Weekly Briefing: UK inflation remains high, income tax receipts rise & house prices increase by 0.8%

This week we review some of the most significant macroeconomic news from the past seven days, including inflation expectations and the likely responses from Central Banks around the world, as well as UK tax data and changes to the SEIS coming into force this tax year. Furthermore, we continue to round up headlines regarding pressure in the banking sector, as well as rising average house prices in the UK and trends in global venture capital and private equity markets.

UK economy

Inflation remains high in early 2023

- Inflation in the UK is proving to be particularly persistent, with the headline CPI rate calculated at 10.4% in February 2023, a 0.3% increase from January and close to the 2022 peak of 11.1%.

- Some of the leading inflationary pressures in the UK include rising goods and energy prices, however, headline inflation is likely to fall over the coming months.

- Economists are predicting weaker growth, a normalisation of supply conditions and reduced commodity prices to deliver a significant fall in UK inflation rates.

UK GDP expected to rise by £1.8bn after joining Trans-Pacific trading bloc

- The UK has signed a trade pact with 11 Asia and Pacific nations, grouped the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

- The CPTPP is a free trade agreement between Japan, Australia, New Zealand, Singapore, Canada, Mexico, Malaysia, Vietnam, Brunei, Chile and Peru.

- Countries within the CPTPP agree to reduce or remove tariffs on the vast majority of goods and cooperate on regulations and standards.

- This is one of the world’s largest trading blocs, worth 15% of global GDP after the UK joins.

- The UK Government stated that the deal is expected to boost UK GDP by 0.8%, or £1.8bn, over a 10-year time span.

Global economy

US inflation down by over a third since 2022 peak

- US inflation peaked at 9.1% in 2022 and has fallen by over a third, to 6.0%, in February 2023.

- Boston Fed president Susan Collins expects the US Federal Reserve to implement one more 25bp interest rate rise to bring inflation closer to the 2% target, despite uncertainties about the state of the financial system.

Euro inflation remains above US

- Inflation in the Euro area has also moderated, falling from the 2022 peak of 10.6% down to 8.5% in February 2023.

- The rate is estimated to fall further to 6.9% as of March 2023.

- On average, economists expect inflation in the US, euro area and UK to fall to approximately 3.5% by December 2023.

UBS seeks to assure investors that Credit Suisse takeover can pay off

- While describing the biggest bank rescue since the global financial crisis as a milestone for the industry and a major challenge for the bank, UBS Chairman Colm Kelleher told shareholders that UBS’s takeover of Credit Suisse also meant "a new beginning and huge opportunities ahead for the combined bank and for the Swiss financial centre as a whole."

- Kelleher stated that UBS is confident in its ability to successfully manage Credit Suisse's integration and that the combined bank will remain well capitalised, stating: “we believe the transaction is financially attractive for UBS shareholders".

- A survey by political research firm gfs.bern found the majority of Swiss citizens did not support the deal that would create a financial institution with assets double the size of the country's annual economic output. The merged entity is expected to hold more than $5 trillion in total invested assets.

UK tax update

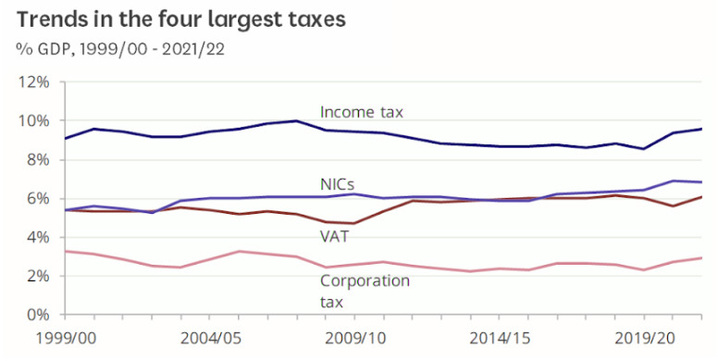

Income tax receipts are rising as a percentage of GDP

- Before the pandemic, income tax receipts as a percentage of GDP were smaller than they were in 1999/00. But, post-pandemic they are larger, with UK income tax receipts as a percentage of GDP almost reaching 10% in the 2021/22 tax year.

- The Institute for Fiscal Studies (IFS), an economic think tank, analysed how much average households pay in tax. Their analysis covered around three quarters of tax revenues (including income tax, National Insurance Contributions, VAT, excise duties and council tax) and found that the 50% of households with the largest incomes contribute to approximately 78% of taxes.

- Specifically regarding income tax, the 10% of income taxpayers with the largest incomes contribute to over 60% of income tax receipts.

- Data from the 2023/24 tax year could change this figure as the additional rate (45%) income tax threshold is lowered from £150,000 to £125,140.

- As a result, high earners may increasingly look to tax-efficient investment routes, such as ISAs and the EIS and SEIS (offering up to 50% income tax relief), to minimise their income tax bill, as well as other tax bills, as more people fall into the top income tax band.

Venture capital

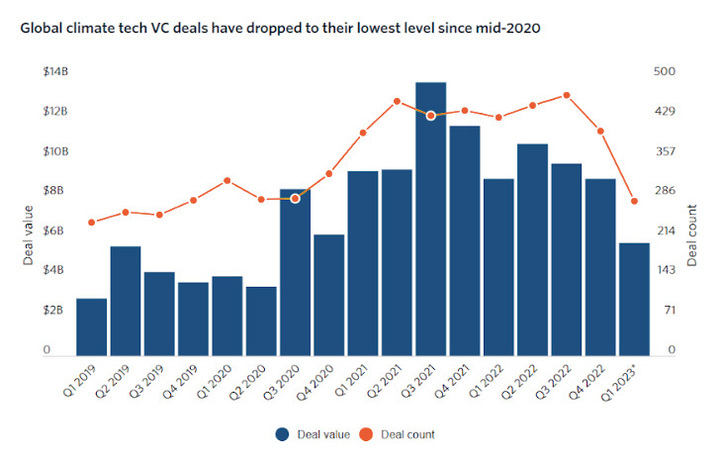

Global climate tech VC deals fall to lowest level in almost three years

- VC funding for climate tech startups has slowed to its lowest pace in nearly three years.

- In Q1, climate tech startups raised $5.7 billion across 279 VC deals, according to PitchBook data. This means that deal value has declined by 36% and deal volume has declined by 31% from the previous quarter.

- From the peak in Q3 2021, quarterly deal value has fallen more than 50%.

New SEIS rules begin on April 6 2023

- One of the few points from last Autumn’s Mini Budget to not be U-turned, the changes announced for the Seed Enterprise Investment Scheme (SEIS) are set to come into force in the 2023/24 tax year.

- The changes include:

- Increased maximum investment raise: A qualifying company can now raise up to £250,000 of investment under the SEIS (as opposed to £150,000)

- More inclusive eligibility criteria: Companies with a maximum asset value of £350,000 (as opposed to £200,000) and a trading history of three years (as opposed to two) can now qualify for the SEIS

- Higher investment allowance for investors: The annual SEIS investment limit for investors has doubled from £100,000 to £200,000

- These adjustments to the scheme can not only benefit early-stage startups and UK VC investors, but the UK economy as a whole.

Private equity

Takeover of Hyve opposed by several shareholders

- U.S. investment fund Providence Equity recommended a cash offer price of 1.08 pounds per share in March to take over Hyve, valuing the company at approximately £320 million.

- M&G Investments will vote against a takeover of British events group Hyve plc, along with two other Hyve shareholders who believe the bid significantly undervalues the international exhibition company.

Private equity firm to take over LSG Group

- Deutsche Lufthansa stated on Wednesday that it would sell the remaining part of airline caterer LSG Group to private equity firm Aurelius.

- The carrier expects the deal to positively impact its operating margin and adjusted ROCE.

Property

UK house prices rise 0.8% between February and March

- The average UK house price as of March 2023 was £287,880, as highlighted by data released by the Halifax House Price Index on April 6.

- This is 0.8% higher than last month and 1.6% higher than the same time last year.

- The data reveals that house prices in the UK are continuing to rise month-on-month, albeit at a slower pace than in February 2023.

A final note

Whilst global inflationary pressure currently remains high and the fallout of Silicon Valley Bank and Credit Suisse continues to cause uncertainty throughout the financial industry, the economic outlook for Q3 and Q4 2023 shows signs of improvement. Inflation in the UK, US and Euro area is anticipated to fall to an average of 3.5% by December and Central Banks are expected to have completed their series of interest rate hikes by mid-2023.

Ultimately, investors can feel confident that markets are showing signs of settling, and EIS and SEIS investments, in particular, can provide significant value over coming tax years, especially with tax freezes, falling thresholds and the extension to the SEIS.

%20(3)%20(2).jpg)