Weekly Briefing: economy grows 0.3%, NI trade deal agreed and house prices begin to rise

This 'Week in Review' highlights key economic data ahead of the Chancellor’s Budget announcement on March 15. From the Government’s £370 million tech investment plan to the Windsor Framework, we’ve compiled some of the most significant updates on the UK economy and investment outlook, as well as key economic data regarding the Eurozone.

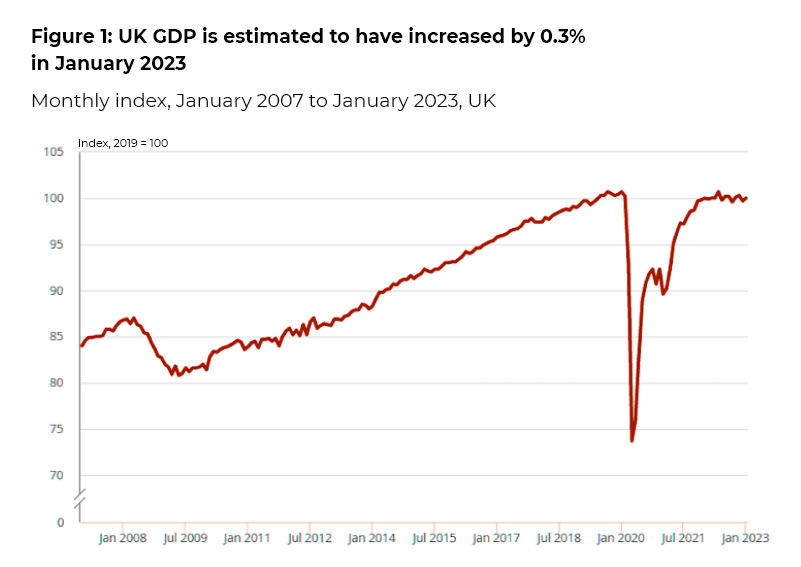

UK economy grew 0.3% in January 2023

- Following a 0.5% decrease in GDP growth in December 2022, the UK economy unexpectedly grew by 0.3% in January 2023.

- The services sector grew by 0.5% in January 2023 and was the main driver of the UK’s 0.3% increase in GDP.

- However, production fell by 0.3% in January 2023, and construction output decreased by 1.7%.

Government launches £370 million plan to boost tech investment

- The UK government has pledged more than £370 million to support tech investment in a bid to make the country a "science and technology superpower" by 2030, as highlighted by PitchBook.

- The plan includes a £250 million allocation to support startups in AI, quantum technologies and engineering biology, an additional £10 million set aside for the UK Innovation and Science Seed Fund, and up to £50 million for co-investments.

- The framework also sets out a number of other measures intended to increase public and private investment in science and tech, better attract talent and improve regulation.

- Prime Minister Rishi Sunak and Chancellor of the Exchequer, Jeremy Hunt, have vocalised their shared determination to make tech investment a priority for the current government.

Challenger and specialist banks accounted for a record share of gross lending in 2022

- Challenger and specialist banks have surpassed high street banks for smaller business lending, with new data showing they accounted for 55% of the UK SME market in 2022.

- According to the British Business Bank's Small Business Finance Markets Report 2023, challenger and specialist banks provided a record £35.5bn in 2022.

- This is a 12.8% increase from 2021, and 16.6% more than the £29.6bn deployed by traditional UK banks in 2022.

- The report also reveals the smaller business asset finance market reached a record level in 2022, with an increase in new business of 11% in 2022, taking the total figure to £22.1bn.

- In part, this was driven by some easing of supply chain shortages and by rising asset prices.

NI trade deal: the Windsor Framework

- On Monday March 6th, Prime Minister Rishi Sunak and European Commission president Ursula von der Leyen announced a set of processes, called the Windsor Framework, designed to reduce the impact of the trade border in the Irish Sea.

- This new Northern Ireland protocol aims to cut red tape, reduce the role of EU law and the European Court of Justice in the region, smooth trade with Northern Ireland and end years of strained post-Brexit ties between London and Brussels.

- Following the trade deal, von der Leyen opened up the opportunity for the UK to join the EU’s Horizon Europe research programme, in which legal entities from the EU and associated countries can participate.

- Horizon Europe is the EU’s key funding programme for research and innovation, with a budget of €95.5 billion.

- The programme supports job creation, economic growth, industrial competitiveness and the creation and better dispersion of crucial knowledge and technology, with the overall aim of optimising investment impact.

Eurozone inflation outlook

- Euro area annual inflation slowed to 8.5% in February 2023 - down from 10% the previous month - but was still higher than some economists’ expectations.

- Annual inflation in Germany – the EU’s largest economy – stood at 8.7% in February, although this is relatively mild compared to many other EU countries.

- For instance, the inflation rate was 26.2% in Hungary, 21.4% in Latvia and 19.1% in the Czech Republic as of January 2023.

UK tax update

- Jeremy Hunt is finalising plans for tax breaks designed to spur UK business investment ahead of the March 15 Budget announcement.

- The Chancellor is considering providing UK companies with tax relief on capital investment to offset the sharp planned rise in corporation tax following the end of the government’s £25bn “super-deduction” regime.

- Many business leaders have called on the Chancellor to soften the planned rise in corporation tax from 19% to 25% to allay growing fears over the health of the British economy and faltering levels of company investment.

PitchBook News: global fintech and venture capital update

- The fintech industry remains one of the most well-funded spaces in the VC landscape.

- Enterprise fintech startups are capturing more of the broader fintech VC pool, and PitchBook’s latest Emerging Tech Research explores why investors are paying attention to this segment.

- Global VC investment in the broader fintech space reached $57.6bn across 2,747 deals in 2022.

- However, exit activity sharply declined due to difficult economic headwinds, dropping 74.3% YoY to $18.1bn.

- US-based fintechs accounted for 36% of all fintech funding raised in Q4 22, followed by Europe (26%) and Asia (25%).

UK VC outlook

- Venture capital funding increased in the UK between Q3 and Q4 2022, from $3.3bn to $3.5bn.

- Despite this, the volume of deals remained largely unchanged.

- This might suggest a growing preference for greater ticket sizes among many VC investors.

Preqin News: global private equity AUM set to reach $7.6tn by 2027

- Preqin anticipates continued but slower expansion of assets under management for the global private equity industry, forecasting that worldwide AUM could grow to $7.6tn by 2027.

- This would represent an 80% increase on the industry's collective AUM today, which is estimated at $4.2 trillion.

- The secular trend is that private markets will continue to grow relative to public markets.

Halifax House Price Index: February 2023 update

- The average UK house price is now £285,476, as measured by the Halifax House Price Index.

- This is 1.1% higher than in January 2023 and 2.1% higher than the same time last year.

- Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labour market are each partially helping to stabilise house prices following the falls seen in November and December.

UK rental property trends

- Private rental prices remain on an upward trajectory in the UK.

- Rents for people moving into private accommodation rose by 12% last year according to real estate data provider, Hometrack.

- Higher interest rates for buy-to-let mortgages, heavier taxation of landlords and more stringent energy efficiency regulations are causing buy-to-rent landlords to sell up, shrinking the supply of rental properties.

- ZOPA reports that the supply of rental property is almost 40% below the average levels for the last five years.

- At the same time, demand for rental properties has soared with the end of lockdowns & return to offices.

A final note

Whilst notable economic and geopolitical challenges are still present, the UK economy grew by 0.3% in January 2023, up from a sharp fall in growth the previous month. Furthermore, the March Budget announcement could offer more insight into key fiscal and monetary policy set to lessen the impact of high inflation combined with slow growth. Importantly, with significant tech investment plans announced, the Windsor Framework agreed, and house prices appearing to stabilise, this week has certainly brought some positive news for UK consumers, investors and businesses.

%20(3)%20(2).jpg)