Weekly Briefing: inflation falls faster than expected, Chancellor announces “Mansion House Reforms” & US PE records jump in exit value

This week, we focus on UK inflation falling at a faster rate than expected (and the likely response from the Bank of England), as well as the Chancellor’s Mansion House Reforms and the impact they may have on early-stage investors in the UK. We also explore data regarding high-net-worth individuals and impact investing, in addition to key news surrounding venture capital, private equity, and the UK property market.

UK economy

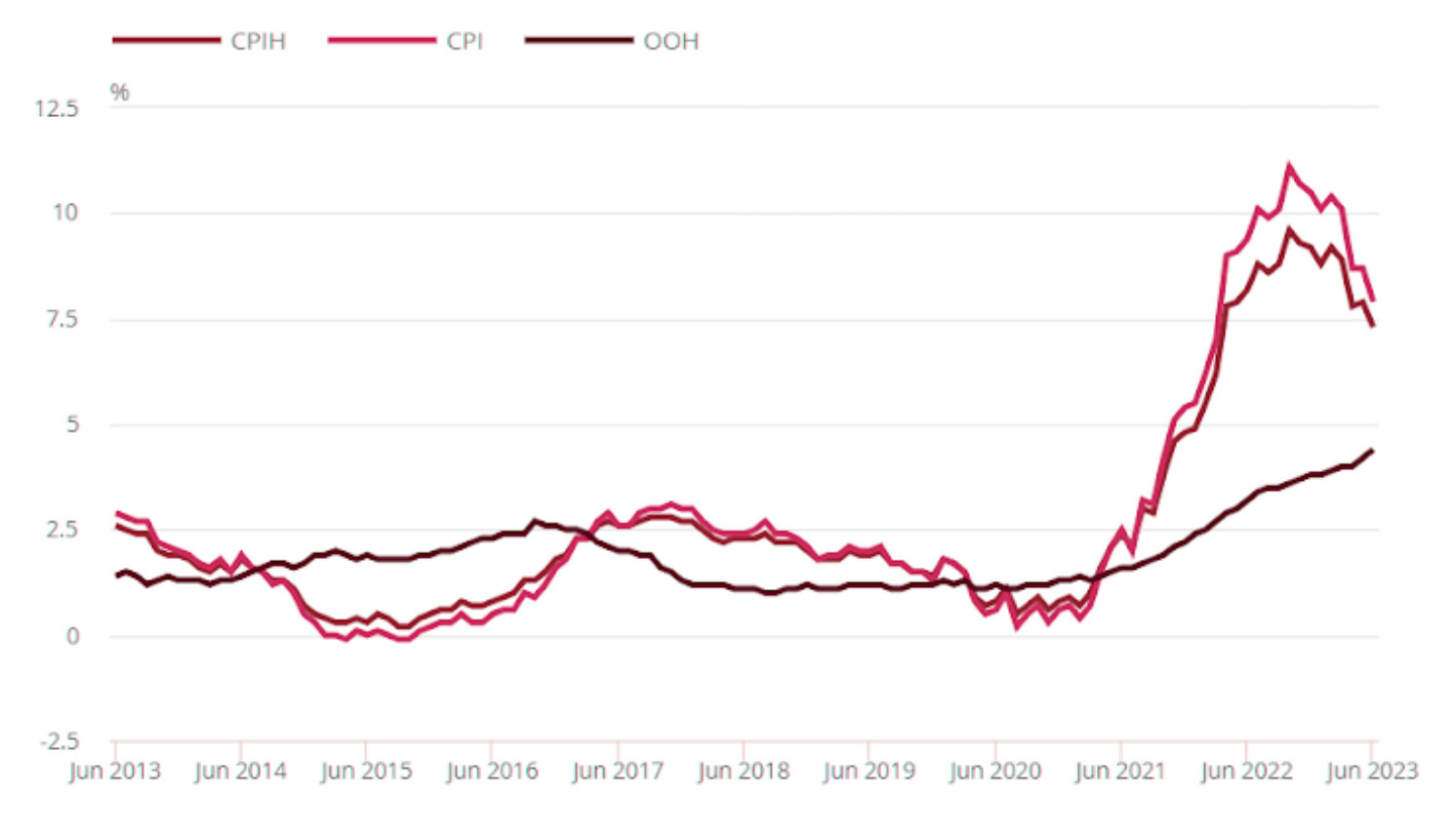

Inflation falls to 7.9% in June 2023

- The UK Consumer Prices Index (CPI) rose by 7.9% in the 12 months to June 2023, down from 8.7% in May.

- Month-on-month, CPI rose by 0.1% in June 2023, compared with a rise of 0.8% in June 2022.

- Falling prices for motor fuel led to the largest downward contribution to the monthly change in annual inflation rates, while food prices rose in June 2023 but by less than in June 2022, also leading to an easing in the rates.

When will the Bank of England stop raising interest rates?

- Over recent weeks, markets have taken the view that the Bank of England’s Bank Rate will rise from 5% to at least 6.25%.

- This follows data showing a further rise in wage growth and hawkish comments on curbing wage inflation from both the Governor and Chancellor.

- Given all this, the Bank, like the US Federal Reserve, may find it difficult to stop hiking until either wage inflation eases, or core inflation is shown to have peaked (this will be the best guide that underlying inflation pressures have eased).

- Importantly, with the latest inflation data (for June 2023) surprising on the downside, the likelihood of the Bank Rate being raised further may begin to decrease if this recent data indicates that UK inflation is peaking.

Global economy

US inflation slows dramatically in June 2023

- Inflation slowed significantly in the US last month, sparking speculation it could end the fastest series of interest rate hikes since the 1980s.

- The US Consumer Price Index (CPI) rose by 3% in the year to June, down from 4% the previous month – marking its smallest rise since March 2021.

- However, the current figure is still above the Federal Reserve's inflation target of 2%.

- The Federal Reserve will make its next decision on interest rates on 25-26 June.

- Rates currently stand at 5.00-5.25%, but Fed officials had indicated even before June's CPI figures emerged that the Bank was getting close to concluding its series of rate rises.

- As a result of the possibility of interest rate hikes drawing to a close, global stocks pushed record highs for 2023.

UK tax update

Chancellor’s “Mansion House Reforms” – how might they affect investors?

- In his first Mansion House speech, Chancellor Jeremy Hunt unveiled plans that could transform prospects for both investors and young British enterprise.

- As part of the reforms, Hunt announced nine of the UK’s largest pension providers – collectively representing over £400bn in assets – have agreed to a voluntary “compact”.

- This means they have committed to investing at least 5% of their default investment plan in unlisted companies, startups, and private equity by 2030.

- It also means British enterprise could potentially unlock up to £50bn in patient capital funding by the end of the decade if other pension providers follow suit.

- The new Mansion House Compact means more liquid capital may be available for investment into unlisted companies, which in turn can scale up and drive productivity across the country.

- It comes on top of recent reforms which allow SMEs to invest an extra £100,000 via the Seed Enterprise Investment Scheme (SEIS) – a change advocated for by the Adam Smith Institute.

- The Mansion House reforms could have less immediate but far-reaching implications for VCT, EIS, and SEIS investors.

- It is not unusual for companies operating in these sectors to need more capital over a longer period than VCTs and S/EIS are allowed to offer. Once the tax incentives run out, the number of potential investors shrinks significantly, leaving many young companies struggling to fund their next stage of growth.

- Indeed, a 2020 report from the Scale Up Institute and Innovate Finance found the UK was facing a £15bn growth capital gap that was stifling the technology sector’s ability to grow.

- The injection of fresh funds promised by the Mansion House reforms could provide much-needed support for young British businesses to help them continue on their growth path. In turn, this could translate into enhanced returns for early-stage investors.

- At the same time, the Mansion House reforms have promised several changes that should make it easier for the most ambitious companies to list on the main stock market and raise larger sums from investors more quickly. This could make it easier for early-stage investors to realise their investment returns.

Impact investing

Socially-responsible investing: how HNWIs are using their wealth for good

- According to the most recent Investing for Global Impact: A Power for Good report from Barclays Private Bank, over three quarters of private wealth holders (77%) engage in impact investing.

- The report also revealed that 36% of the 150 ultra-high-net-worth individuals (UHNWIs) surveyed wanted to demonstrate that family wealth can be invested for positive outcomes, a 13% rise compared to 2021’s results.

- Sally Tennant, Founder of Acorn Capital Advisers, says:

We are seeing more individuals and families embracing the idea of creating meaningful impact through their investments. The pandemic has undeniably played a role in raising awareness and igniting a desire to improve pressing societal challenges like climate change, health inequality, poverty, and in particular access to vital services like healthcare and education.

- Philanthropic foundations have been shifting their investment focus from exclusionary practices, such as prohibiting tobacco and arms, to actively seeking out opportunities with the ability to create positive societal changes.

Venture capital

VC exit trends in H1 2023

- US startups have progressed precariously through 2023, and several signs point to more challenges ahead if dealmaking and fundraising conditions continue to tighten and exit markets remain closed, according to the Q2 2023 PitchBook-NVCA Venture Monitor.

- While sharp declines in both deal value and count have stabilised somewhat in recent quarters, factors including the loss of crossover investors and dismal fund performance are reminders that investors and LPs may continue to look elsewhere for returns.

- The flood of IPOs in 2021 was far larger than any in the past decade. And the subsequent drought has been much longer than usual, leading to a backlog of IPOs for US VC-backed companies.

- For 17 months running, the number of IPOs has fallen far short of what would be expected based on long-term trends.

- But VCs still need liquidity, which has contributed to acquisition activity – now the source of most exits both in terms of the number of deals and the value generated for investors.

- The median VC-backed acquisition has climbed to $69.5m – a four-year high.

- For corporations, the current environment is a prime opportunity to acquire discounted startups.

Private equity

US PE records its first significant jump in exit value in over a year

- With four large M&A sales and IPO listings to end Q2, US private equity recorded its first significant period of exits in more than a year.

- Exit value surged by 66.9% from last quarter, the best since six quarters ago.

- Debt for leveraged buyouts (LBOs) has dropped off notably in 2023. The average loan-to-value ratio debt has dropped to 43% this year, down from the five-year average of 52%.

- Among other deal types, take-privates got smaller this year, with more than half of announced deals recorded at under $1bn each.

Property

UK housing market forecast to avoid slump despite zero growth in prices

- The UK’s housing market is expected to avoid a downturn triggered by rising interest rates, despite a drop in house price inflation to zero in May.

- Recent figures from Nationwide and Halifax have shown annual prices falling, but the ONS’s broader measure of the market, which includes cash buyers, found that annual property inflation had narrowly avoided going backwards.

- The Office for National Statistics said a decline in month-on-month growth from 0.5% in April to 0% in May meant the annual rate of house price inflation has dropped to 1.9%.

- However, a bigger than expected fall in UK inflation has meant financial markets are no longer expecting interest rates to increase as sharply, ultimately helping the housing market.

- Meanwhile, rents jumped for the 14th consecutive month, by a record 5.1%, adding to concerns that the private rental market is struggling to meet a rising level of demand from people unable to buy a home.

A final note

Overall, this week provided welcome news for the UK economy; inflation is on a downward trajectory. Despite this, it remains more than five percentage points above the Government's inflation target of 2%. Ultimately, with inflation slowly retreating, this can have far-reaching impacts across the rest of the economy, from monetary policy to the performance of listed equities. Hopefully, as the cost of living crisis begins to ease, UK consumers and investors alike can start to feel less pressure on their finances.

%20(3)%20(2).jpg)