UK income tax rates 2025/26: maximise your allowance

When creating an annual tax plan, for the vast majority of UK taxpayers, income tax considerations will play a pivotal role.

In the 2025/26 tax year, this has been and will continue to be true. The government relies on income tax as a major source of revenue, and as global economic conditions change, so too do the challenges and opportunities in tax planning.

Income tax receipts as a proportion of GDP are at their highest level since the 1980s, and with an estimated 400,000-600,000 more taxpayers being forced into the 40% income tax band in 2025/26, this level has risen further.

The changes in tax brackets as well as fiscal drag mean that taxpayers need to be increasingly aware of how their earnings are spread across different tax thresholds to minimise liabilities.

As a result, understanding income tax rates and how to minimise or offset your exposure in tax in 2025/26 and beyond – for high earners especially – can prove particularly beneficial.

What are the UK income tax rates for 2025/26?

The UK income tax rates for 2025/26 have remained the same as 2023/24 & 2024/25, at 20% for basic rate taxpayers, 40% for higher rate taxpayers and 45% for additional rate taxpayers (except Scotland).

Whilst this might seem positive at first, there's more to uncover later.

Income Tax Bands in England, Wales and Northern Ireland

2024/25 and 2025/26

|

2024/25 |

2025/26 (current) |

|||

|

|

Bracket |

Rate |

Bracket |

Rate |

|

Personal Allowance |

£0 to £12,570 |

0% |

£0 to £12,570 |

0% |

|

Basic |

£12,571 to £50,270 |

20% |

£12,571 to £50,270 |

20% |

|

Higher |

£50,271 to £150,000 |

40% |

£50,271 to £125,140 |

40% |

|

Additional |

Over £150,00 |

45% |

Over £125,140 |

45% |

*Those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000 and then see it be totally eroded at £125,140.

The income tax personal allowance, basic rate threshold and higher rate threshold have remained the same since the 2022/23 tax year, but the additional rate threshold was reduced from £150,000 to £125,140 in the 2023/24 tax year and has remained the same going into the 2025/26 tax year for the UK including Scotland.

Income Tax Bands in Scotland

2024/25 and 2025/26

|

2024/25 |

2025/26 |

|||

|

|

Bracket |

Rate |

Bracket |

Rate |

|

Personal allowance |

£0 to £12,570 |

0% |

£0 to £12,570 |

0% |

|

Starter Rate |

£12,571 to £14,876 |

19% |

£12,571 to £15,397 |

19% |

|

Scottish Basic Rate |

£14,877 to £26,561 |

20% |

£15,398 to £27,491 |

20% |

|

Intermediate Rate |

£26,562 to £43,662 |

21% |

£27,492 to £43,662 |

21% |

|

Higher Rate |

£43,663 to £75,000 |

42% |

£43,663 - £75,000 |

42% |

|

Advanced Rate |

£75,001 - £125,140* |

45% |

£75,001 - £125,140* |

45% |

|

Top Rate |

Above £125,140* |

48% |

Above £125,140* |

48% |

*Those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000 and then see it be totally eroded at £125,140.

The Starter rate band has increased by 22.6%, and the Basic rate band has risen by 6.6%, raising the thresholds for both the Basic and Intermediate tax rates by 3.5%.

Meanwhile, the Higher, Advanced, and Top rate thresholds remain frozen until 2026-27. The UK-wide Personal Allowance has stayed at £12,570, as was confirmed in the 2024 Autumn Statement.

2026/27 Income Tax Rates

In terms of the 2026/27, income tax rates are likely to remain in exactly the same shape as 2025/26.

Now, on the surface, this could seem to be positive news, but the underlying intention is to rapidly increase taxes over time.

How are taxpayers being affected?

The reduced additional income tax threshold of £125,140, introduced across the UK in 2022/23, significantly increased the tax burden for high earners especially. Previously set at £150,000, the £24,860 reduction initially pushed an additional 250,000 taxpayers into the 45% tax bracket.

For individuals earning £125,140 or more, the long-term impact is particularly erosive. In 2025/26, a taxpayer in England, Wales, or Northern Ireland earning £150,000 will pay 45% tax on £24,860 of their income.

But the bigger issue isn’t the threshold change alone - it’s the combination of frozen tax bands until 2031, strong wage growth, and the inflation spikes of recent years.

With years of 6% average wage growth, an individual earning £150,000 in 2022/23 would have seen their salary rise to £160,050 in 2023/24 with a negligble increase in buying power, meaning an additional £10,050 is taxed at 45%, adding £4,523 in extra tax. Continuing this trend into 2025/26, the same taxpayer could have seen their salary increase further to £188,282, with the total extra tax paid amounting to over £17,000.

Over time, these effects have and will compound, making fiscal drag an increasingly pressing issue.

It's also worth noting that whilst real wage growth is now positive, meaning that wage growth is outpacing inflation. In the year to December 2022, wages were again rising roughly 6%, contributing again to fiscal drag.

However, real wage growth was -2.8%. In other words, people were paying more tax while their earnings were losing purchasing power. Thankfully, this isn't looking to be an issue over the next few years.

Example of fiscal drag starting 2022/23 with a salary of £150,000

|

Year |

Salary |

Extra Tax |

|

2022/23 |

£160,050 |

£4,523 |

|

2023/24 |

£169,973 |

£4,465 |

|

2024/25 |

£180,002 |

£4,513 |

|

2025/26 |

£188,282 |

£3,726 |

|

Increase |

£38,282 |

£17,227 |

The Table above shows that over the last 3 tax years, for a salary of £150,00, the equivalent of an entire personal allowance in tax has been wiped.

Impact across the wider population

With minimum wage having risen by 6.70% in April 2025, average wage growth has seen an increase of 4.60%. With inflation hovering between 3.5% and 4%, only a narrow slice of that growth translates into real gains - and even that is subject to fiscal drag.

Looking to the next tax year, with a 4.1% increase to minimum wage, we could expect to see around 2.8% in average wage growth, and if inflation remains close to that level, almost all wage growth will be neutralised. The one thing that does rise: income tax.

Since the freeze began in 2022/23, the cumulative extra tax paid by all is already colossal and will continue to climb until 2031.

This isn’t just a high-earner issue - it’s simply most visible at the top. A more worrying angle is how many people are being dragged into the 40% band. What was once intended for a small minority at the top of the income distribution is gradually shifting toward the middle. By the end of the freeze in 2031, the 40% threshold could sit close to the earnings midpoint, meaning nearly half the population may be paying higher-rate tax.

As earnings continue to rise and thresholds remain static, more people will be taxed at higher rates across employment income, dividends, and other revenue streams. The direction of travel is clear: freezes will continue and the burden will be heavier.

Are there any allowances available to reduce my tax liability in 2025/26?

In the UK, individuals can make use of several tax-free allowances each year. Spanning taxes from income tax to capital gains tax, utilising these together can help to minimise annual tax liabilities.

Some of the most significant include:

- Personal allowance: In the UK, taxpayers are entitled to a personal allowance, which is the level of annual income they can earn before they start paying income tax. For the 2025/26 tax year, the personal allowance is £12,570. For every £2 earned over £100,000, taxpayers lose £1 from their personal allowance (which is then taxed at the 40% rate). This means that all taxpayers with an income over £125,140 do not receive the personal allowance. Looking into salary sacrifice schemes can be a great option when earning between £100,000 and £125,140, where individuals might be able to reduce their taxable income - by extension, maintain greater tax efficiency on both their salary and dividend income.

- Capital gains tax allowance: Individuals can realise profits on the sale of assets such as shares and property up to a certain level each year free of capital gains tax. In 2025/26 this allowance is £3,000, less than a quarter from 2022/23’s figure of £12,300.

- Dividend allowance: Individuals can earn up to £500 in dividends annually – free of dividend tax – as of the 2025/26 tax year. This allowance applies to dividend income from various sources and is a quarter of 2022/23’s figure of £2,000.

- ISA allowance: The level of capital an individual can contribute to an ISA each tax year without paying tax on interest, dividends, or capital gains is £20,000 in 2025/26. This can be split across four types of ISAs – Cash ISAs, Stocks and Shares ISAs, Innovative Finance ISAs (IFISAs) and Lifetime ISAs – or allocated solely to one ISA. In the 2026/27 tax year, the Cash ISA segment will be reduced to £12,000, with the overall limit remaining £20,000.

Which reliefs & schemes can I use to minimise my income tax liability in 2025/26?

Alongside the tax-free allowances individuals can make use of, a number of reliefs and schemes can be accessed to further minimise income tax liabilities. With tax-free allowances being gradually reduced and cut by the UK government – for high earners especially – understanding how to make use of these tools is becoming increasingly essential.

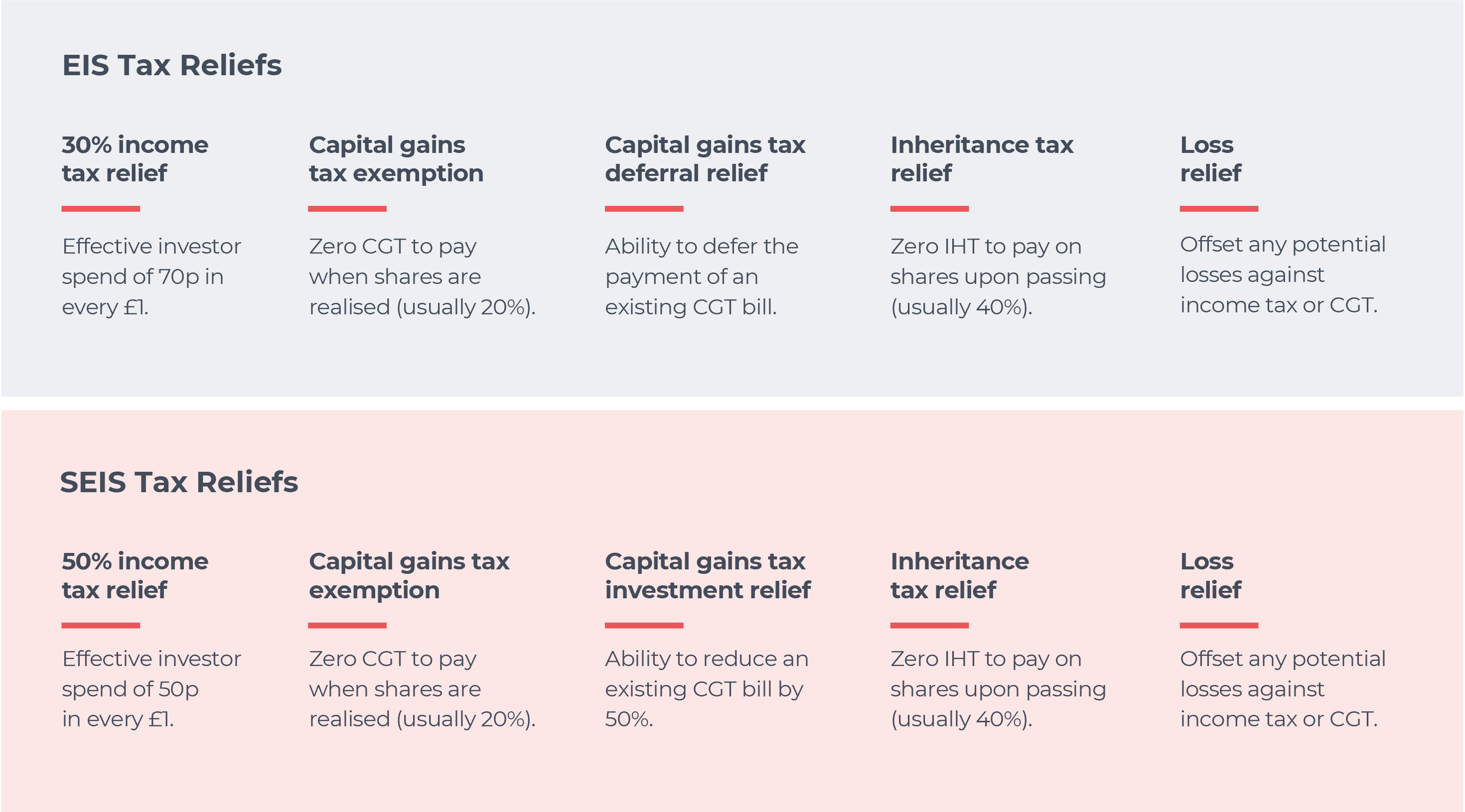

1. Enterprise Investment Scheme (EIS)

The Enterprise Investment Scheme (EIS) is a tax-efficient venture capital scheme that offers individuals a generous range of tax incentives when investing in early-stage companies.

One of the most attractive tax incentives offered by the EIS is 30% income tax relief. This relief enables an investor to claim back up to 30% of the sum they invest into the EIS from their income tax bill of the current or previous tax year.

With the annual EIS investment maximum standing at £1 million in 2025/26 (or £2m should everything over £1m be invested into knowledge-intensive companies [KICs]), this can enable taxpayers to claim annual income tax relief of up to £600,000, ultimately reducing the overall tax liability on both employment earnings and other revenue streams.

2. Seed Enterprise Investment Scheme (SEIS)

The Seed Enterprise Investment Scheme (SEIS), is the 'younger sibling' of the EIS. Introduced in 2012, it facilitates investment specifically into especially early-stage startups, and in turn, offers investors even more generous tax reliefs to offset the added risk this can bring.

The headline SEIS tax incentive is 50% income tax relief on the amount invested (up to £200,000 annually, following changes that came into effect in April 2023).

Alongside this income tax relief, the EIS and SEIS offer investors capital gains tax exemption, capital gains tax deferral/reinvestment relief, inheritance tax exemption and loss relief. For individuals with considerable tax bills, this can make the schemes especially attractive in 2025/26.

3. Venture Capital Trusts (VCTs)

VCTs are investment trusts that pool investor capital to invest in a collection of small to medium-sized companies on the investors' behalf and with the advantage of several added tax reliefs. VCTs currently offer 30% income tax relief up to a maximum investment of £200,000 per year, though their tax advantages are not as extensive as those of the EIS and SEIS. In fact, VCT tax relief has been reduced to 20% from 30%.

4. Individual Savings Accounts (ISAs)

Individual Savings Accounts (ISAs) allow investors to save and/or invest money without paying tax on any interest or capital gains earned. The annual ISA allowance for the 2025/26 tax year is £20,000. Investors can allocate this allowance across the full ISA family, including the Cash ISA (whose limit is being reduced to £12,000 in the 2026/27 tax year), Stocks and Shares ISA, Innovative Finance ISA and Lifetime ISAs.

5. Pension Contributions

In the UK, income tax relief is available on contributions to pension schemes. Basic-rate taxpayers can receive 20% tax relief, while higher-rate and additional-rate taxpayers can receive 40% and 45% respectively. Investors can contribute up to 100% of their earnings to a pension scheme, subject to an annual allowance of £60,000 for the tax year 2025/26.

In addition to regular pension contributions, it’s worth exploring options such as transferring unused allowances from a partner through the marriage allowance, which can further enhance your overall tax position. Individuals looking to invest using their pension can make use of an additional range of tax advantages via both personal schemes and occupational schemes set up by employers.

Popular examples of these include Self-Invested Personal Pensions (SIPPs) and Small Self-Administered Schemes (SSAS).

6. Salary sacrifice schemes

Salary sacrifice schemes (SSS) are arrangements where an employee agrees to reduce their salary in exchange for non-cash benefits. This helps lower taxable income, thereby reducing income and National Insurance contributions whilst making individuals less susceptible to income tax rate changes.

Unlike investment schemes like the Enterprise Investment Scheme (EIS) or Seed Enterprise Investment Scheme (SEIS), which provide tax relief on investments, salary sacrifice schemes directly reduce taxable income. They also indirectly control how much of your earnings spill over into higher tax thresholds and tax brackets.

Options within Salary Sacrifice Schemes:

- Pension Contributions: Sacrificing part of your salary to contribute to a pension scheme offers tax efficiencies and boosts retirement savings.

- Childcare Vouchers: Available to existing members, this option helps cover childcare costs (closed to new applicants).

- Cycle to Work Scheme: Employees can lease a bike and safety equipment, promoting healthier commuting while reducing taxable income.

- Car Leasing: Some employers offer schemes for leasing cars, including electric vehicles, such as the Octopus Energy SSS, which reduces taxable income.

- Technology Schemes: Sacrifice salary in exchange for tech products like laptops and smartphones, often at a reduced cost.

- Holiday Schemes: Some employers allow employees to sacrifice salary for planned holidays.

As these schemes reduce both income tax and National Insurance contributions, they are increasingly popular, but, as a result, have been reduced in the recent budget.

It's worth noting that the government has now made its first move to tighten the rules. From 2029, only the first £2,000 of salary-sacrifice pension contributions each year will be exempt from National Insurance Contributions, although the full amount will remain free from income tax. This confirms the point for caution previously here: once a tax advantage becomes widely used and begins to erode revenue, it becomes a target for reform.

Forming an income tax plan in 2025/26 and beyond

When crafting an income tax plan, it’s important to consider various strategies to optimise your tax position. Combining different tax relief options, such as the Enterprise Investment Scheme (EIS) or Seed Enterprise Investment Scheme (SEIS), with other methods can create a more comprehensive approach to managing tax liabilities.

For example, salary sacrifice can reduce taxable income and EIS can provide valuable income tax relief after taxation, ensuring a robust strategy for tax reduction on both ends.

The most appropriate tax strategy for any individual will depend on their unique circumstances. As income tax rules become stricter and tax-free allowances remain frozen, taxpayers will need to explore more effective ways to reduce their liabilities, whether through utilising relatively straightforward tools like the marriage allowance or employing portfolios of tax-efficient investment options. For some, utilising the UK’s tax-free allowances may be sufficient.

However, those with higher income tax bills may need to consider additional tools to minimise their exposure, ensuring that all thresholds and brackets are optimally managed.

As tax rules continue to evolve, staying informed about the latest changes and the full range of available tax-efficient tools will be crucial. Effective income tax planning for 2025/26 and beyond requires a proactive, well-informed approach to ensure the right strategies are employed to minimise liabilities and maximise available benefits.

GCV Invest is an FCA authorised co-investment platform and private investor network. We do not offer financial or tax advice. Individuals should seek professional advice from a qualified adviser prior to investing.

Income Tax FAQs

1. How does the income tax personal allowance decrease after £100,000?

Once an individual starts earning over £100,000, the annual income tax personal allowance begins to reduce. For every £2 over £100,000, the allowance decreases by £1.

Personal allowance = £12,570

2:1 ratio £12,570x2 = £25,140

£100,000 + £25,140 = £125,140

Here is a graph that illustrates the progressive decrease of the UK personal allowance:

2. How does PAYE work for employees and pensioners, and what should I do if I think my tax code is wrong?

If you're employed or receive a pension, your income tax is usually collected through the Pay As You Earn (PAYE) system. This system uses a PAYE tax code, issued by HMRC, to tell your employer or pension provider how much tax to deduct from your earnings or pension.

You should always check your tax code and the amount of tax being taken from your income. If something looks off or you don’t understand it, it’s important to contact HMRC to query it. Mistakes can happen, and using the wrong code could mean you're paying too much or too little tax. We’ve put together simple guidance to help both employees and pensioners check their HMRC coding notices.

How does PAYE work?

PAYE is the system HMRC uses to collect tax throughout the year, rather than in one lump sum. The tax year runs from 6 April to 5 April the following year.

PAYE involves three parties:

-

HMRC, which issues your tax code and collects the tax,

-

Your employer or pension provider, who applies the code and deducts the tax,

-

You, responsible for checking your tax code and understanding what’s being deducted.

How often is tax deducted under PAYE?

Tax is deducted based on how often you're paid:

-

Most employees and pensioners are taxed weekly or monthly,

-

Some pensions may be paid quarterly or annually, and the tax is adjusted accordingly.

PAYE usually ensures your tax is collected automatically, but you should still keep an eye on your code and deductions to make sure everything is correct.

3. When do I need to complete a Self-Assessment tax return?

There are several reasons why you might be required to complete a Self Assessment tax return in the UK. While each individual’s situation is different, the most common reasons include:

-

You’re self-employed or a sole trader.

-

You rent out a UK property, whether as a landlord or through platforms like Airbnb.

-

You’ve sold an asset in the UK, such as shares, property, or other investments, and may need to report capital gains.

-

You’re a director of a limited company, even if you don’t take a salary.

-

You earn over £100,000 per year from any source.

-

You live abroad for part or all of the year, but still have UK income (such as rental or investment income).

-

You receive foreign income, such as overseas investments, pensions, or earnings, that needs to be declared in the UK.

If any of these apply to you, it's likely that HMRC will expect you to file a tax return - even if all your tax has already been paid through PAYE. If you're unsure, it’s a good idea to check directly with HMRC or seek professional advice.

%20(3)%20(2).jpg)