Weekly Briefing: growing value of impact assets, falling VC funding for crypto firms & private investors increasing exposure to PE

This week, we discuss the UK’s level of GDP growth compared with similar economies, the general performance of different industries and geographies on global public equity markets, and high-net-worth individuals being expected to increase their asset allocation to PE by 2.4x within the next two years.

UK economy

UK economy remains 0.5% smaller than before Covid-19

- Britain’s economy grew by just 0.1% in the first three months of 2023, unchanged from an initial estimate by the Office for National Statistics (ONS).

- This left output 0.5% lower than it was in the final quarter of 2019, before the Covid-19 pandemic.

- "The final Q1 2023 GDP data confirms that the economy steered clear of a recession at the start of 2023. But with around 60% of the drag from higher interest rates yet to be felt, we still think the economy will tip into one in the second half of this year," said Ashley Webb, an economist at Capital Economics.

- Britain's economic recovery since the pandemic has been much slower than almost every other advanced economy, though Germany has also struggled and its economy in the first quarter was also 0.5% smaller than before the pandemic.

- Some economists said the weak GDP data stood at odds with more robust trends for jobs, wages, and consumer confidence, and further sluggish growth was more likely than an outright recession.

Global economy

Global growth across tech, consumer stocks, and banking

- Optimism has returned in 2023 due to lower energy prices and hopes that the US and Europe will avoid recession.

- Looking at listed equities, technology stocks are some of the top performers.

- Nvidia, a maker of semiconductors, has seen its share price almost triple in 2023 on expectations of a boom in artificial intelligence, and auto stocks have surged by 50% as last year’s semiconductor shortages, which significantly hit car makers, have begun to ease.

- Consumer-related stocks have also performed well so far. Across the main markets, travel and leisure and consumer discretionary stocks have risen by more than 20% this year.

- Better-off consumers, especially those with savings accumulated in the pandemic, have continued to spend, with stocks including Sony Group, American Airlines, and MGM Resorts outperforming their broad markets. Shares in two of the major cruise lines, Royal Caribbean and Carnival, have doubled since January.

- Looking specifically towards the banking sector, bank stocks have performed well in most countries, though less so in the US where the crisis in regional banks in April and May dragged down the broad index.

Listed equity performance in Greece, Japan, China, and the UK

- Greek and Japanese equities have outperformed this year, with Greece recording particularly significant progress since the turmoil that followed the euro crisis.

- Fiscal and bureaucratic reform, favourable growth, and the re-election of the New Democracy party have helped power a 32% rise in Greek equities this year.

- Japanese equities have outperformed all other major markets since January, with the benchmark Nikkei 225 rising 28% to reach the highest levels since the equity boom of the early 1990s.

- Equities have been supported by the resilience of the Japanese economy and the hope that an era of disinflation is coming to an end.

- Gains in emerging market equities have generally lagged those in richer economies.

- After a surge in value on the reopening of the Chinese economy towards the end of 2022, Chinese equities have fallen back and returned just 1.0% since January.

- On average, emerging markets have returned 5% this year, well below the 15% seen in the US and the euro area.

- The UK has all but missed out on the global equity rally, with the broad index almost flat so far this year.

- Stubborn inflation and the absence of technology stocks in the UK index haven’t helped, while a heavy weighting in oil and resource stocks has knocked UK equity performance as commodity prices have fallen back.

- The bright spots in the UK market have been retail, up 16% year to date, and travel and leisure, up 24%, helped by a strong performance from stocks including EasyJet, Next, Whitbread (owners of Premier Inn), and Games Workshop.

UK tax update

What is diverted profits tax?

- Diverted profits tax (DPT) was introduced in 2015 to counter the use of ‘contrived and artificial arrangements’. It is potentially applicable to a wide range of multinational businesses trading in the UK. Some very prominent multinational groups have reported receiving DPT notices, and the tax has raised more than initially forecast.

- HMRC statistics suggest a yield of over £8bn can be attributed to DPT between 2015 and 2022.

- The core issue that the Government is considering is whether to bring DPT into corporation tax.

- It is hoped this will clarify the relationship between DPT and transfer pricing, and provide access to treaty benefits while maintaining the other essential features of the regime, including the higher rate (31% from April 2023) and requirement for advance payment of tax liabilities.

- The task of integrating DPT into corporation tax is going to be a major challenge, and simplification may prove difficult.

- HMRC is holding four public consultation events, from 27th June to 10th July, and interested parties are welcome to join and discuss how the UK’s rules in these areas can be improved.

Impact investing

Institutional investors are fastest-growing source of capital for impact investment managers

- Institutional investors have become the fastest-growing source of capital for impact investment managers, one of the largest surveys of impact investors to date reveals.

- The research published this week by the Global Impact Investing Network (GIIN) is based on responses from more than 300 impact investors from around the world, including investment managers, foundations, development finance institutions, pension funds, and insurance companies.

- The survey shows that impact assets under management (AUM) have grown at a compound annual growth rate of 18% between 2017 and 2022.

- Investors in the sample managed an aggregated $213bn in 2022, up from $95bn five years before.

- Together, pension funds and insurance companies grew the capital they allocate to impact strategies at a compound annual growth rate of 32% between 2017 and 2022 – representing the fastest-growing source of funding for impact investment managers.

- They are followed by sovereign wealth funds, which grew their allocation to impact strategies at a compound annual growth rate of 22% over the same period.

- These increased flows of institutional capital towards impact suggest “a shift in investment approaches and the dynamics of financial markets”, according to the report.

Venture capital

VC funding for crypto firms has dropped in 2023

- Fundraising in the cryptocurrency world has slowed significantly in the first half of 2023.

- Just eight venture capital funds focused on crypto raised a combined $500m globally as of 16th May, according to a report from Fortune citing PitchBook data.

- This adds up to only 2.3% of the total value raised in 2022 and marks a 90% drop in the number of funds to receive financial backing.

- The crash of cryptocurrency exchange FTX started a chain reaction in November that has continued into this year.

- Crypto-friendly Silicon Valley Bank was the first lender to fail in 2023, followed by Silvergate Bank and Signature Bank, sending shockwaves through the crypto community.

- In the wake of the banking crisis, regulators have stepped up scrutiny of crypto platforms, seeding further doubt about the future of the sector.

- On 5th June, the US Securities and Exchange Commission (SEC) sued Binance, the world’s largest crypto exchange, alleging it committed a series of securities violations.

- Global venture capital funding for crypto plunged 80% in the first quarter of 2023 compared to the previous year, from $12.3bn to $2.4bn, according to PitchBook data.

- Meanwhile, overall VC activity has dropped amid a global economic slowdown, plummeting 53% year-over-year in the first quarter.

Private equity

HNWIs expected to allocate $1.2tn to PE by 2025

- Private equity has traditionally been a preserve for institutional investors. However, today managers are increasingly targeting high-net-worth individuals and experienced private investors.

- By 2025, high-net-worth individuals are expected to have 2.4x more assets in PE funds than in 2020, a total of $1.2tn globally, according to a report by Boston Consulting Group.

- Furthermore, a Q1 2023 survey by Goldman Sachs found that family offices are planning to increase their exposure to risk assets, including PE, this year.

- Respondents had an average 26% asset allocation to PE, second only to 28% in public equities.

- Goldman Sachs also found that 41% were planning to increase their exposure to PE over the course of this year.

- KKR is planning for up to 50% of its new capital raised over the next few years to come from private wealth, consulting firm Bain & Company reported.

- The outperformance of PE may explain the projected growth in investment – PE has outperformed major public market indices by well over 300 basis points over 5-, 15- and 20-year periods, according to the Cambridge Associates US Private Equity Index as of 30th January 2023.

- Over a one year period, US PE buyout and growth equity funds have returned a modest 6.7%, which still compares well to the 25.6% and 10.9% losses recorded in the Russell 2000 and S&P 500 respectively.

Property

UK housing market strains as mortgage rates edge higher

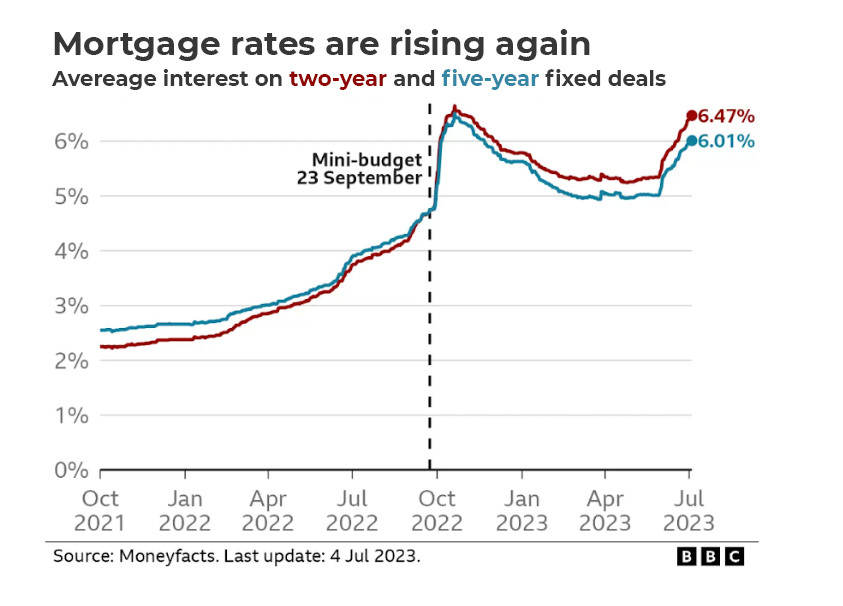

- The average rate for a five-year fixed mortgage in the UK now stands at 6.01%, whilst the average two-year fixed deal has reached 6.47%, according to the financial information service Moneyfacts.

- This is an increase from the average rate on a two-year mortgage deal of 5.82% last month and 5.30% in May 2023.

- Stubbornly high British inflation data has sparked a large increase in market interest rates as investors priced in further increases in borrowing costs from the Bank of England in coming months.

- Interest rates offered by mortgage lenders have soared in response.

- In June, HSBC temporarily withdrew mortgage products for customers applying via brokers.

- "To help ensure that new customers get the best possible service, we occasionally need to limit the amount of new business we can take each day via broker services," an HSBC spokesperson stated.

- Rival lender Nationwide Building Society also raised its mortgage rates in June.

- "This repricing of mortgage products coincides with the peak period for existing fixed rate deals ending," said Andrew Goodwin, chief economist at Oxford Economics.

A final note

Overall, this week has revealed that economic uncertainty is still prominent, particularly in the UK. Despite this, investor confidence remains strong, especially for those who prioritise long-term value-creation strategies and portfolio diversification.

%20(3)%20(2).jpg)