Weekly Briefing: UK faces biggest tax-raising drive since 1979, Twitter buys VC-backed startup & London’s super-prime property market rebounds

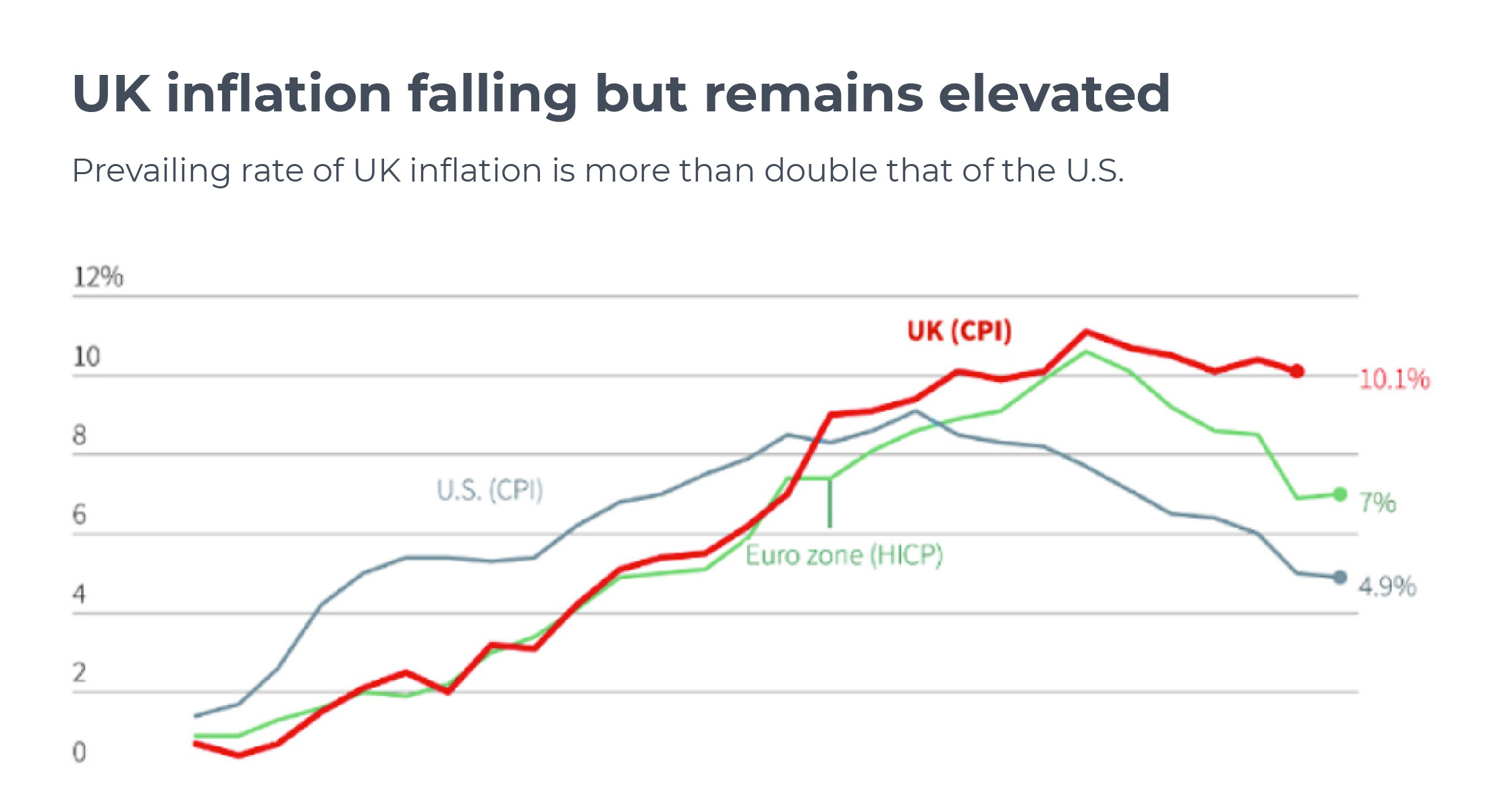

This week we examine the Bank of England's recent interest rate rise to 4.5% and questions about its future direction, with experts suggesting that slowing wage growth and signs of declining demand in the job market may not warrant further increases.

On the taxation front, the Institute for Fiscal Studies (IFS) warns that the UK is facing its largest tax-raising drive since 1979, and the freeze and reductions of certain income tax thresholds will result in a significant number of individuals falling into the higher- and additional-rate bands. As a result, exploring tax-efficient investment routes – particularly the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS), which offer 30% and 50% income tax relief respectively – could prove to be highly beneficial for a growing number of individuals.

UK economy

Expectations for UK Bank Rate movements in the near future

- Last week the Bank of England increased interest rates to 4.5%, the highest level in 15 years. Following this decision, James Smith at ING stated that momentum in UK wage growth appears to have eased since 2022, and together with signs that excess demand is falling in the jobs market, there is nothing in the latest report that highlights a strong need to continue increasing the Bank Rate.

- Samuel Tombs at Pantheon Macroeconomics reiterates this sentiment, stating “Wage growth is slowing rapidly enough for the Monetary Policy Committee to keep the Bank Rate at 4.50% at its next meeting on 22nd June.”

- Martin Beck, Chief Economic Advisor to the EY ITEM Club, said “On balance, the latest developments in labour market quantities and prices don’t offer any obvious support to another rate rise when the MPC meets next in June. The focus now switches to the next set of inflation data, due on 24th May, to see if that shows the evidence of inflation persistence required to make the MPC increase rates again.”

- Importantly, the BoE upgraded its economic growth forecasts and stated the UK is expected to avoid a recession.

Global economy

Considering the impacts of a US debt default

- The International Monetary Fund (IMF) stated on Thursday that a US debt default prompted by failure to raise the country's debt ceiling would have "very serious repercussions" for the US economy, as well as the global economy.

- IMF spokesperson Julie Kozack stated US authorities needed to remain vigilant on new vulnerabilities in the US banking sector, including in regional banks, that could emerge in the adjustment to a much higher interest rate environment.

- Detailed talks on raising the US government's $31.4tn debt ceiling began on Wednesday, a day after President Joe Biden and Kevin McCarthy (speaker of the United States House of Representatives) met on the issue for the first time in three months.

- US Treasury Secretary Janet Yellen has warned that a default on US payments could come as early as 1st June if Congress fails to raise the borrowing cap.

UK tax update

Britons face biggest tax-raising drive since 1979, reports the Institute for Fiscal Studies

- A rise in the number of higher-rate taxpayers over the next five years is being driven by the Government’s income tax threshold freeze.

- By its final year (2027/28), this freeze is expected to represent the single most significant tax increase since Geoffrey Howe increased VAT to 15% in 1979.

- The freeze, and the reduction of the threshold at which the 45% additional rate of income tax is due (from £150,000 to £125,140), represent the latest policy choices that have seen an ever-growing share of UK adults pay the highest rates of income tax.

- Since the mid 1970s, income tax thresholds have, by default, risen in line with inflation. Suspending these increases by freezing thresholds means that, as incomes grow, a rising number of individuals could find themselves pulled into paying higher rates of tax, even if incomes have not kept up with inflation.

- In other words, individuals who experience falling levels of disposable income in real terms may nonetheless see themselves facing higher rates of income tax.

- The process is called fiscal drag and it occurs when inflation or income growth moves a taxpayer into a higher tax bracket without the Government having to directly raise rates.

- The impact of these measures are displayed clearly by statistics from the Institute for Fiscal Studies (IFS):

A third of the expected record fall in household incomes this year is likely to be a result of this tax freeze.

- The IFS also stated that in 1991/92, 3.5% of UK adults (1.6 million people) paid the 40% higher rate of income tax. By 2022/23, 11% (6.1 million people) were paying higher rates, and it is expected that 14% of adults (7.8 million people) will pay income tax at 40% or more on some of their income from the 2027/28 financial year.

- Isaac Delestre, a Research Economist at the IFS, stated:

For income tax, the story of the last 30 years has been one of higher-rate tax going from being something reserved for only the very richest to something that a much larger proportion of adults can expect to encounter.

- Delestre added:

Achieving this increased level of income tax revenue via a freeze leaves the income tax system hostage to the movements of inflation – the higher inflation turns out to be, the bigger impact the freeze will have.

Impact investing

Carbon fintech recorded significant progress in Q1 2023

- Carbon fintech and consumer startups are increasingly popular verticals among climate investors, according to the latest Emerging Tech Research from PitchBook.

- Carbon and emissions tech startups are showing resilience; these companies logged 212 VC deals totalling $3.6bn in Q1, a 13% decline in value from Q4, but a 35% year-on-year increase.

- Green solutions to steel and concrete production are accelerating, as are carbon accounting startups serving companies with new ESG pledges.

- Additionally, VC investment in energy efficiency is spiking, reaching its highest-ever quarterly value in Q1 2023.

Venture capital

VC’s rise and fall in Europe

- European venture valuations have yet to fully reflect the difficult market for startups, with most stages still seeing increases in the median price tag. Only early-stage and venture growth saw the median pre-money valuation drop.

- With more corrections anticipated as the year progresses, PitchBook’s Q1 2023 European VC Valuations Report covers where valuations currently stand across stages, geographies and exits. Key takeaways include:

- Nontraditional investor participation in VC deals remains subdued, with venture growth seeing the largest decline.

- Combined post-money valuations of European unicorns plateaued in Q1.

- Having reached a decade low in 2022, down rounds took a larger share of all VC deals.

Twitter buys VC-backed hiring startup in first Musk-era deal

- Twitter's newly formed parent company, X Corp, has made its first acquisition since Elon Musk took leadership: the San Francisco-based tech hiring platform, Laskie.

- Laskie, launched in 2021, offers tools designed to match tech workers with jobs. The company previously raised $6m from investors including Bloomberg Beta and Peak State Ventures.

- If Laskie is added into the Twitter platform, an integrated job search service could offer a new stream of revenue for the company.

- Twitter has also recently partnered with trading platform eToro to provide Twitter users with the ability to buy and sell stocks and crypto through its app.

- The deal comes as Twitter makes preliminary moves to fulfil Musk's ambition of turning the platform into a "super app".

Private equity

PE owner looking to sell Centre Parcs

- Center Parcs has been put up for sale by its Canadian private equity owner, Brookfield Property Partners, for between £4bn and £5bn.

- This could net a windfall for Brookfield – chaired by former Bank of England governor Mark Carney – which bought the holiday resort group from Blackstone for £2.4bn in 2015.

- The Canadian firm’s investment in Center Parcs since its acquisition has included £100m on tech upgrades alone.

- Investment bankers appointed by the firm have been sounding out potential buyers in the past week, and the business’s real estate was independently valued at £4.1bn last month.

- Notably, Brookfield CEO Bruce Flatt warned of consolidations in the private equity industry following a tough year for smaller players in the sector.

Property

London’s ‘super-prime’ property market is back to pre-Brexit levels

- More than 160 properties worth £10m or more were sold in London in the 2022/23 financial year – the most since 2016 when Brexit spooked the global super-rich from investing in the UK’s ‘super-prime’ market.

- A total of 161 such sales – equivalent to three a week – were made in the year to March, according to analysis of Land Registry data by Knight Frank and data provider, LonRes.

- The combined figure spent on the £10m-plus properties totalled £3.1bn, an average of just above £19m per sale (up from the £2.5bn total spent on 144 properties the previous year).

- The highest number of £10m+ sales were in Kensington (26), followed by Belgravia (25) and Mayfair (22).

A final note

Ultimately, the growing tax burden in the UK combined with wider macroeconomic challenges and uncertainties emphasises the importance of careful tax-planning and an effective investment strategy. Many EIS and SEIS opportunities, in particular, can provide both of these elements; the potential for superior returns alongside significant tax benefits. As always, thorough due diligence and strategic decision-making will be essential in navigating this difficult economic landscape.

%20(3)%20(2).jpg)