Weekly Briefing: improved UK construction activity, SVB fallout & Spring Budget recap

With the Chancellor’s Spring Budget announcement, the European Central Bank’s interest rate decision and the aftermath of Silicon Valley Bank’s collapse, there is certainly a lot to take note of this week. A number of positive economic headlines stemmed from the Spring Budget, although these are coupled with much uncertainty as stock markets around the world reflect wavering confidence.

UK economy

Inflation set to fall by almost ¾ from October 2022 peak

- The Office for Budget Responsibility (OBR) forecasts UK CPI inflation to fall from 11.1% in October 2022 (the highest rate in 40 years) to 2.9% by the end of 2023.

- The forecasted figure is within the Government’s official inflation target and would further help the UK avoid a technical recession.

GDP growth outlook revised upwards

- The OBR revised the UK’s GDP growth outlook upwards for 2023. Now, a smaller contraction of 0.2% is expected.

- This upwards revision is largely due to the improved inflation outlook, as well as a number of measures announced in the Chancellor’s Spring Budget aiming to boost innovation and growth.

New regional investment zones announced in eight locations

- Twelve new investment zones spread over eight regions across the UK were announced in the Spring Budget.

- Each zone is set to receive £80 million over the next five years and a number of tax incentives to promote investment.

- The zones will be focused on driving growth in technology, the creative industries, life sciences, advanced manufacturing and the green sector.

- The tax incentives and funding are designed to improve skills, provide specialist business support and enhance local infrastructure in each location.

Global economy

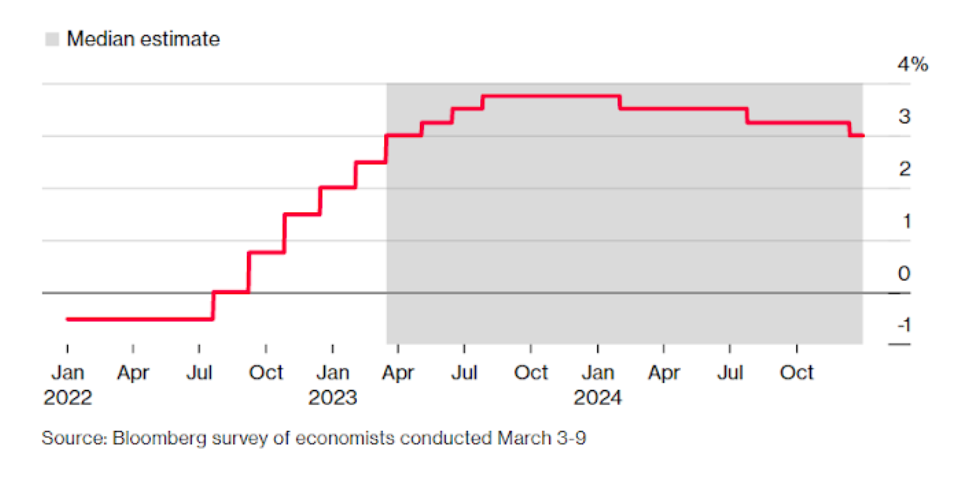

ECB deposit rate predicted to reach peak of 3.75% in July

- European Central Bank (ECB) officials made one of the most consequential decisions in months as they judged that market turmoil centering on Credit Suisse was not severe enough to derail a long-awaited interest-rate hike.

- The ECB Governing Council increased the three key ECB interest rates on Thursday March 16th, each by 50 basis points.

- This is in line with the “determination to ensure the timely return of inflation to our two per cent medium-term target”.

- The decision surprised some investors, who thought the uncertainty surrounding Credit Suisse could have encouraged the ECB to reconsider its plans.

- Markets are pricing a peak in the ECB deposit rate of 3.75% in July 2023.

Goldman Sachs increases odds of a US recession

- Goldman Sachs boosted its estimate of the odds of a US recession over the next 12 months to 35% in response to increased uncertainty over the economic impact of bank stress.

- The previous estimate was a one-in-four chance, but this increased by 10 percentage points after the collapse of Silicon Valley Bank.

Feature: global banking news

What happened to Silicon Valley Bank?

- On Friday 10th March, Silicon Valley Bank (SVB) was taken over by US regulators and placed under the control of the Federal Deposit Insurance Corporation (FDIC) after $42bn in client withdrawal requests the previous day left the bank insolvent.

- This is the largest US bank failure since Washington Mutual Bank in 2008.

- While no buyer has been announced yet for the US operations, the Federal Reserve, FDIC, and Treasury Department assured depositors that 100% of their capital is safe and available.

- The US government has also taken over Signature Bank (a New York-based commercial bank which had many clients heavily involved in crypto), over indications that this institution was most vulnerable to a similar bank run.

How has this impacted the UK?

- Early on Monday 13th March, the Bank of England announced the sale of SVB’s UK branch to HSBC for £1.

- The transaction has been facilitated by the Bank of England in consultation with HM Treasury, and it has been announced that the deal with HSBC involved no taxpayer money and customer deposits have been protected.

- This acquisition has enabled many UK tech businesses to continue operating, providing added reassurance for a number of tech investors.

Credit Suisse turns to Swiss National Bank for support

- Credit Suisse suffered significantly from the global banking pressure, with shares falling almost 30% on Wednesday 15th March after its largest shareholder, Saudi National Bank, stated it could not add to its existing stake in the bank.

- Following its downward share price spiral, Credit Suisse announced in an overnight statement that it would receive up to 50bn Swiss francs (£44bn) from the Swiss National Bank in what it called “decisive action” to strengthen its liquidity.

Venture capital

SVB collapse may increase demand for non-bank lenders

- British start-ups backed by venture capital held approximately £2.5bn with Silicon Valley Bank UK.

- Following SVBs collapse, it is expected that VC-backed startups will increasingly look to raise funds from non-bank lenders. Should this be the case, competition for loans from non-bank entities may push prices higher.

Key VC points from the Spring Budget

- It was announced in the Spring Budget that, as the UK is following the global trend of an ageing population, the Chancellor intends to provide the ability for pension funds to gain further exposure to the venture capital industry in the UK.

- Furthermore, whilst there was no other direct reference to tax-efficient investment schemes in Wednesday’s Budget, the Treasury Committee announced a week prior that the Chancellor intends to extend the Enterprise Investment Scheme (EIS) and will provide further details in due course.

Private equity

£481 million deal agreed for PE group to buy British company

- US private equity group Providence Equity Partners agreed a £481m buyout deal of British event organiser Hyve.

- Providence agreed to pay 108p in cash for each Hyve share.

- Hyve had previously rejected two offers worth 101p and 105p a share from Providence.

- Following this announcement, shares in the London-based company jumped more than 12% in early trading, to 111.8p.

Property

UK construction activity grows at record rate in nine months

- UK construction activity beat investor expectations in February to register its highest growth rate in nine months as an improving global outlook boosted commercial projects.

- The S&P Global/CIPS UK construction purchasing managers’ index – which measures monthly changes in total industry activity – registered 54.6 in February, up from 48.4 in January.

- The index measure “paints a bright picture of progress in the construction sector with a robust jump in output last month”, said John Glen, CIPS chief economist.

- Construction order books expanded for the first time since November 2022 and input price increases were the slowest since November 2020.

A final note

Whilst global banking pressure is still causing uncertainty, markets are beginning to somewhat calm following Government intervention with Silicon Valley Bank and central bank intervention with Credit Suisse. Furthermore, the UK’s growth and inflation outlook remains on track and investment plans announced by the Chancellor on Wednesday may further boost the UK’s investment appeal and overall business and consumer confidence.

%20(3)%20(2).jpg)