Weekly Briefing: record ESG-focused AUM, UK dividend tax allowance halved & US inflation down to 5%

This week, the beginning of the 2023/24 tax year in the UK saw a number of tax-free allowances change (notably, the annual dividend allowance halved to £1,000). Meanwhile, the Federal Reserve announced that US inflation in March 2023 fell to the lowest level since May 2021; this figure is now more than half of the current UK inflation rate (10.4%).

Focusing on alternative asset classes, activity in the global venture capital and private equity space for 2023 remains lower than in the previous two years. However, forecasts for ESG-focused deals and property investments appear to be on a different trajectory.

UK economy

Roundup of GDP, employment, and the strength of the pound against the dollar

- Monthly GDP data shows UK activity flatlined between January 2022 and January 2023.

- However, the UK employment rate continued to rise and was estimated at 75.7% in the period of November 2022 to January 2023 – 0.1 percentage point higher than the previous three-month period.

- The UK unemployment rate is close to its lowest level in 50 years, standing at 3.7% over the same period.

- Additionally, in early April the pound sterling reached its highest level against the US dollar in ten months – valued at £1.25 to the dollar.

Global economy

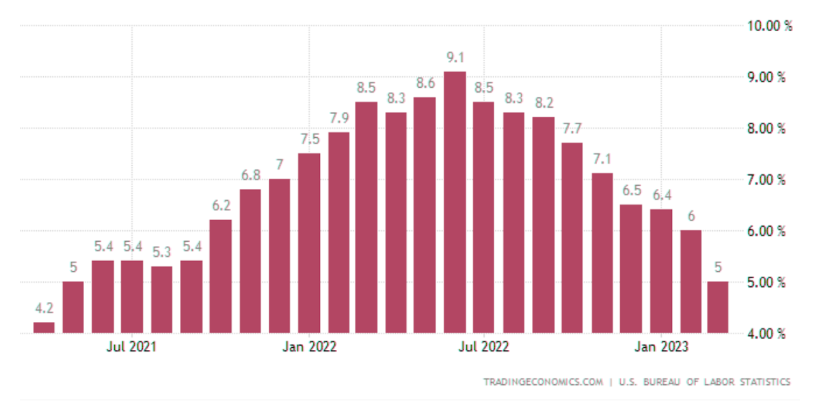

US inflation falls to 5.00%, the lowest rate since May 2021

- As announced by the Federal Reserve on Wednesday April 12th, inflation in the US fell for the ninth consecutive month, from 6.0% in February 2023 to 5.00% in March 2023, reaching the lowest rate recorded since May 2021.

- This current rate is below market forecasts of 5.2%, and now stands at only two percentage points away from the nation’s optimum inflation target of 2%.

UK tax update

Dividend tax allowance reduced to £1,000 in 2023/24 tax year

- Introduced in the 2016/17 tax year, the annual tax-free dividend allowance originally stood at £5,000.

- In 2018/19 this threshold was reduced to £2,000 and remained at this level until 6th April 2023.

- The tax free dividend allowance for the 2023/24 tax year has now been halved to £1,000.

- Furthermore, the allowance is set to be halved again at the beginning of the 2024/25 tax year.

- Standing at £500, this will equate to a 90% decrease in the allowance in the space of six years – one of the most significant decreases of any UK tax during the same period.

Feature: McKinsey Global Private Markets Review 2022

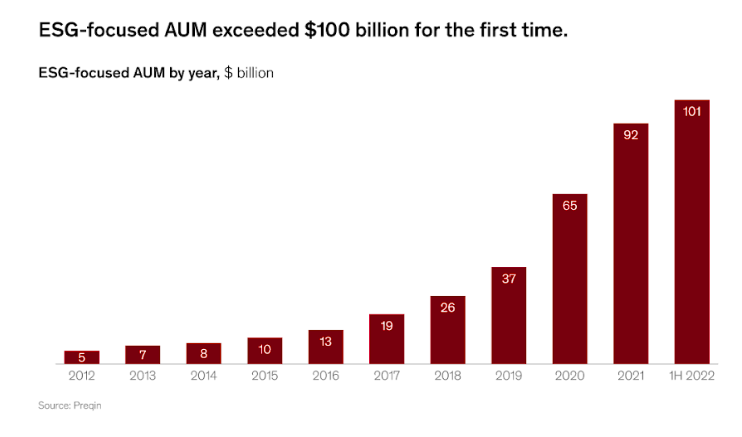

Sustainable investing gained scale in 2022

- Recorded as the best year yet for ESG-focused fundraising, $24 billion was raised in the first half of 2022.

- The proportion of total private capital fundraising that came from managers with an investment policy that includes ESG issues rose to 66% in 2022, a new high.

- Furthermore, the evidence supporting a positive correlation between ESG and financial performance continues to mount – as long as the underlying company is healthy.

- ESG’s growing impact on private markets goes beyond dedicated funds and deals: most funds (of any strategy) now consider ESG risk factors in due diligence, and some explicitly include ESG concepts in their value creation plans.

- Across the entire investment life cycle, from fundraising and asset selection to value creation and exit planning, ESG is on the minds of investors. Across McKinsey’s clients, it’s expected that ESG will become a strong competitive differentiator and driver of returns.

- Additionally, in H1 2022, ESG-focused assets under management (AUM) exceeded $100 billion for the first time, as reported by Preqin.

Venture capital

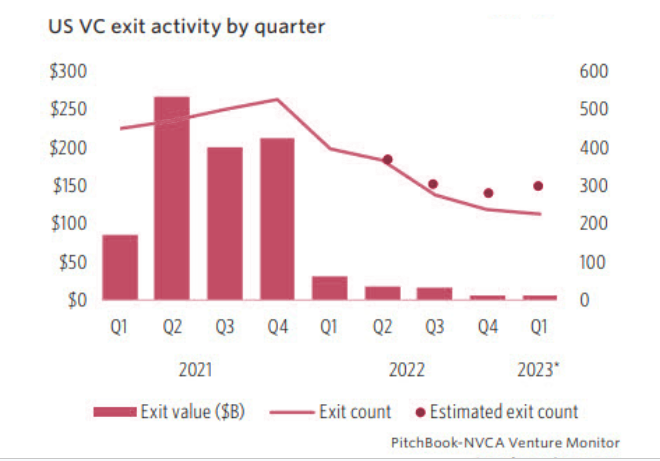

Contraction for US VC in Q1 2023 may leave the market vulnerable

- The US venture capital market experienced a difficult first quarter, partly due to the collapse of Silicon Valley Bank combined with challenging global macroeconomic movements.

- In 2022, the strongest element of the US VC industry was fundraising, which set an annual record. However, $11.7 billion was raised in Q1 2023, setting the year on a path toward the lowest annual total since 2017.

- In Q1 2023, $5.8 billion in exit value was generated, a figure that represents only 2.2% of the quarterly high from the past two years and the lowest quarterly value since the global financial crisis.

- Ultimately, US VC exit value and exit count remained largely similar to that of Q4 2022.

Missouri investment bank plans to win over the VC market following SVB's collapse

- Stifel, a full-service wealth management and investment banking firm headquartered in St Louis, Missouri, is planning a broad expansion into the venture ecosystem following the hiring of three top bankers from Silicon Valley Bank last month, as reported by PitchBook.

- Leaders within Stifel's commercial banking unit say their strategy is about more than savings and loans; the larger vision is to serve as a hub for the wider entrepreneurial community.

Private equity

Data from Preqin reveals slowdown in private equity fundraising

- In Q1 2023, 151 new private equity funds closed globally, raising a total of $147bn, as highlighted by Preqin data.

- This reflects a marked slowdown in volume from Q1 2022 (276 funds; $147bn) and Q1 2021 (393 funds; $189bn).

- However, last week, international alternative assets manager KKR closed an $8bn private equity fund for Europe. The firm raised $6.6bn in 2019 for its previous Europe fund.

Property

A speedy recovery ahead: opportunities in commercial real estate

- The commercial real estate service industry experienced record profitability in 2021 during a period of low interest rates, more available capital and strong real estate valuations.

- However, the current economic landscape has left investors concerned about the prospects of commercial real estate (CRE) service firms.

- Morningstar analysts argue that CRE service firms are well-positioned to weather the economic downturn with strong balance sheets and an ability to better control their expenses.

- Although the near-term outlook is challenging, valuations look compelling from a long-term perspective.

A final note

Overall, the effects of a turbulent Q1 are likely to persist – particularly in the VC market – further into the year. Whilst this may pose additional challenges for many startups and investors, it can be reassuring to know that global macroeconomic data is largely showing signs of settling and, as a result, helping to provide a more stable environment for investment and the wider economy.

%20(3)%20(2).jpg)