Weekly Briefing: interest rates tipped to hold, Britain leads Europe for venture capital investment & house prices set to rebound

This week, we take a look at what could be happening to UK interest rates amidst signs higher rates are having a negative impact on the economy, cover the latest data, insights and news surrounding Europe’s venture capital market, and more.

UK Economy

Interest rates tipped to be held as jobs market weakens

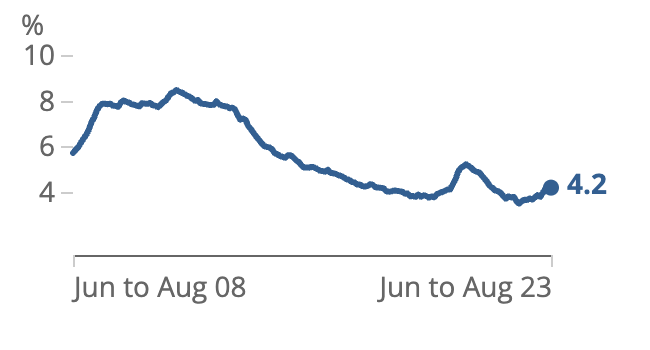

- The UK’s unemployment rate reached 4.2% between June and August according to the latest data, up from the 4% recorded between March and May.

- Businesses look to be hiring less due, in part, to the impact of rising prices and higher interest rates.

- The Office for National Statistics (ONS) have pointed out that these latest figures are “experimental statistics”, derived from different data than usual to provide “a more holistic view of the state of the labour market while the Labour Force Survey (LFS) estimates are uncertain”.

- The data has reaffirmed predictions that the Bank of England (BoE) will keep interest rates at 5.25% once again when they next meet in November.

- When the BoE last decided to keep interest rates unchanged – ending a period of 14 consecutive rises – the Bank’s Governor Andrew Bailey stated there were “increasing signs” that high interest rates were beginning to hurt the UK’s economy, and these latest figures from ONS paint a similar picture.

Adjusted experimental unemployment rate

Source: LFS from ONS, PAYE RTI from HMRC and Claimant Count from ONS.

Source: LFS from ONS, PAYE RTI from HMRC and Claimant Count from ONS.

Venture Capital

Britain leads Europe for venture capital investment in start-ups

- New research by HSBC Innovation Banking and Dealroom shows that British start-ups have secured $15 billion in investment from venture capital firms so far in 2023.

- Outstripping the $8 billion and $7 billion attracted by start-ups in France and Germany respectively, it cements the UK’s status as Europe’s top hub for young high-growth companies.

- It also places the UK behind only the US and China as a destination for VC investments.

- Britain is on course to secure $18 billion in start-up investment this year, higher than that recorded in 2020 but lower than the exceptional amount attracted in 2021 and 2022.

- US investors have been the biggest source of venture capital for British start-ups in Q3, providing 37%. UK investors provided 31%, whilst European investors provided 9% and Asia and the rest of the world contributed 20%.

- This impressive data highlights British start-ups as a particularly attractive option for investors both in the UK and beyond.

Europe’s venture market sees uptick in deal value

- According to Pitchbook’s latest European Venture Report, the value of venture capital deals in Europe reached $43.6 billion in the first nine months of 2023.

- This is down on the same period last year but is at similar levels to years prior to the unusually high levels of activity witnessed in 2021 and 2022.

- This indicates that venture activity has “undergone structural growth on a longer time horizon” states Pitchbook.

- Looking at the shorter term, VC deal value in Europe has been increasing quarter-on-quarter in 2023, with Q3 deal value 5.9% higher than Q2.

- The figures indicate that activity could be “past trough levels”, though whether the tentative recovery will be sustained remains to be seen.

Top venture capital firms back plans to pump pension cash into the economy

- It has been announced that 20 venture capital firms including Octopus, Balderton and Northern Gritstone have joined forces to help boost UK pension investments in unlisted equities.

- With £25 billion in combined assets under management, the 20 firms have signed the Venture Capital Investment Compact which is backed by the Treasury and looks to help £50 billion flow into unlisted companies by the end of the decade.

- In response to the announcement, Chancellor Jeremy Hunt said: “This compact is a huge win, demonstrating that our world-renowned venture capital firms stand ready to help our pension providers allocate funding to our high-growth companies. This could boost British pension pots to the tune of £1,000.”

- This follows the Mansion House Compact that was signed by pension firms this Summer which the Government claimed will unlock an additional £75 billion for high-growth businesses and increase a typical earner’s pension pot by 12% over the course of their career.

Property

UK house prices forecast to rebound 5% in 2024

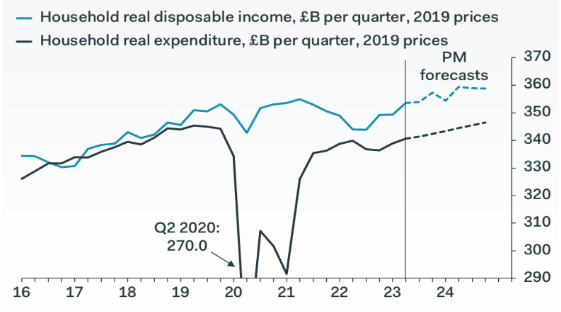

- Pantheon Economics – one of the UK’s most trusted and accurate forecasters – has suggested that house prices look set to rebound significantly in 2024.

- With the current elevated interest rates and pressures on household finances, Pantheon Economics’ Chief UK Economist Samuel Tombs does expect house prices to fall further over the next six months, stating: “We still think house prices will drop 6% peak-to-trough, with the nadir coming in March.”

- However, Pantheon’s current best case estimates for the BoE’s interest rate movements is a 25bp drop each quarter from Q2 2024, taking it from 5.25% to 4.5% by the end of next year.

- This means the benchmark mortgage rate should drop to circa 4%, taking notable pressure off households.

- UK households’ disposable income is also set to rise by around 1.2% in 2024. This should mean the average two-earner household will be required to devote 23% of their income to mortgages by end-2024, down from the current 29%.

- Meanwhile, the gap between supply and demand is expected to remain significant and Pantheon “expect house prices to rise by 5% in the final three quarters of 2024, thereby reversing nearly all of the near-term decline” says Tombs.

Source: Pantheon Economics.

Source: Pantheon Economics.

A Final Note

Whilst macroeconomic challenges remain evident, it’s excellent to see signs and forecasts that suggest a tentative recovery for a number of markets – such as VC and property – could be on the horizon as we head into 2024 and beyond.

At GCV, we remain commited to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decision when choosing where to allocate their capital.

If you would like to find out more about a number of effective investment strategies in 2023, discover our range of downloadable resources here.

%20(3)%20(2).jpg)