Weekly Briefing: Bank Rate reaches 5.25%, PE firms are acquiring asset managers at record rate & 28% of UK HNWIs have no IHT plans in place

This week, the UK’s Bank Rate was increased to 5.25%, the highest level in 15 years. Following this, the Bank of England expects inflation to fall to 5% by the end of 2023 – this would be a welcome development for investors, businesses, and consumers alike.

Additionally, almost half of investors in the Persian Gulf are planning to expand their allocations to private equity in 2023, with many investors prioritising fintech, tech, e-commerce, and healthcare over energy.

UK economy

Bank of England raises interest rates for 14th consecutive time

- The Bank of England has increased its interest rate by 0.25 percentage points to 5.25%. The last time rates were this high was in April 2008.

- Chancellor Jeremy Hunt acknowledges the rise will be difficult for many, but says the government is sticking to its plan for lowering inflation.

- The Bank has pledged that inflation will be 5% or below by the end of the year – but the overall target remains 2%.

Cost of living pressures set to intensify UK’s regional economic divide, finds latest EY report

- According to the latest EY UK Regional Economic Forecast, Gross Value Added (GVA) is expected to decline by 0.6% throughout 2023, with London (-0.2%) the only part of the country predicted to see a smaller economic contraction than the UK overall.

- Although Scotland is expected to match the overall UK GVA performance in 2023 (also contracting by 0.6%), other parts of the UK are forecast to lag behind. Yorkshire and the Humber and the East Midlands are predicted to see the steepest GVA contractions, at 1% each.

- The new forecast also states that, by the end of this year, UK GVA is expected to be 0.1% higher than it was in 2019, with London (up 3.2%), Yorkshire and the Humber (0.6%), the South West (0.5%), the East of England, Northern Ireland and the East Midlands (all 0.3%) outpacing the rest of the country.

- Furthermore, between 2024 and 2026, UK GVA is expected to grow at an annual average of 2.1%, with London growing 2.6% per year.

- Like London, the West Midlands and the South West are both expected to be boosted by strong growth in the information and communication sector, which is expected to be the UK’s fastest-growing sector in the medium term.

Global economy

Private capital AUM in Australia increased by 21% in less than a year

- According to Preqin’s Australian Private Capital Market Overview, Australia-focused private capital AUM stood at $118bn AUD in September 2022, up 21% from December 2021.

- Total fundraising increased by 61% in 2022, largely driven by private equity and VC, which raised $9bn AUD and $2.7bn AUD, respectively - significantly beating previous records.

- Meanwhile, managers from across the globe have been turning to Australia’s giant superannuation schemes, with the Australian market being seen as a relative bright spot for capital raising amid an otherwise challenging environment.

UK tax update

Many high-net-worth individuals lack measures to address IHT liability

- Over a quarter (28%) of high-net-worth individuals (HNWIs) do not have measures in place to address inheritance tax (IHT) or increase the level of tax-free assets that they aim to pass on, according to the Saltus Wealth Index report.

- Of the 2,000 respondents, 8% stated they do not have any plans in place at all, although they do plan to at some point.

- Additionally, 4% have not thought about it, and 2% do not plan on taking any measures at all to mitigate the impact of inheritance tax.

- The high number of respondents with plans in place reflects a strong desire to protect and pass on their wealth to future generations.

- To explore the impact that IHT may have on your estate, you may find it useful to download GCV's free investor guide to inheritance tax.

Impact investing

ESG in the US: greater transparency or more room for greenwashing?

- A significant portion of the alternatives and larger investment community supports ESG and accepts the integration of sustainability considerations – many investors and fund managers view ESG as an appropriate approach to risk management.

- BlackRock CEO, Larry Fink, stated in his annual letter to shareholders, ‘climate risk is investment risk’, citing ESG as a key component of the firm's ‘net zero’ plan.

- In 2022, the US Securities and Exchange Commission (SEC) proposed historical mandates that would require firms of select sizes to disclose scope 1, 2, and 3 emissions.

- While such mandates will strictly apply to public companies, the proposal has incited a greater push by investors for more transparency around ESG practices.

- As more companies and nations make pledges to lower their carbon emissions, ESG is increasingly being seen as a means of securing market share.

- However, a survey conducted by PwC found that 87% of investors suspect that corporate disclosure contains some level of greenwashing.

- ESG investing has become integral to the dialogue around due diligence, risk management, and investment responsibility. Fund managers, investors, and political officials alike will long be tasked with determining the extent to which sustainability impacts the future of investing – and navigating the challenges of greenwashing.

Venture capital

VC in the Persian Gulf – many nations expanding global alternatives allocation

- Saudi Arabia’s $620bn AUM sovereign wealth Public Investment Fund has been involved in at least 65 private equity and VC deals around the world since 2018.

- However, Saudi Arabia is not the only Gulf state to expand its global footprint in alternatives.

- There’s a much wider regional push, outlined in a new Preqin report with the Dubai International Finance Centre (DIFC) about the future of private equity and VC.

- Preqin’s survey of Middle East investors earlier this year found 72% regarded private equity to have met or exceeded return expectations.

- Around 44% of the region’s investors planned to commit more to the asset class in 2023 – 15% said they’d commit less.

- Trends in alternatives also exemplify the longstanding ambition in countries such as the UAE for more economic diversification and competitiveness – many Middle Eastern investors in private equity and VC have prioritised fintech, tech, e-commerce, and healthcare above energy.

Private equity

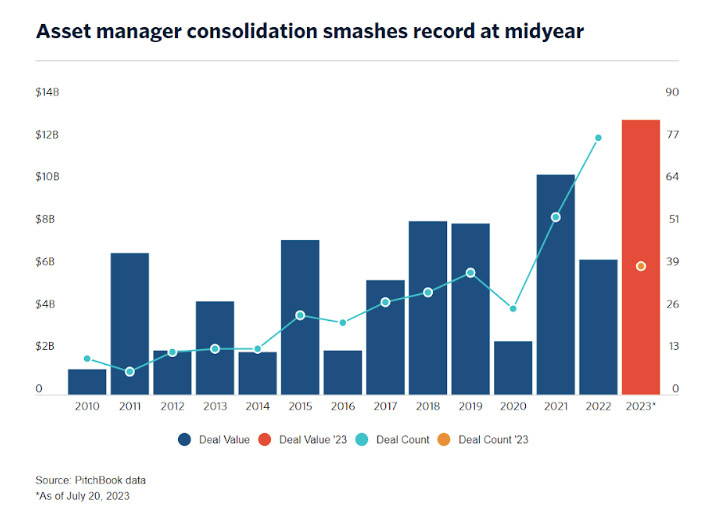

PE firms are acquiring asset managers at a record rate

- In the first half of 2023 alone, the private equity industry invested more capital than in any year of the past decade on deals to acquire asset management firms.

- As of 20th July, there were 39 deals totaling $13bn, already $2.6 billion higher than the previous peak in 2021, according to PitchBook data.

- Many acquisitions aim to tap into more lucrative segments of the market, such as the middle market, in which deals require less leverage than mega-deals. That segment outperformed deals made by mega-funds for three consecutive quarters through Q1, according to PitchBook's Q1 2023 US PE Middle Market Report.

- "Asset management companies are using alliances both as a mechanism for improving their operational efficiencies as well as developing new routes to customers," said Andrea Guerzoni, EY's global vice chair of strategy and transactions.

- There was a 13% jump in strategic alliances of asset managers in financial services and other sectors from 2019 to 2022, according to EY.

- The wave of consolidation comes amid dampened private market deal flow as firms grapple with limited financing options and the elevated cost of capital.

- For asset managers struggling to execute deals, strategic acquisitions offer the potential for higher realisation multiples.

Property

Will there be a soft landing for the UK housing market?

- According to data released by the Nationwide Building Society, UK house prices were broadly flat month-on-month in June 2023, but down 3.5% compared with June 2022.

- All regions except Northern Ireland recorded annual price falls in Q2 with East Anglia being the most affected region with prices down 4.7% year-on-year.

- Underlying inflation in the UK economy isn't moderating quite as quickly as expected and the Bank of England (BoE), in the short term at least, is continuing with its policy of raising interest rates.

- When there is a sustained and significant rise in interest rates, house prices will most likely fall.

- However, there's generally a delay of up to 18 months before an interest rate change affects house prices due to most mortgages being fixed for two to five years and so the impact is not immediately felt.

- Last year, many mortgage holders would have been immune to the interest rate rise but with 400,000 to 500,000 people now looking to remortgage each quarter and interest rates for fixed mortgages having doubled over the last year, reality is shifting.

- According to one estimate commissioned by the National Housing Federation (NHF) and Crisis from Heriot-Watt University, around 340,000 new homes need to be supplied in England each year, of which 145,000 should be affordable.

- The Government's ambition is to supply 300,000 new homes per year and the supply has increased year-on-year from a low point of 125,000 in 2012/13 to an all-time high of 243,000 in 2019/20 – but is still falling short of the required demand.

- The consistent demand for housing is pushing back against the damning effect of rising interest rates and keeping the housing market relatively stable, but with interest rates potentially still on the increase, the future remains uncertain.

- After 14 consecutive interest rate rises, house prices have fallen around 3 to 3.5% over the last year, a much more favourable picture than was predicted 12 months ago.

- Prices are likely to fall in the short term but there's an argument to say the predictions of a housing market crash are unlikely to materialise.

A final note

Overall, with interest rates rising further, the UK economy is still facing pressure and investors are continuing to navigate a high-inflation, high-rate environment. With predictions of the UK’s CPI falling below 5% by the end of 2023, it seems as though the BoE’s campaign of tightening monetary policy may soon start to yield results.

%20(3)%20(2).jpg)