Investment Opportunity Q&A with Intelligence Fusion

Edit: Intelligence Fusion's first round has now closed. To register your interest for potential follow on rounds, please click here.

We sat down with founder of Intelligence Fusion, Michael McCabe, to ask him the questions investors want to know...

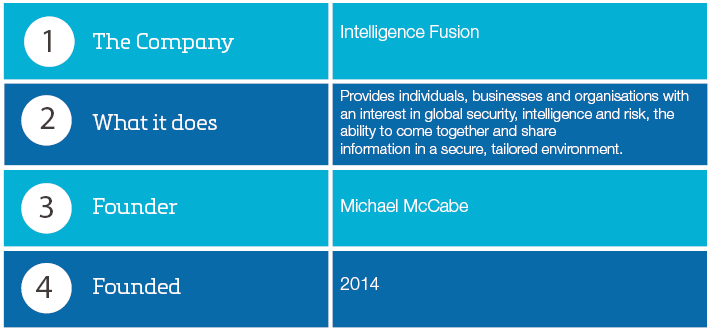

Vital Stats

Q&A with founder, Michael McCabe

What sector does your company operate in?

Intelligence Fusion operates in the computer software/services sector, covering specifically, security, risk and research.

Is there a specific person or company which has influenced your career in this industry?

Not specifically, no. I have operated in the security industry since I was 18 and over the past 14 years I have worked for or have had exposure to many of the major security companies across the globe, witnessing not only their strengths but also their failings. Intelligence Fusion will draw on all of the strengths that I witnessed, while being mindful of their failings.

What problem are you trying to solve?

As global trade has increased and we have become more connected around the world, through use of the Internet, an increase in the amount of data available means that companies are often hindered by information overload.

In a time of growing political uncertainty and conflict, many companies can also find themselves having to outsource their intelligence and security support which can be financially draining. Let’s take the current conflict in Yemen as an example.

There is uncertainty with regard to the security of the countries ports. In addition, the land-based conflict is preventing up-to-date information on situations being relayed to businesses and organisations who have an interest in the country.

With Intelligence Fusion, any new issue or development would be highlighted immediately and all forum members would be alerted. This means that all businesses and organisations with an interest in Yemen, directly or indirectly, are able to protect their people, equipment and investments.

Intelligence Fusion connects people on one platform, to ensure that there are no breaks in information and businesses have awareness of the current situation at all times.

What solution are you offering?

We’ve fused the techniques used in intelligence analysis with technology to create an online network and communications platform for the security and intelligence sector. Think Linked In, but specific to this sector. However, Intelligence Fusion is far more intuitive, as it has been created specifically to allow subscribers to the network, to uncover new sources of information, and then share this important intelligence quickly.

We make information sharing more streamlined and effective, significantly reducing the costs associated with outsourcing intelligence support by providing a common intelligence picture which minimises risk and maximises opportunity.

How big is the market – and how much of it do you think you can own?

This market cuts across multiple sectors and industries, covering maritime security, land based security, cyber security, business intelligence, travel security, crisis management, intelligence support, security consultancy and others.

To put some figures on these sectors, the maritime security industry is set to be worth $19.48 billion by 2018, land based security has been assessed to grow to $86 billion in 2016, the business intelligence market is set to be worth $20.81 billion by 2018 and the cyber security market is assessed to be worth $155.74 billion by 2019. Private intelligence companies are big business and growing.

In addition, intelligence is an enabler, meaning it provides in roads into an organisation, allowing Intelligence Fusion to diversify into different services such as operations management, business development, operational enabling and recruitment. If Intelligence Fusion can get the traction I feel it can, it will be one of the prominent global private intelligence companies.

It is difficult to know how much market share we can take, however, technology and big data is currently revolutionising all of these sectors and I feel we can take a substantial bite out of all the sectors, providing we continue to adapt and innovate.

What trends are you currently seeing in your space?

Historically, private sector intelligence was scarce and mainly looked at the geopolitical risk to large oil and gas companies in the energy sector; however, it is now an exploding industry.

There is a great opportunity to help small and medium enterprises, all the way up to large global companies realise opportunities around the globe and identify where they can grow by providing them with the answers to their critical decision making questions.

Intelligence Fusion focuses on risk management and situational awareness, but also helping identify new opportunities in non-traditional markets and provide clients with the knowledge to operate there safely.

What advice would you give other entrepreneurs trying to secure pre-seed or seed capital?

Read ‘The Lean Startup’ by Eric Ries. This book is about building a business from the ground up with what your customers really want in mind. This will help you improve your businesses strategic vision, producing a better business plan which will translate more effectively to potential investors and ultimately create a more successful business.

In addition, if possible, find a business mentor, ideally with experience of start-up businesses and achieving early stage finance. I was mentored myself, and while I had many strengths, my mentor helped fill the gaps in my business knowledge and acted as a soundboard for my business. A good mentor will not only cover the basics and provide some hard truths, but also push you to grow.

How does Intelligence Fusion stand out from competitors?

There are two types of competitors in the market (i) private intelligence companies who use teams of analysts and (ii) software companies who use algorithms to scrape the World Wide Web for key search terms and populate maps.

The private intelligence companies often have a small team of analysts, and are highly expensive and generally considered to produce average quality reporting.

The software companies on the other hand are in essence news-reporting services, populating maps with open source articles which are often geo-located incorrectly and lack the so what that businesses need to know.

Intelligence Fusion on the other hand, will have thousands of subscribing vetted professionals across the globe, providing often real time intelligence to the community with a team of intelligence/security administrators for moderation and support.

Every organisation and business have different needs and requirements so a generic report on a country will often leave a client with intelligence gaps. We provide the global community with one single platform to go to in order to answer their particular information requirements in a highly cost effective manner.

What’s been the most unexpected (but valuable) lesson you’ve learnt so far?

Online digital marketing has to be understood and engaged with. There is no way to get around it, digital marketing is the future, is here to stay and can be a very cost effective method in order to build your client base.

I would recommend embracing digital marketing for your business, learn as much as you can about this space and keep on top of technological and social changes as it will give you an edge over the competition.

What’s been your biggest mistake so far?

Spending too long planning and not pushing forward with Intelligence Fusion sooner. There is a famous quote which states, “No plan survives contact with the enemy” and I believe that is absolutely correct, especially with a start-up business.

I remain fluid in my outlook and maintain the ability to make changes in order to enhance the business concept and the platform’s service offerings. While planning is necessary and helpful, I feel you need to keep dynamism at the heart of your business especially when operating in the technological sector.

What do you think the next year has in store for your business and sector?

In the next year Intelligence Fusion will be built, we will have tested the initial concept and validated the business plan. At that point we can begin to scale the business, while continually adapting and innovating the platform.

In our sector, as the global economic environment continues to be volatile we will witness an increasing need for security, intelligence and risk management services as we are currently in the most dangerous geopolitical situation since World War II.

Are there any startups you’re watching, and why?

I watch startup media organisations and new digital currencies coming to the market. We are in an age of great financial and political uncertainty and peer to peer cryptocurrencies and alternative news outlets are gaining in traction, particularly among the younger generation and must be monitored.

%20(3)%20(2).jpg)