touchstone issue in the UK. Much of our individual wealth is held in the value of our homes.

In recent years homeowners have leveraged their accumulated wealth to make separate financial investments (including buy-to-let properties), support a more comfortable retirement through equity release, and provide reassurance that they will leave an inheritance for their loved ones.

Whatever their motivation, they retain a keen interest in their asset maintaining its value.

As the Institute for Government reported in 2014:

“In many cases, the health of the housing market has become critical to individuals' long-term financial security.”

This represents one side of the housing conundrum. As a nation of aspiring homeowners (given a free choice, 86% of British residents would buy, rather than rent their home), increased property values have made it difficult for first time buyers to get a foot on the housing ladder.

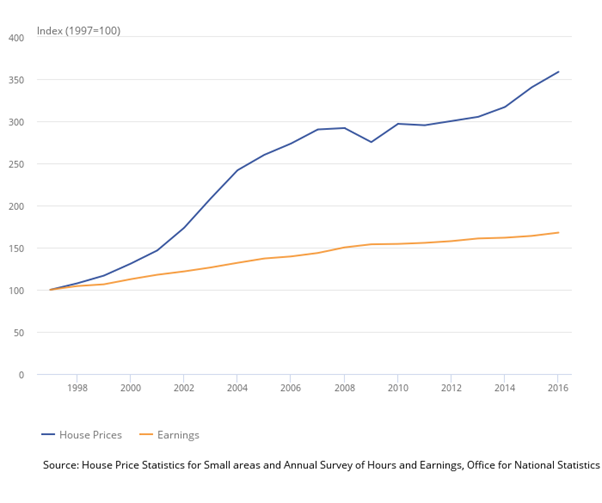

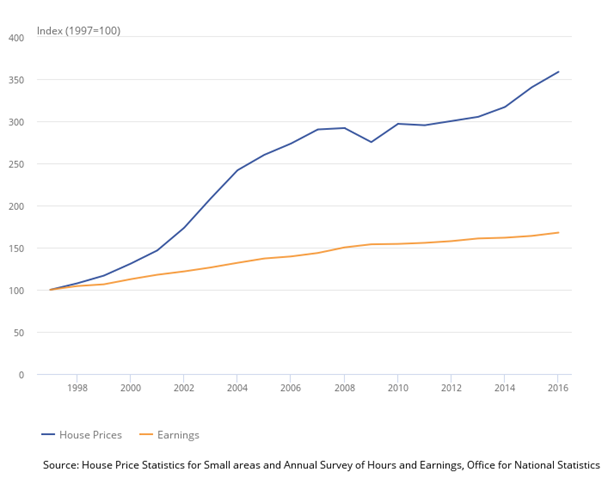

Figure 1 below sets out the extent to which median house prices have, across England and Wales, increased much more rapidly than earnings since 1997.

Figure 1: Median price paid for property and annual earnings indices (England & Wales)

This trend is particularly acute in London, where median house prices can exceed median earnings by a ratio of up to 38.5:1 (LB Kensington & Chelsea) in 2016. Affordability has traction way beyond the fundamental purpose of housing; to provide secure accommodation.

The Social Mobility Commission’s most recent annual report contains a full chapter evidencing the role of housing as a driver of social mobility. As such, resolving structural faults in the housing market can help to deliver a range of government policy objectives.

Recent intervention

The UK Government launched the Help to Buy scheme in April 2013. It was launched with the intention of supporting first-time buyers and housebuilders and, in many ways, extended and enhanced the financial support previously available through an earlier initiative, FirstBuy.

Help to Buy currently supports homebuyers in the following ways:

- Equity loans, which enable buyers to purchase new build properties up to the value of £600,000 (England) with a 5% deposit and a 55% (London) or 75% (rest of England) mortgage, with the residual 40%/20% comprising a Government equity loan available interest free for five years.

- A Help to Buy ISA, which provides a capped, matched saving incentive for people who save towards the purchase of their first home. This, along with other members of the ISA family, is explained in detail in our free guide to Tax Efficient Investing.

Help to Buy also, between October 2013 and December 2016, offered a mortgage guarantee product worth 30% of a property’s value, subject to the homebuyer contributing a 5% deposit. This reduced mortgage providers’ exposure to risk were they to approve a 95% mortgage.

Evidence on the efficacy of Help to Buy is mixed. Advocates claim that it has succeeded in making it easier for first-time buyers to purchase their first home.

However, criticism has been more forthcoming, with organisations as varied as the IMF, OBR, and IoD suggesting that making homebuying easier had fuelled demand - which, in the absence of any equivalent measures to boost supply, simply increased house prices still further.

2017 Diagnosis

“The housing market in this country is broken, and the cause is very simple: for too long, we haven’t built enough homes.”

We might typically associate such a bold statement with a tubthumping pressure group, but it’s actually the first line of the UK Government’s 2017 Housing White Paper. The tone of the analysis suggests that the Government has broadly accepted the critique of Help to Buy put forward by commentators, and policy will hereon prioritise increasing the supply of housebuilding.

The white paper calculates that decades of under provision – since the 1970s an average of 160,000 new homes per year have been built – determines that between 225,000 and 275,000 houses must be built every year for the foreseeable future.

Last week, Communities Secretary Sajid Javid announced that this annual target should be stepped up to 275,000 to 300,000 homes per year.

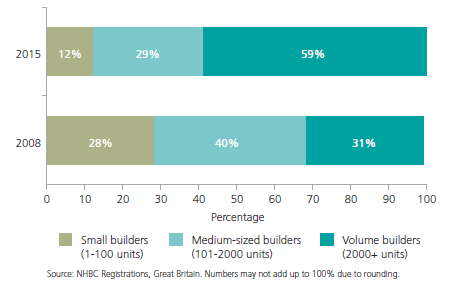

The white paper also includes a specific commitment to supporting small and medium-sized builders to make a greater contribution to housebuilding: ‘Diversifying the market’ is one of four major, complementary objectives within the paper. This reflects analysis that shows that the proportion of homes built by small and medium-sized builders fell by forty percent between 2008 and 2015; from 68% in 2008 to 41% in 2015 (see figure 2, below).

Figure 2: Market share by housebuilder size

Future solutions

The Government is proposing to almost double the number of new homes built annually and, specifically, to facilitate a greater role for small and medium-sized housebuilders in pursuit of this.

This begs the question; how will this be achieved?

The headline initiative charged with delivering this is the Home Building Fund. Offering housebuilders access to a £3 billion loan fund, each individual application must be between £250,000 and £250 million.

Loans are classified either as development loans (repayment terms of up to five years) or infrastructure loans (20 years), secured against property assets, and charged at commercial rates. Although small and medium-sized builders are encouraged to borrow through the Home Building Fund, it is nor reserved for this market.

In addition to raising the annual housebuilding target, Sajid Javid also last week signalled an important shift in the Government’s approach to fiscal management. Specifically, he stated that Government borrowing to fund housebuilding “can be the right thing if done sensibly”. This represents a clear departure from the focus on deficit reduction since 2010 and further underlines the importance that the Government is attaching to this agenda.

This sets the scene for the Chancellor’s Budget on Wednesday 22nd November. There are huge, competing demands on the UK’s public finances. The acid test of the Government’s commitment to increased housebuilding will be the appearance of financial measures that add substance to Sajid Javid’s suggestions.

In the interim, the most enterprising housebuilders are developing innovative financial solutions of their own. These include embracing establishing special purpose vehicles (SPVs) to secure equity investment – either institutional or through crowdfunding platforms – and loan finance - either from corporations or through peer-to-peer lending platforms.

Combining the asset-backed assurance offered by property investments with the high growth potential offered by equity investing in SPVs creates a compelling proposition for investors. We have a sense that this model could emerge as a leading investment proposition as we enter 2018. Watch this space.

%20(3)%20(2).jpg)