What tax reliefs are available when investing in UK startups?

From capital gains tax exemption to 50% income tax relief, startup investment tax reliefs can vary considerably, but are most commonly accessed via one of three routes:

- Enterprise Investment Scheme (EIS)

- Seed Enterprise Investment Scheme (SEIS)

- Venture Capital Trusts (VCTs)

With venture capital (VC) being classed as a high risk/high return asset class, these routes aim to minimise the risk and maximise the returns associated with early stage investments by utilising a range of tax reliefs

However, with each route varying in structure, target growth and the mix of tax incentives it offers, researching the differing features of each tax efficient investment method can prove crucial in determining the most suitable option for investors.

Enterprise Investment Scheme (EIS)

One of the most popular routes within the UK venture capital space, the Enterprise Investment Scheme (EIS) was introduced in 1994 with the aim of stimulating growth into innovative UK startups and scaleups, and since that point has attracted over £26 billion of investment into more than 36,000 SMEs, in part due to the generous range of tax reliefs it offers investors.

Included with the goal of minimising downside risk and maximising potential returns associated with early stage investments, the EIS offers investors five main tax advantages:

- 30% income tax relief on investments of up to £1 million per year

- Capital gains tax exemption when shares are realised

- Capital gains tax deferral on existing CGT liabilities when returns are reinvested

- Inheritance tax exemption on the value of shares when passed on

- Loss relief against the investor’s marginal rate of tax should the investment not realise positive returns

The below table illustrates three potential outcomes of a £50,000 EIS investment for an additional rate taxpayer, in which the hypothetical company fails, breaks even and triples in value.

Certain criteria must be met for these tax reliefs to be claimed. Explored in-depth in GCV’s comprehensive guide to the Enterprise Investment Scheme, several of these include:

- Shares must be held for three years from the point of investment to benefit from income tax relief

- Investors must have accrued sufficient income tax liabilities to draw relief from

- Investors cannot claim more than £300,000 in income tax relief per tax year (30% of the £1 million annual EIS investment maximum)

- Deferral relief can be claimed with EIS investments made in a window spanning between 1 year prior and up to 3 years after the gain is realised

Though this range of tax reliefs is often among the scheme’s most attractive benefits to experienced investors, a number of factors have contributed to the EIS’s growing popularity in recent years. Notably, the scheme’s ability to generate considerable investment growth.

When invested in directly (rather than via a fund), individual EIS investment opportunities will often target returns anywhere from 5x - 20x money-on-money (and even higher in some cases).

Though returns cannot be guaranteed and VC investments are classified as high-risk/high-return strategies, should opportunities be accessed via reputable co-investment platforms and investors take advantage of the full library of tax reliefs available, a proportion of this risk can be mitigated.

Seed Enterprise Investment Investment Scheme (SEIS)

The sibling scheme to the EIS, the Seed Enterprise Investment Scheme was introduced in 2012, and since that point has attracted over £1.5 billion of investment into more than 15,000 UK startups.

Launched with the goal of channeling investment into especially early stage startups, the SEIS boasts narrower eligibility criteria for companies than the EIS to ensure qualifying small businesses are at an even earlier stage of growth than those of its sibling scheme.

In order to offset the added risk of investing in early stage startups, the SEIS offers investors an even more generous range of tax reliefs than its more established counterpart, these include:

- 50% income tax relief on investments up to £200,000 per year

- Capital gains tax exemption when shares are realised

- 50% capital gains reinvestment relief when returns are reinvested

- Inheritance tax exemption on the value of shares when passed on

- Loss relief against the investor’s marginal rate of tax should the investment not realise positive returns

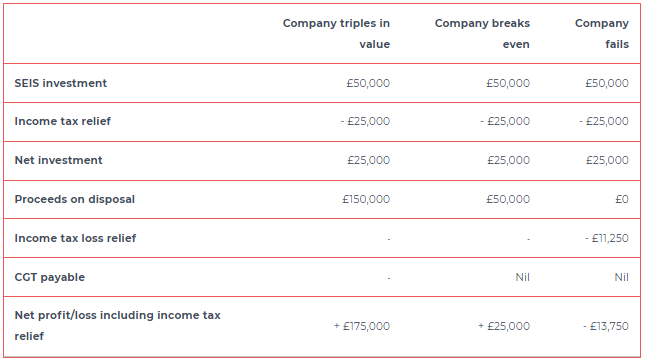

The below table illustrates three potential outcomes of a £50,000 SEIS investment for an additional rate taxpayer, in which the hypothetical company fails, breaks even and triples in value.

Similarly to its sibling scheme, SEIS tax reliefs involve a range of caveats. Explained in detail in GCV’s guide to the Seed Enterprise Investment Scheme, a number of these include:

- Shares must be held for three years from the point of investment to benefit from income tax relief

- Investors must have accrued sufficient income tax liabilities to draw relief from

- Investors cannot claim more than £100,000 in income tax relief per tax year (50% of the £200,000 annual SEIS investment maximum)

- Reinvestment relief can be claimed with EIS investments made in a window spanning between 1 year prior and up to 5 years after the gain is realised

Alongside the scheme’s generous tax reliefs, the significant investment growth individual SEIS investments are able to generate (due to startups being inherently earlier stage, and usually meaning share prices are lower) is among the key draws of the scheme.

This higher risk/return nature, alongside the SEIS’s ability to offer angel investors the opportunity to play a key role in the growth journey of an innovative young startup, can make the route particularly attractive to more experienced investors.

Venture capital trusts (VCTs)

Introduced in 1995 to help facilitate small businesses with growth capital following a lack of availability of small business loans, since that point venture capital trusts have attracted more than £10.5 billion of investment from private investors.

Unlike the EIS and SEIS, venture capital trusts are not government-backed investment schemes, but rather companies, listed on the stock exchange, that pool capital from private investors to invest in a portfolio of early stage businesses, selected by a fund manager.

VCTs do offer investors a range of tax reliefs, although this is not as extensive as that offered by the EIS and SEIS. This includes:

- 30% income tax relief on investments up to £200,000 per year

- Capital gains tax exemption when shares are realised

- Dividends tax exemption on any dividends issued

As with the EIS and SEIS, a number of limits also exist when claiming VCT tax reliefs, some of these include:

- Shares must be held for five years from the point of investment to benefit from income tax relief

- Investors must have accrued sufficient income tax liabilities to draw relief from

- Investors cannot claim more than £60,000 in income tax relief per tax year (30% of the £200,000 annual VCT investment maximum)

Though VCTs do allow investors to a achieve a less effort-intensively diversified portfolio, due to capital being spread across a range of companies (only 80% of which are required to be classified as ‘early stage’) they generally target considerably lower investment growth than direct investments, and will typically charge investors additional fund fees.

Investing in startups tax efficiently

Regardless which route an investor follows when looking to access tax reliefs via startup investments, the range of tax efficient options investors have at their disposal in the UK means that investors adopting various investment strategies, portfolio splits and growth goals have the ability to minimise the risk and maximise the potential returns attached to their VC allocation.

Ultimately, as venture capital remains one of the best-performing asset classes in an alternative investment market forecasted to grow by 40% by 2025 to 21.1 trillion, and traditional investments look increasingly threatened by market volatility and heightened taxation in the coming years, the demand for tax efficient startup investment options such as these shows no sign of slowing down.

%20(3)%20(2).jpg)