Weekly Briefing: navigating the 60% income tax trap, ESG equity funds experience net outflow & UK house prices rise quarter-on-quarter

This week, we explore the 60% income tax trap in the UK and how it works, signs of the global venture capital market stabilising, data suggesting more newly-listed companies are returning to private ownership, and UK property prices experiencing a quarterly rise of 0.3%, according to data from the Halifax House Price Index.

UK economy

FTSE 100 slows in comparison to US and German markets

- The FTSE 100 entered H2 2023 with a rally driven by housebuilders, UK banks, and financials.

- However, the index is already down 3.78% so far in 2023 (as of 10th July).

- This compares to a 15.3% year-to-date gain in the S&P 500 and a 0.32% rise in the German DAX, as of 10th July.

- “As we conclude the first half of 2023, investors are taking stock of markets and what might happen next. Essentially last year’s losers have become this year’s winners, with the US market bouncing back fast,” said Russ Mould, Investment Director at AJ Bell.

- “In contrast, the UK has not been able to keep its crown following last year’s decent showing. In the first six months of 2023, it’s done zilch for investors’ portfolios excluding dividends.”

- “One might think this is a confusing turn of events. After all, recession fears have been focused on the US while the UK has proved to be more robust than previously thought. Yet if you exclude the handful of mega-cap winners in the US, performance hasn’t been as good.”

Global economy

Signs of a deflationary spiral in China

- China's inflation data for June surprised on the downside, with consumer prices slipping 0.2% on the month to leave annual CPI flat.

- Producer prices fell 5.4% on the year, the sharpest decline since late 2015.

- This implies there is plenty of scope to ease monetary and fiscal policy further.

- Yet it also underlines the scale of the challenge that Beijing faces in avoiding an outright deflationary spiral.

- Japan's experience shows that deflation combined with a shrinking population can have serious long-lasting concerns for an economy.

UK tax update

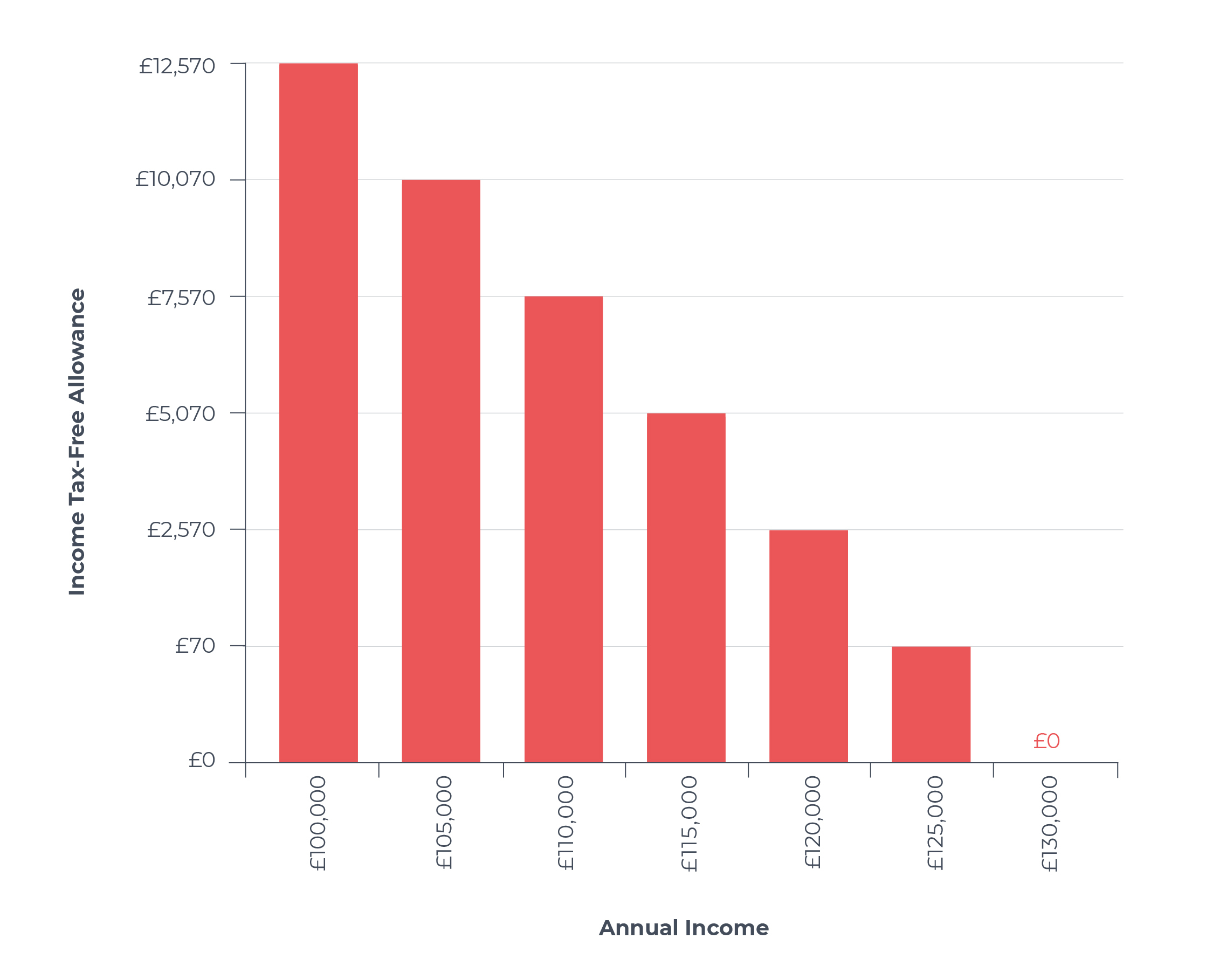

Navigating the hidden 60% income tax trap

- In 2023, higher-rate taxpayers in the UK can unwittingly fall into a 60% tax bracket.

- Income tax is charged at 0%, 20%, 40%, or 45% in the UK, depending on how much you earn (with some slight variations for those in Scotland).

- However, the UK tax system is complex and is known to have a number of hidden tax ‘sinkholes’. A prime example is the 60% income tax trap, which is not published in any HMRC guidelines.

- This 60% rate occurs as a result of the tapering of the personal annual tax-free allowance (currently £12,570) for higher earners.

- If you earn above £100,000 per year, the annual personal tax-free allowance is tapered at a rate of £1 for every £2 earned above £100,000.

- This means that for every £100 of income earned between £100,000 and £125,140, individuals may only receive £40.

- This is because £40 in income tax is deducted (in line with the higher rate of 40%), while another £20 is lost by the tapering of the personal allowance - or essentially 60% in tax.

- Then, once earning £125,140 or more, individuals don’t receive any personal allowance at all.

- It is possible to mitigate and even avoid this sinkhole completely with the right financial advice and some careful forward planning, such as through the use of tax efficient investments.

- The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances. Receiving professional financial advice can help ensure you remain up-to-date with taxes and always pay what you owe – and no more.

Impact investing

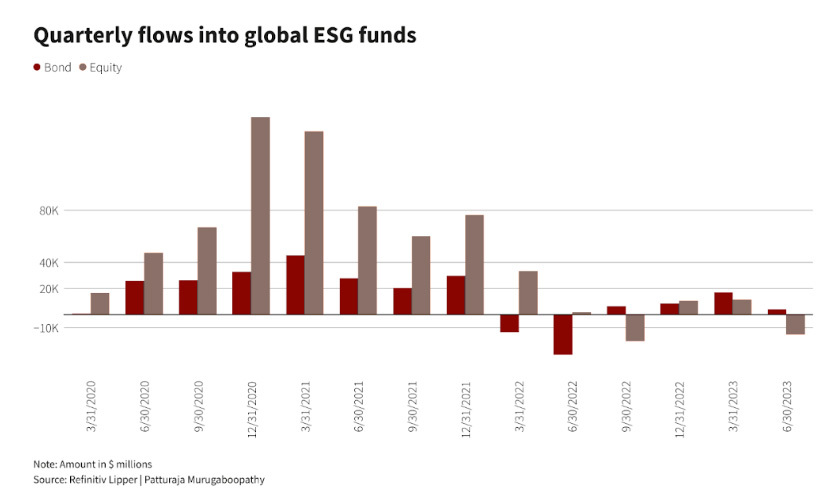

ESG equity funds suffer significant outflows

- Equity funds with an environmental, social and governance (ESG) tilt suffered a large loss of investors in the three months to the end of June, dragging the sector into a rare net outflow for the first half of the year.

- Outflows were largely driven by economic and regulatory worries in Europe and by concerns connected to an anti-ESG backlash in the United States, where funds saw their fifth consecutive quarter of net outflows.

- ESG funds that invest in shares saw $15.4bn of net outflows in the second quarter, outpacing first-quarter net inflows after a particularly challenging June, even as global stock markets rallied.

- Analysts said the data underlined that once-booming ESG funds were no longer immune from wider market dynamics.

- "Nervousness around equities as an asset class now also means nervousness about ESG equities," said Edward Glyn, Head of Global Markets at Calastone.

- ESG funds suffered their worst month on record in June for outflows, according to Calastone, with selling focused on North American funds, whereas ESG fixed-income funds enjoyed net inflows, with the popularity of the smaller asset classes holding up far better than equities.

Venture capital

VC shows signs of stabilising

- The venture capital market has started to stabilise after a sharp correction that began last year. But investors have yet to regain the optimism that fuels startup bull cycles, despite a keen interest in generative AI and a comeback for large tech stocks.

- US VC-backed companies raised $39.8bn in Q2 2023, a 48% decline year-over-year.

- However, US startups still remain on track to raise approximately the same overall amount as in 2020.

- Median US VC valuations have continued to correct across all stages except for the seed stage, where valuations are modestly higher than last year.

- The decline has been sharpest at the venture-growth stage, where the median pre-money valuation fell 62% YoY to roughly $126m.

- Few VC-backed companies have achieved notable exits so far this year. The IPO market has yet to attract a significant tech listing, and acquisitions have been dampened by corporate cost-cutting and higher borrowing costs for leveraged buyouts.

- Several generative AI startups have also been acquired in recent weeks: Databricks paid $1.3bn for MosaicML, and Thomson Reuters agreed a $650m deal for legal AI startup Casetext.

Private equity

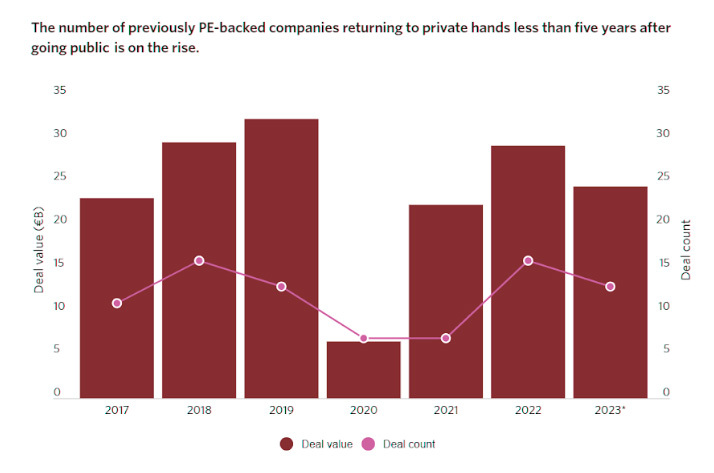

IPO reversals: more newly public companies return to PE ownership

- The number of companies that have been taken back into private equity ownership after five years or less on the markets is rising once again.

- So far in 2023, PitchBook data shows there have been 13 PE take-private deals worth a total of $26.7bn involving previously PE-backed companies that have been public for less than five years.

- The number suggests a return to a trend seen prior to the pandemic – when 40 such deals worth a combined $92.6bn took place between 2017 and 2019.

- "The growth in public-to-private transactions this year is a continuation from last year's sell-off in recently listed stocks," said Per Einar Ellefsen, co-founder of Amundsen Investment Management.

Property

Halifax House Price Index: UK house prices in June 2023 2.6% lower than June 2022

- The average UK house price fell slightly in June 2023, down by around £300 (-0.1%) compared to May 2023, with a typical property now costing £285,932.

- This was the third consecutive monthly fall, albeit a modest one.

- Conversely, the annual drop of -2.6% (-£7,500) is the largest year-on-year decrease since June 2011.

- With very little movement in house prices over recent months, this rate of decline largely reflects the impact of historically high house prices last summer – annual growth peaked at +12.5% in June 2022, supported by the temporary Stamp Duty cut.

- These latest figures do suggest a degree of stability in the face of economic uncertainty, and the volume of mortgage applications held up well throughout June, particularly from first-time buyers.

- “The resulting squeeze on affordability will inevitably act as a brake on demand, as buyers consider what they can realistically afford to offer. While there’s always a lag effect when rates go up, many existing mortgage holders with variable deals or rolling off fixed rates will likely face an increase in the next year.

- The recently announced Mortgage Charter provides important reassurance that mortgage holders have a range of options if they’re concerned about making repayments, and that lenders will be flexible when supporting anyone in difficulty.

A final note

Overall, this week has reinforced the challenges of investing and curating a well-placed investment strategy in 2023, largely due to wider economic movements – and complex tax systems in the UK. However, news headlines and data releases this week have also displayed signs of stability within global markets. In particular, positive updates from venture capital funding and seed-stage valuations, as well as a keen interest in generative AI deals, are providing a boost to the asset class.

%20(3)%20(2).jpg)