Weekly Briefing: PE’s outperformance during downturns, rising property prices for first-time buyers & UK attracts record new FDI projects

This week, we explore the UK’s ability to attract foreign direct investment (FDI) and the wider impacts on productivity, economic growth and living standards. We also look at how family offices are adapting to new regulations and values regarding impact investing, as well as venture capital trends in Europe and property price movements in the UK.

UK economy

UK named Europe’s second-best economy for attracting foreign direct investment

- The UK remains second in EY’s annual ranking of European countries by their ability to attract foreign direct investment (FDI) projects despite activity falling in 2022, according to the EY UK Attractiveness Survey 2023.

- France held onto first place for total project numbers for the fourth consecutive year, although the UK once again ranked highest in Europe for new projects and continued to deliver more jobs per project than Germany and France.

- The UK's consistent ranking as one of the top destinations in Europe for new projects demonstrates the nation’s ongoing appeal as a hub for innovation and entrepreneurship, attracting companies looking to establish their presence and expand their operations in the UK.

Global economy

Economists’ outlooks are divided on the near future of the global economy

- Uncertainty appears to be the only certainty remaining when assessing the global economic outlook.

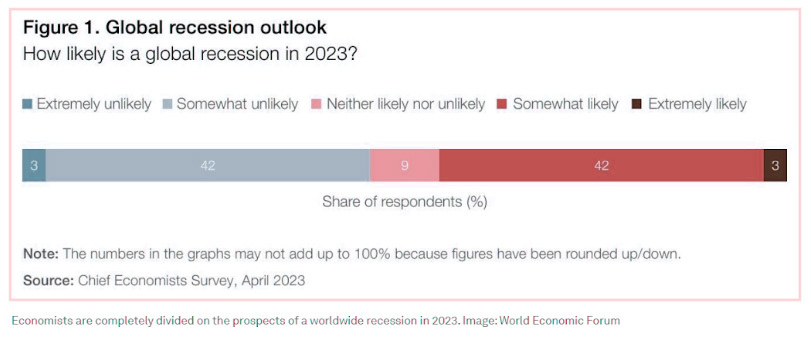

- Economists are not only divided on the prospects of a worldwide recession in 2023, but they are as divided as it is possible to be: 42% of those surveyed think it is likely, while 42% think it is unlikely – even the 3% who view it as extremely likely are balanced by the 3% who see it as extremely unlikely.

- This sentiment is according to the World Economic Forum’s Chief Economists Outlook 2023, which states that the unpredictable future ahead can only be negotiated successfully if countries work together and adapt to changing circumstances.

- Those changing circumstances include established business and industry models being first challenged by the Covid-19 pandemic and now facing further tests from an unpredictable geopolitical environment.

- Exactly how to steer through these developments will be the focus of the Forum's 14th Annual Meeting of the New Champions, which will bring together over 1,500 global leaders from business, government, civil society and international organisations in Tianjin, People’s Republic of China, on 27-29 June.

UK tax update

Nearly half of UK firms set to defer investment due to tax rises

- Almost half of medium-sized British companies are set to delay investment plans due to last month's rise in corporation tax, a survey published on Monday found.

- Low business investment is one of the reasons economists attribute to the weak growth in British productivity and living standards over the last decade, and many businesses have stated that higher tax rates reduce their incentive to invest.

- Britain's headline rate of corporation tax rose to 25% in April from 19% the previous year.

- Accountants BDO said 46% of businesses surveyed with a turnover of between £10m and £300m pounds reported that the rise in corporation tax would delay investment, while 39% said it would slow hiring or lead to job losses.

- To try to limit the impact on investment, finance minister Jeremy Hunt said in March that businesses would be able to immediately offset investment in plant and machinery against tax, a policy known as full expensing.

- "The recent rise in the headline corporation tax rate will dampen current business investment plans although the positive reaction to the new full expensing capital allowances regime suggests this may only be a short-term effect," said Paul Falvey, a tax partner at BDO.

- Britain's overall tax burden remains lower than that in almost all other European countries, but has risen steadily in recent years – reflecting an ageing population and slow economic growth – and is on track to reach its highest since the Second World War.

Impact Investing

Navigating the new era of sustainable investing: how family offices can adapt to evolving regulations and values

- Family offices have a crucial role to play in shaping the future of wealth management through sustainable investing, as the next generation prioritises environmental, social, and governance (ESG) factors.

- Regulatory changes, such as the Inflation Reduction Act (IRA) and the Sustainable Finance Disclosure Regulation (SFDR), are influencing family offices' sustainable investment strategies to align with the values of the next generation.

- The IRA allocates substantial funds for climate change and green energy investment, aiming to reduce carbon emissions and create jobs in the US while supporting social policies.

- The SFDR, a European regulation, requires family offices to disclose sustainability-related information, promoting transparency and informed decision-making among investors increasingly focused on ESG factors.

- To succeed in sustainable investing, family offices will develop tailored strategies in collaboration with experts, ensure compliance with evolving regulations, and continuously monitor and evaluate the impact and performance of their sustainable investments.

Venture capital

How low can European VC valuations go?

- As macro and micro pressures from 2022 extend into 2023, European VC activity has continued to decelerate, with deal value in Q1 declining 65% from Q1 2022.

- Valuations are no doubt under pressure, with down rounds more prevalent this quarter from a decade-low share of deals in 2022. Higher interest rates are a key driving force as financing costs heighten and discount factors for benchmarks decrease.

- As capital availability shrinks, later-stage companies have struggled the most, and they face more challenges when it comes to raising capital and exits.

- However, previous periods of market stress show such players often have economies of scale (plus management tenure) to weather downturns.

- The overall outlook is uncertain, resulting in a widespread reluctance to deploy capital.

- The depth and persistence of valuation declines will become clearer as more data is available throughout the year. With pressures expected to persist through the year, investor attention is likely to turn to core portfolio areas.

VC flight to quality on display at Fintech Nexus USA

- Fintech Nexus USA, an annual conference focused on fintech, just wrapped up in New York City.

- Analysts perceived an overwhelming consensus: investors are focusing on quality startups and core fintech opportunities as deals and funding decelerate.

- The conference also covered how generative AI will be integrated into fintech platforms, how fraud prevention is leading investor interest, and what neo-banks are considering to achieve profitability.

Private equity

How does private equity tend to perform during downturns?

- A recent study by Oliver Gottschalg, a professor at HEC Paris Business School, explored “the GP effect” across private equity downturn deals completed over a five-year period.

- The study identifies the downturn deals by looking at the evolution of the stock market index from acquisition to the PE firms’ exit.

- A situation in which the stock market returns are negative – or at least so low that they would have been unable to cover the cost of debt in the buyout – are considered “downturn deals”.

- Using HEC Paris data on 12,434 realised buyouts worldwide by 195 PE firms – each of which made at least nine realised buyouts – between 1993 and 2018, Gottschalg was able to measure the proportion of downturn deals. Some 4,018 downturn deals, or 32%, were identified using this method.

- The findings reveal that PE demonstrates an impressive ability to navigate downturns, with 65% of downturn deals resulting in positive returns, termed "downturn successes."

- This number provides strong empirical evidence in line with the long-standing academic predictions regarding the superiority of PE in particular downturn situations.

- Attributes such as active ownership, a hands-on approach to portfolio management and long-term nature are at the root of firms’ ability to weather a crisis, according to the study.

Property

Asking price of properties popular with first-time buyers reaches record high in April 2023

- Rightmove reports that the average asking price of properties popular with first-time buyers – those with one or two bedrooms – has hit a record price of £224,963 in the last month.

- This is 2% higher than last year, despite the fact that higher mortgage rates have made homes less affordable for many first-time buyers.

- The first-time buyer section of the market appears to be outpacing the others, with sales now 4% higher than in March 2019, while the “second-stepper sector” remains 4% behind, and top-of-the-ladder property sales are 3% lower than four years ago.

What effect could relaunching zero-deposit mortgages have on the housing market?

- Skipton Building Society has launched a new zero-deposit mortgage this month, aimed at helping first-time buyers and renters access the property ladder by effectively eradicating one of the biggest barriers to homeownership – the deposit.

- While this may be welcome news for those stuck in generation rent, there are concerns that reintroducing 100% mortgages could result in wider financial concerns, particularly given the current fragile state of the economy.

A final note

Overall, this week has offered valuable insights regarding macroeconomic expectations, as well as more focused studies on venture capital, private equity and property price increases for first-time buyers in the UK. Whilst many areas of the economy continue to signal a range of uncertainties and potential risks (such as the debt ceiling in the US) a number of opportunities still present themselves to investors during times of downturn and recession.

%20(3)%20(2).jpg)