Weekly Briefing: the future of UBS and Credit Suisse, Bank Rate reaches 4.25% & house prices continue to rise

With the Bank Rate being increased further to 4.25%, UK inflation unexpectedly rising and ongoing global banking struggles, there is – yet again – a lot to take note of this week. Here, we explore UK economic data, banking sector updates, record tax receipts being reported and a number of new papers released relating to venture capital, private equity and property investing in 2023.

UK economy

Bank of England increases UK base rate to 4.25%

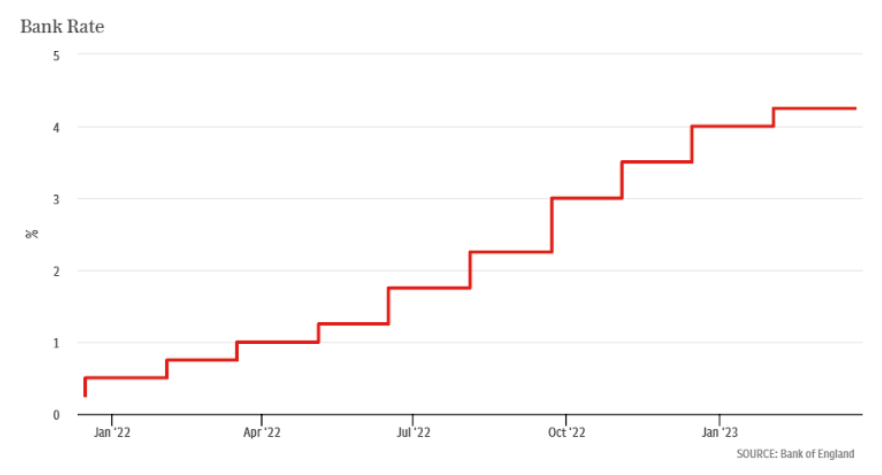

- On Thursday March 23, the Bank of England’s Monetary Policy Committee (MPC) voted, with a 7-2 majority, to increase the UK Bank Rate for the eleventh consecutive time.

- The single rise of 0.25 percentage points takes the rate to 4.25%.

- The Committee has not been deterred by recent banking stress, and continues to raise interest rates in an attempt to combat inflation.

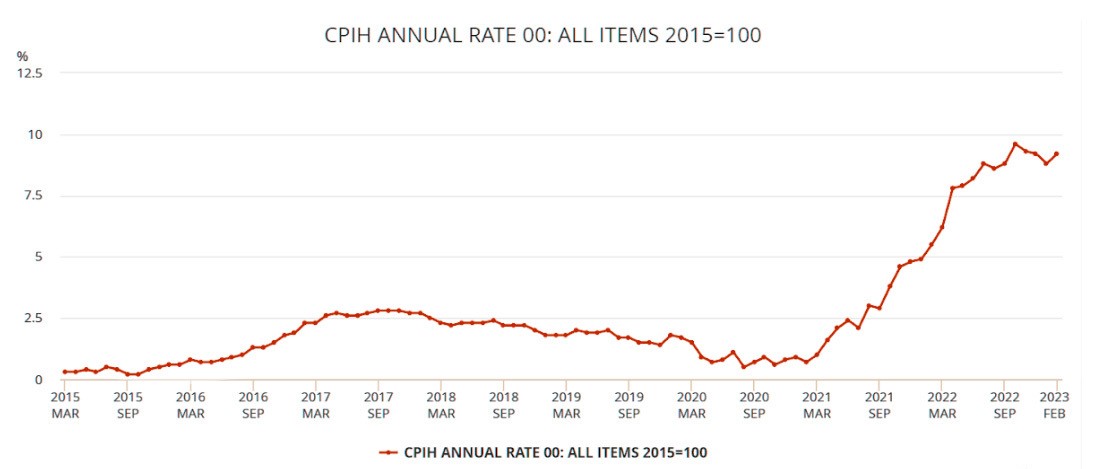

- The rate increase comes after the UK’s Consumer Price Index including owner occupiers' housing costs (CPIH) rose by 9.2% in the 12 months to February 2023, up from 8.8% in January.

Highest level of business confidence reported in 12 months

- A study from Accenture and S&P Global indicates that business confidence in the UK is at the highest level in 12 months.

- The expectations of UK businesses for economic activity increased by a net balance of more than 20% between October 2022 and February 2023.

- Both Ireland and the UK saw more than 40% of respondents anticipate positive economic activity.

- The findings showed that UK companies were more confident than almost all of their European counterparts; UK levels of business confidence were nearly double the average seen in the Eurozone – around 23%.

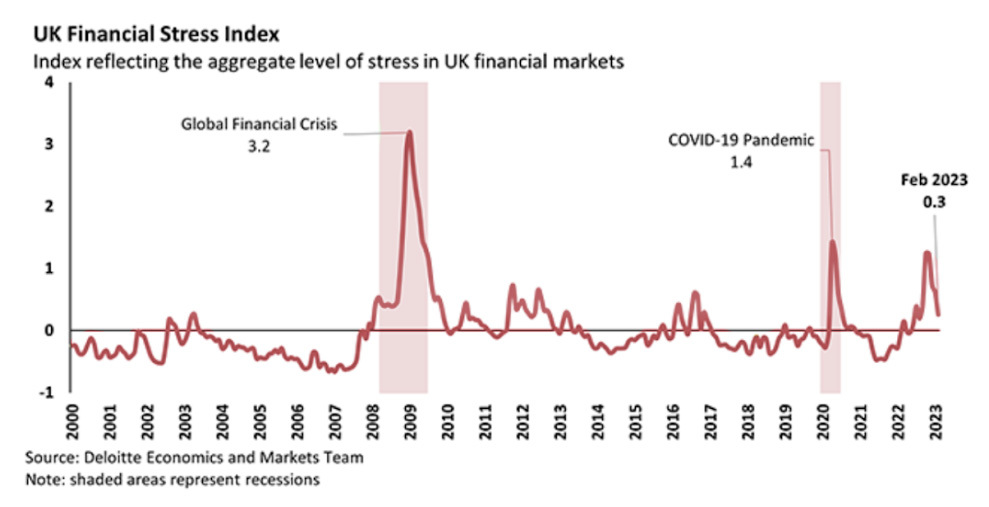

Deloitte’s UK Financial Stress Index expected to surge

- Deloitte’s UK Financial Stress Index (FSI) is a monthly measure of volatility and performance in UK financial markets.

- The index uses interest rates/yield spreads, valuations and volatility to assess stress across the following six key financial market categories: short-term financing, sovereign debt, corporate debt, equities, foreign exchange and real estate.

- The higher the FSI, the greater the level of stress. A positive reading signals that the UK financial system is experiencing higher than average levels of stress, whilst a negative reading signals the opposite.

- The FSI rose sharply after September’s mini-budget announcement, before falling to 0.3% in February. The index is anticipated to surge in March following global banking pressure.

Global economy

More banking struggles and the future of UBS

- In less than a fortnight, three mid-sized US banks (Silvergate Bank, Signature Bank and Silicon Valley Bank) have failed, and Credit Suisse has been fast-tracked into a $3.2bn takeover by UBS.

- The US banks that collapsed largely catered to the tech sector, and while those are some of the biggest bank failures in the US since 2008, none were as large as Credit Suisse.

- UBS executives have made it clear that they plan to wind down Credit Suisse’s trading operations and limit the size of its overall investment banking arm, which is expected to generate annual cost savings of $8bn by 2027.

- However, UBS has expressed interest in keeping some Credit Suisse investment bankers in key industries – technology, media and healthcare, among others – to augment its own advisory operations and complement its core wealth management business.

UK tax update

Highest self-assessment income tax receipts recorded in January 2023

- The UK received the highest level of self-assessed income tax receipts since records began in 1999, boosting January’s fiscal balance to a £5.4bn surplus.

- According to the Office for National Statistics (ONS), the government generally receives more in tax than it spends every January due to the amount of self-assessed taxes submitted.

- However, the ONS said the government faced "large one-off payments" in January relating to historic customs duties owed to the EU.

- In addition, borrowing was expected to rise – partially due to the large amount the government is spending on supporting households with energy bills.

- But ultimately, these costs were offset by record self-assessed income tax payments of £21.9bn in January, which left the government with a fiscal surplus.

Tax break announcements from last week’s Budget

- The Government is set to spend almost £1bn on 12 new low-tax investment zones, with each location scheduled to receive £80 million over the course of five years.

- Furthermore, it was announced that UK businesses are to receive £27bn in investment tax breaks, aiming to encourage investment, research & development, innovation and ultimately close the UK’s productivity gap.

Feature: Preqin’s Investor Outlook for Alternative Assets H1 2023

- As highlighted by Preqin survey results, investors believe alternative assets will continue to play a significant role in their portfolios in 2023 and beyond, with 35% planning to increase their alternative asset allocation over the next 12 months.

- The survey also revealed some institutional investors’ main reasons for investing in a range of different alternative assets:

- Portfolio diversification and high absolute returns were noted as the key draws for venture capital investments.

- For private equity, institutional investors highlighted high risk-adjusted returns and portfolio diversification as the main reasons for investing.

- For property investments, the ability to act as a hedge against inflation and provide a reliable income stream, as well as portfolio diversification, were identified as the main reasons many institutional investors decide to invest.

Venture capital

New report highlights the positive impact of the UK’s venture capital schemes

- Recommendations made in a briefing paper developed by the All-Party Parliamentary Group (APPG) for Entrepreneurship have been welcomed by the Venture Capital Trust Association (VCTA).

- The briefing paper highlights the role the Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS) and Venture Capital Trusts (VCTs) play in supporting the growth of early-stage UK companies and aims to improve awareness and understanding of the tax reliefs available to investors via the schemes.

- The report also discusses the removal of the Sunset Clause for the EIS and VCTs – ensuring both schemes become evergreen – providing clarity for early-stage businesses requiring future investment.

Private equity

Toshiba accepts $15bn buyout proposal from private equity fund

- The Board at Toshiba has accepted a $15bn buyout proposal from Japanese private equity fund Japan Industrial Partners (JIP).

- The JIP-led consortium will purchase shares from existing shareholders and intends to leverage debt to finance the buyout.

- The long-awaited decision follows years of turmoil for Toshiba, which has recently faced scandals, financial trouble and high-level resignations.

Property

UK house prices rise by an average of almost £3,000

- The average UK house price experienced a rise of £2,906 in March 2023, according to the Rightmove House Price Index.

- Despite low growth and historically high mortgage rates, which have prompted forecasts of a 10% fall in prices this year, the average UK home is on the market at £365,357 in March, a rise of 0.8% from February.

- Prices in the North of England are rising much faster month-on-month than in London, with house prices up by 1.1% and 2% in the North West and North East, respectively, and prices falling by 0.1% in the capital.

A final note

It appears that recent global banking pressure wasn’t severe enough to deter wider monetary policy decisions in the UK, US and Europe. Many economists expected central banks to hold off rate increases this month, however the Bank of England, Federal Reserve and European Central Bank (ECB) each raised interest rates despite banking turmoil. This reiterates the shared determination to control inflation, which is now expected to fall by more than previously anticipated in the near-term, according to the Bank of England.

%20(3)%20(2).jpg)