EIS capital gains tax relief: an overview for investors

The Enterprise Investment Scheme (EIS) offers investors some of the UK's most generous tax reliefs available when investing in early-stage companies.

Among the most sought-after are the scheme's capital gains tax (CGT) reliefs.

As CGT rates and allowances tighten, these advantages are proving increasingly desirable for investors keen to minimise capital erosion. As a result, understanding their finer details can be crucial to maximising their effectiveness.

1. What is EIS capital gains tax relief?

EIS capital gains tax relief (also known as CGT exemption or disposal relief) is a tax incentive available under the Enterprise Investment Scheme (EIS). It enables investors to sell EIS shares free of the 10%-20% rate of capital gains tax typically due on the sale of assets.

The maximum amount an investor can invest via the EIS per tax year is £2 million. In turn, this relief alone can facilitate a CGT saving on shares of up to £400,000 per year (for higher and additional rate taxpayers).

|

Tax Bracket |

Income Range |

CGT Rate on Assets |

CGT Rate on Property |

CGT Rate on EIS Shares |

|

Basic rate taxpayer |

£15,571 to £50,270 |

18% |

18% |

0% |

|

Higher rate taxpayer |

£50,271 to £125,140 |

28% |

28% |

0% |

|

Additional rate taxpayer |

Over £125,140 |

28% |

28% |

0% |

For example: an additional rate taxpayer pledges £50,000 in an EIS investment opportunity and five years later the company exits. The investor's share value has tripled to £150,000. The £100,000 capital gain they have realised (that would usually be liable to £20,000 in CGT) will be entirely capital gains tax-free.

To qualify for CGT exemption, investors must have held their EIS shares for at least three years.

2. What other EIS capital gains tax reliefs are available?

Alongside capital gains tax exemption, the EIS offers investors two further CGT-related tax reliefs. Known as deferral relief and loss relief, these can provide tax planning and risk minimisation benefits.

1. Deferral relief

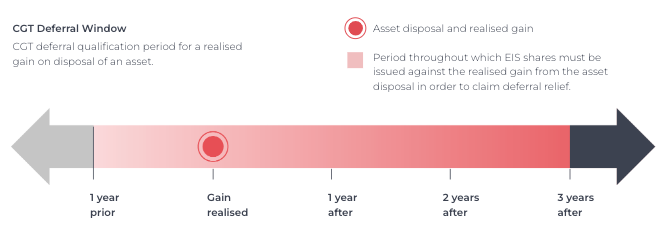

The EIS CGT deferral relief can enable investors to defer the payment of an existing CGT bill (that has arisen from any chargeable asset) to a later year, should the gain's value be reinvested in EIS shares.

To qualify for CGT deferral relief, the sum of the deferrable gain must be reinvested into EIS-qualifying shares between one year prior and up to three years after it is realised.

For example: an additional rate taxpayer sells a property and makes a capital gain of £100,000 on 5th June 2023. £28,000 would typically be deducted from this gain in CGT. However, EIS deferral relief allows them to retain the full gain should it be invested into EIS shares issued between 5th June 2022 and 5th June 2026.

2. Loss relief

Should an unexpected event arise with the EIS investment and a capital loss take place, EIS loss relief can reduce the proportion of the loss the investor incurs, in addition to income tax relief

EIS loss relief can be calculated by multiplying an investor's effective loss by either their marginal rate of capital gains tax or income tax (this can also be done using an EIS calculator). Which tax rate this is claimed against will depend on whichever is preferable to the investor

For example: an additional rate taxpayer invests £50,000 in an EIS opportunity. They claim £15,000 back via income tax relief, but the company fails and their share value reduces to £5,000. The investor multiplies their effective loss of £30,000 (£50,000 - [£15,000 + £5,000]) by their 45% rate of income tax to claim back £13,500 in loss relief.

3. What is the maximum EIS capital gains tax relief I can claim?

The maximum an investor can claim in CGT relief via the EIS varies depending on which relief is being referred to. The limits are:

- CGT exemption: technically an incentive rather than a relief, investors do not have to manually claim this. However, the maximum an investor can invest annually via the EIS is £2 million. In turn, the maximum annual CGT saving on shares from this incentive is £400,000.

- CGT deferral: CGT deferral requires the sum of a gain to be reinvested in EIS shares for its CGT bill to be deferred. This means that the maximum gain an investor can claim deferral relief on is £2 million. In turn, the maximum CGT bill that can be deferred is £560,000 (assuming it arose from a property sale).

- Loss relief: should an investor invest the maximum of £2 million, the maximum loss relief they could receive (should the investment fail) would be £630,000. The sum of this is: £1.4 million (£2 million - £600,000 claimed income tax relief) x 0.45% (additional rate of income tax) = £630,000.

4. How do I claim EIS capital gains tax relief?

Different processes are required to claim each of the EIS's capital gains tax reliefs. These can be both automatic and manual:

- CGT exemption: CGT exemption on EIS investments is a tax benefit applied automatically when eligible shares are disposed of, provided the conditions are met. However, investors may still need to report the disposal on the Capital Gains Tax summary pages of their tax return if the total value of disposals exceeds HMRC's reporting thresholds (e.g., £50,000 in 2023-24). While the gains themselves are exempt from CGT, the disposal proceeds count toward determining whether a reporting requirement exists.

- CGT deferral: following EIS share issue, EIS3 certificates will be distributed to investors. To claim the relief investors can complete the attached claim form before attaching this to the capital gain summary page of their annual tax return. Alternatively, this can be claimed via an online HMRC self-assessment form.

- Loss relief: to claim loss relief investors must complete the 'Unlisted shares and securities' section of their SA108 form, found on their annual tax return. For investors that don’t complete a self-assessment tax return, this form can be requested from HMRC.

5. What benefits are associated with EIS capital gains tax relief?

The EIS's capital gains tax-related incentives can contribute to a range of benefits for investors. Some of the most significant include:

- Reduced CGT bills: in the UK the sale of shares typically triggers a 10% to 20% capital gains tax, with property this is 18% to 28%. With EIS shares being CGT-free upon disposal, this can enable investors to make considerable CGT savings on their annual tax bill. This is especially true for individuals investing significant sums.

- Flexible tax planning: EIS deferral relief offers investors the flexibility to defer the payment of CGT from an asset sale to a future year. This can enable investors to strategically plan their CGT liabilities according to individual tax circumstances.

- Potential termination of a CGT liability: when EIS shares are sold, any deferred gains are then liable to be paid. This is unless the original gain is again reinvested in EIS-eligible shares. In this case, the gain will continue to be deferred. If this continues to be repeated, the original CGT bill can be deferred indefinitely (until the investor's passing, at which point it will be terminated).

- Enhanced target returns: with EIS CGT exemption, investors are not required to pay the 20% CGT typically required upon disposal of shares. This increases the net returns able to be realised from EIS investments (which typically target 5x - 20x money-on-money).

- Risk minimisation: should an investor experience a loss with the investment, EIS loss relief can offset this with added relief. Calculated by multiplying the investor's effective loss by their marginal rate of CGT or income tax, this can further reduce the risk associated with the investment.

- No impact on CGT allowance: the UK capital gains tax allowance is decreasing. In the 2024/25 tax year, it will be less than 25% (£3,000) of what it was in 2022/23 (£12,300). With EIS shares being CGT exempt, this means investments will not negatively impact an investor's annual CGT allowance.

6. What risks are associated with EIS capital gains tax relief?

Though EIS CGT reliefs can contribute to a number of investor advantages, it is important to remember that early-stage investments are classified as high-risk. As a result, investors should be aware of several risks relating to EIS CGT reliefs:

- Changes in UK residency: If the investor does not remain a UK resident within three years of investing, the deferral of their gain will no longer be applicable. To address this, investors may ensure long-term residency plans are in place before committing to the investment.

- Changes in EIS eligibility: If the company raising investment ceases to qualify for the EIS within three years of the investment, CGT deferral will no longer apply. Companies typically maintain EIS eligibility for three years for this reason. However, investors should verify this with the provider prior, to mitigate this risk.

- Regulatory changes: The government has the authority to make changes to the rules governing EIS reliefs. Since its inception in 1996, there have been no negative changes to the EIS. There are also currently no changes anticipated. However, investors should still be aware of this possibility.

- Deferral period uncertainty: deferral relief enables investors to delay payment of external CGT bills until EIS shares are sold. Whilst eligible companies generally achieve exit between five and ten years from investment, this can vary across opportunities.

7. Does the EIS offer other tax advantages?

Alongside the EIS's CGT-related incentives, the scheme offers investors an additional two tax advantages: income tax relief and inheritance tax exemption.

EIS income tax relief enables investors to claim 30% of the amount invested back in income tax relief. This effectively reduces the risk of the investment by almost a third.

EIS inheritance tax (IHT) exemption, allows investors to pass on shares to beneficiaries free of IHT following passing. With the current UK IHT rate standing at 40%, this incentive can make the scheme attractive to individuals with considerable estates planning for later life.

Together the full range of EIS tax reliefs can combine to minimise risk and maximise potential returns. The below table illustrates how this can be possible, demonstrating three example outcomes of a £50,000 EIS investment for an additional rate taxpayer.

|

Company Triples in Value |

Company Breaks Even |

Company Fails |

|

|

EIS investment |

£50,000 |

£50,000 |

£50,000 |

|

Income Tax Relief |

- £15,000 |

- £15,000 |

- £15,000 |

|

Net Investment |

£35,000 |

£35,000 |

£35,000 |

|

Proceeds on Disposal |

£150,000 |

£50,000 |

£0 |

|

Loss Relief (x Income Tax) |

- |

- |

£15,750 |

|

CGT Payable |

- |

Nil |

Nil |

|

Net Profit/Loss Including Income Tax Relief |

+ £165,000 |

+ £15,000 |

- £19,250 |

8. Accessing the most appropriate EIS investment

Capital gains tax advantages are among the most attractive benefits of the EIS. However, when searching for the most appropriate EIS investment, due to the EIS's complexity it can be beneficial to consider a range of additional factors.

Whether this is the route investments are accessed (from co-investment platforms to EIS funds) or the investor focuses (from superior returns to portfolio diversification), understanding these differences can be crucial to selecting an EIS opportunity that closely aligns with personal goals.

As a result, thorough research into the scheme and/or sufficient professional financial advice prior to investing should be prioritised. To assist with this, we have created a free comprehensive guide to the Enterprise Investment Scheme. Providing an end-to-end overview of the EIS for investors, you can access the guide below.

EIS Capital Gains Tax Relief Frequently Asked Questions:

How does the deferral of CGT under EIS compare to other tax relief options?

EIS deferral allows for more flexibility compared to other schemes like SEIS or VCTs, as it provides the ability to defer CGT until the EIS shares are sold, with potential CGT exemptions for long-term investments. This makes it an attractive option for investors looking to delay or reduce their tax liabilities.

Can the deferral apply to gains from assets other than property?

Yes, EIS capital gains tax deferral can apply to gains from a wide range of assets, not just property. This includes stocks, bonds, and business assets, provided the proceeds are reinvested in qualifying EIS investments. You can calculate the tax on your asset using a capital gains tax calculator.

Are there specific restrictions on the types of EIS shares that qualify for CGT deferral?

To qualify for CGT deferral, the EIS shares must meet certain criteria, including being issued by a qualifying company. The company must be unquoted, meet specific size criteria, and use the funds for qualifying purposes such as research, development, or expansion.

What happens if the EIS company fails or the investment loses value?

If the EIS company fails or the investment loses value, the deferral of CGT is not automatically reversed. However, the loss can be used for tax relief through loss relief provisions, where losses on EIS investments may be deducted from other income, reducing the overall tax liability.

%20(3)%20(2).jpg)