Weekly Briefing: rising IFISA subscriptions, improved outlook for UK property market & changing investor sentiment regarding ESG

This week, the state of UK inflation and interest rates has attracted the attention of the Bank of International Settlements. The organisation stated “higher taxes and lower spending could contain financial instability risks in several ways”, an essential consideration with the likelihood of a UK recession increasing.

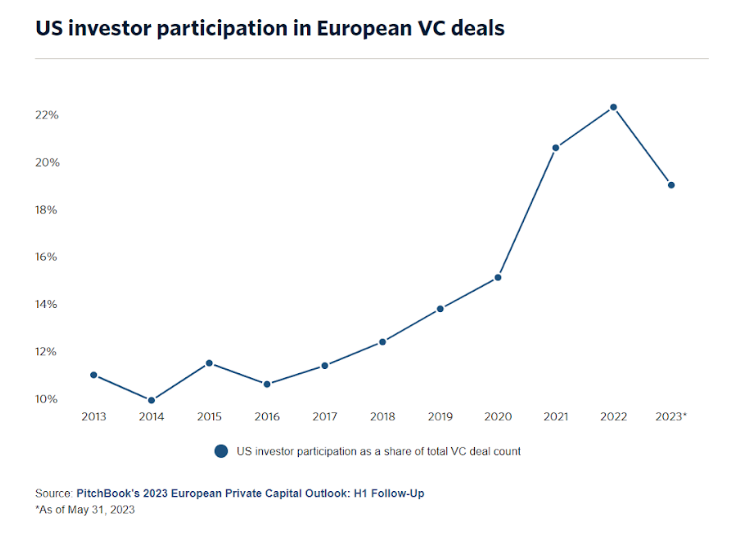

US investors’ behaviour regarding European VC investments also piqued our interest this week. At the beginning of 2023, PitchBook analysts predicted European VC deals with US participation would represent over one quarter of 2023 deal count. It would have been the highest recorded level. Yet, as the numbers stand currently, US presence in European deals is likely to be lower than anticipated, at 19% (three percentage points lower than last year).

We also discuss increased levels of Innovative Finance ISA subscriptions, changing investor sentiment regarding ESG, the UK property market appearing less negative in May 2023 compared to previous months, and the likely role of Africa in the future of the global economy.

UK economy

Bank of England remains focused on reducing UK inflation despite threat of causing a recession

- Although UK inflation is falling, it is still above average levels in Europe and other major economies (standing at 8.7% year-on-year as of May 2023).

- The Bank of England (BoE) remains focused on reducing inflation and it’s believed they will continue to raise interest rates well into the third – and potentially the fourth – quarter of the year, even if this runs the risk of pushing the economy into recession.

- Additionally, increased cautiousness on the part of investors has lifted yields on two-year gilts to over 5% – higher than during the period of volatility in September and October 2022 related to the fiscally expansive “mini budget”.

- Higher gilt yields cause subsequent problems, not only for the Government as a result of more expensive borrowing but also in terms of the housing market.

While there are similar trends of high inflation and low growth in other major economies, it has not been quite as pronounced as it has been in the UK and the rest of Europe. Overall Q1 data for G20 economies have come through much stronger.

– Kate Parker, Senior Analyst, Economist Intelligence Unit (EIU)

- According to the Bank of International Settlements (BIS), governments must raise taxes or cut public spending after central banks have kept interest rates “too low for too long” in the face of higher inflation.

- Amid concerns that the UK economy is already heading into a recession after a succession of sharp interest rate rises, the BIS took a tough stance, stating higher taxes and lower spending could contain financial instability risks in several ways.

The longer inflation is allowed to persist, the greater the likelihood that it becomes entrenched and the bigger the costs of quenching it.

– Bank of International Settlements

Global economy

“The global economy’s future depends on Africa”

- The most recent UN estimates project that Africa’s population will grow from 1.4bn today to 2.5bn by 2050.

- This year, one out of every three children born in the entire world will be born in Africa. As a result, in 2040, one of every three people in the world between the ages of 15 and 24 will be African.

- By 2050, the prime-age working population of Africa will be five times as large as that of Europe, and larger than that of India and China combined.

- Another way to view this is to note that the entire world’s prime-age working population will increase by 428m between 2020 and 2040.

- Of that increase, 420m will be in Africa, accounting for 98% of the total net labour force growth in the world.

- From 1980 to 2020, sub-Saharan Africa tripled its GDP from $600bn to $1.9tn, and from 2000 to 2020 Nigeria nearly tripled its GDP whilst Ethiopia’s has grown fivefold.

- If these countries can build on this performance and carry other African economies with them through greater regional integration, a generation of young Africans can help to create a global boom.

- Importantly, African leaders already recognise the need for environmentally-conscious development.

- The Kigali Communiqué, a written commitment to ensure a “just and equitable energy transition in Africa” (signed by ten African countries in May 2022), and the African Common Position on Energy Access and Just Transition (led by the African Union Commission), both present a vision for Africa’s future of development and job creation based on clean energy, powered by sustainable electricity production.

UK tax update

IFISA subscriptions rose to £144m in 2021/22

- New HMRC data released this month stated that £144m was allocated to Innovative Finance ISAs (IFISAs) in the 2021/22 tax year, up from £92m the previous year.

- The total number of IFISA accounts subscribed in 2021/22 was 17,000, compared to 16,000 in 2020/21, and the average amount invested per IFISA account also experienced growth in 2021/22, rising to £8,520 from £5,750 the previous year.

- Stricter regulations, including marketing restrictions, have caused many peer-to-peer lending platforms to pivot away from restricted retail investors towards sophisticated, high-net-worth and institutional capital.

- Within this growing market, property bonds (such as those offered by Carlton Bonds), are becoming an increasingly popular option.

- Simon Lenney, Chairman of Carlton Bonds, stated:

The growing popularity of the IFISA amidst such unprecedented market conditions is unsurprising. The attractive, tax-free target returns – which are outperforming many mainstream investments – and opportunities for portfolio diversification make the product a crucial consideration for sophisticated investors and high-net-worth individuals looking to utilise their ISA allowance and maximise their potential returns.

Impact investing

Changing sentiment of UK investors regarding ESG

- New research conducted by communications agency AML Group and research company The Nursery suggests that British investors are less focused on the ethical, environmental and social impact of their investments than they were 12 months ago, with more investors solely focused on generating superior returns.

- Of the 1,100 UK adults who have a minimum of £10,000 invested surveyed, 38% said that ethical and green investments were important to them, down from 44% last year, according to the Investor Index.

- The demographic least focused on ethical investing is those aged 65 and over, with only one-quarter (24%) prioritising ethical investments.

The shift we’re seeing away from ESG priorities can be interpreted in several ways and will be an important trend to watch in the coming years.

In qualitative sessions, younger investors told us that they wanted their investments to do good for the world but not at the expense of personal gain. The areas they were most interested in supporting were new green initiatives and future-focused tech solutions like AI and robotics, but fully expect that these are good for profit as well as people and planet.

– Pauline McGowan, Head of Strategy at The Nursery

Venture capital

US investors move away from European VC in favour of domestic deals

- US investors are scaling back on European venture capital investments as they refocus their attention on domestic opportunities.

- At the beginning of this year, PitchBook analysts predicted European VC deals with US participation would represent over one quarter of 2023 deal count. It would have been the highest recorded level.

- Yet, as the numbers stand currently, US presence in European deals is likely to be lower than anticipated.

- As of 31st May, US investors took part in 692 deals worth $11.3bn, according to PitchBook's 2023 European Private Capital Outlook: H1 Follow-Up. This represents 19% of overall deal count, a drop from 22% in 2022.

- It was anticipated that comparatively lower valuations and portfolio diversification would lead to more deals with US participation. But the intensifying downturn as well as the collapse of Silicon Valley Bank have led to a tighter liquidity market, and VCs appear more hesitant to explore deals outside of their comfort zones.

- Additionally, both the pound and the euro have strengthened against the dollar since last year, meaning European investment is no longer as cheap as it would have been in December 2022.

- While US investors appear to be pulling back somewhat, their presence has still been seen in some of Europe's largest deals this year, including solar energy startup Enpal's €215m Series D being led by TPG, and Access Biotechnology leading Hemab Therapeutics' €123m Series B.

Private equity

France's Ardian raises $20bn to purchase stakes in buyout funds

- French investment firm Ardian has raised more than $20bn to buy stakes in private equity funds from investors.

- The Paris-based company raised the money for a secondary fund that profits from institutional investors who sometimes sell stakes in private equity funds early.

- Ardian eventually aims to raise $25bn for the secondary fund.

- Abu Dhabi Investment Authority (ADIA) has agreed to invest $6bn in the fund through co-investment in its deals. This comes after Ardian stated earlier this year it was opening an office in Abu Dhabi.

- The private equity firm also manages Mubadala Capital, the Abu Dhabi sovereign wealth fund's asset management arm.

Property

Property prices and market expectations less negative in May than previous months

- The Royal Institution of Chartered Surveyors (RICS) expressed a more positive outlook for house prices in May 2023, despite rising interest rates that are expected to impact buyers’ affordability.

- RICS reported that new buyer inquiries, prices, and expectations for the market were all less negative in May compared to previous months.

- However, despite their positive outlook for the property market, RICS did caution that an increase in mortgage rates could constrain the market in the future.

- RICS noted that the banking sector expects this, as many banks and building societies have already introduced products with higher interest rates.

- While economists have warned of a potential 10% slump in property prices this year, limited supply and a strong labour market provide some support.

- David Hannah, Chairman at Cornerstone Group International, noted on the current state of the property market:

While surveyors are showing a slightly more positive outlook for UK house prices, the looming threat of rising mortgage rates is likely to dampen the market in the coming months.

Stubbornly high inflation is expected to trigger further interest rate increases, leading to higher mortgage rates and reduced affordability for buyers. However, I remain confident in the UK property market. Historically, it has been more stable than any other global property market.

A final note

Overall, the UK economy is continuing to prove resilient amidst persistent inflation and strict fiscal and monetary policy. However, the threat of recession is not fully eliminated.

Within this environment, it is wise for investors to adopt a diverse investment portfolio to ensure risks are mitigated as much as possible. Building a long-term strategy to grow and protect your wealth is highly important. Many routes can assist with this, in particular the tax-efficient investment routes available in the UK.

%20(3)%20(2).jpg)