Weekly Briefing: UK inflation remains persistent, Bank Rate reaches 5% & UK leads VC space investment in Europe

This week saw the UK’s inflation rate remain at 8.7% – unchanged from last month. In response, the Bank of England raised the Bank Rate for the 13th time in a row, now reaching 5% (the highest rate since 2008). Elsewhere, US inflation fell to 4% in the year to May – a 0.9 percentage point month-on-month fall – and the Eurozone was announced as experiencing a technical recession in the first quarter of 2023.

Looking towards the alternative investment industry, PitchBook notes that Paris is beginning to move closer to London in terms of being Europe’s most prominent city for venture capital (VC), and the UK has been announced as the second most popular VC ecosystem for space investment after only the US. This comes as PwC analysis calculates a median 400% increase in deal size for early-stage investments in the space sector.

UK economy

UK inflation stays at 8.7%, prompting Bank of England to raise interest rates to 15-year high

- The UK's inflation rate remained at 8.7% in May – the same figure recorded in April.

- This stops the downward trend in UK inflation figures, which had been falling after reaching a peak of 11.1% last year.

- The Office for National Statistics (ONS) stated that rising prices for "air travel, recreational and cultural goods" were key factors causing inflation to remain high, whilst falling prices for motor fuel were the largest downward contribution.

- Core inflation – which strips out energy and food costs – is at the highest rate since 1992.

- In response to this, the Bank of England raised UK interest rates by half a percentage point on Thursday to a 15-year high of 5%.

- This is the 13th increase in UK interest rates in a row, going back to December 2021.

- Separate figures show UK debt is now higher than annual GDP for the first time since 1961.

Labour market shows strength in Q1 2023

- The UK employment rate was estimated to be 76% in February to April 2023, 0.2 percentage points higher than the previous three-month period.

- Between March and May 2023, the estimated number of job vacancies fell by 79,000 compared to the previous three-month period, down to 1,051,000.

- Growth in average total pay (including bonuses) was 6.5%, and growth in regular pay (excluding bonuses) was 7.2% between February and April 2023.

- For regular pay, this is the largest growth rate seen outside of the Covid-19 pandemic, although still lower than the rate of inflation (8.7%).

Global economy

US inflation falls in May and Federal Reserve pauses interest rate rises

- US inflation fell to 4.0% in the year to May, down from 4.9% the previous month.

- US core inflation saw a more modest decline, from 5.5% to 5.3%, over the same period.

- Rising house prices are responsible for much of the stickiness of US core inflation but given that US house prices have stabilised, core inflation is expected to fall sharply over the coming months.

- The Fed has kept its interest rate target on hold at 5% to 5.25%, and markets around the world reacted positively to this news.

World Bank and OECD issue new growth forecasts

- The World Bank has reduced its global growth forecast for 2024 from 2.7% to 2.4% in its latest Global Economic Prospects report.

- Central bank monetary tightening and increasingly restrictive credit conditions were key factors in the cut, Reuters reports.

- However, the World Bank has increased its forecast for 2023, predicting that real global GDP will rise by 2.1% this year, compared with an earlier forecast of 1.7%.

- In comparison, the global economy grew by 3.1% last year.

- Indermit Gill, the World Bank Group’s Chief Economist and Senior Vice President, stated:

The world economy is in a precarious position. Outside of East and South Asia, it is a long way from the dynamism needed to eliminate poverty, counter climate change and replenish human capital.

Eurozone entered technical recession in Q1 2023

- The Eurozone entered a technical recession in the first quarter of 2023, according to new data from Eurostat.

- GDP in the 20-country bloc saw a quarter-on-quarter decline of 0.1% in January to March 2023.

- This followed another 0.1% quarter-on-quarter drop in October to December, meaning the Eurozone faced two successive quarters of contraction, which is the definition of a technical recession.

- Household spending, public expenditure and inventory changes all had an impact on quarterly GDP, according to the statistics agency.

UK tax update

Favourable UK tax unlikely to stop falling North Sea oil and gas output

- Once one of the world's key energy sources, Britain's North Sea oil and gas output is set for a further decline after shrinking by two thirds over the past 20 years, leaving the country increasingly dependent on imports.

- A windfall tax introduced last year as energy prices soared prompted oil and gas producers, including some of the UK North Sea's biggest (such as TotalEnergies and Harbour), to reduce investment.

- While the government decided last week to waive the levy (which hiked taxes on oil and gas producers to an overall rate of 75%) should prices fall far enough, industry sources doubted it would succeed in its stated aim of boosting energy security by encouraging investment.

- The Government itself also said forecasts indicated the new price floor mechanism is unlikely to be triggered before the windfall tax – which has so far raised an additional £2.8bn to help consumers with high energy bills – runs out in 2028.

Impact investing

B Lab Centre for Impact Investing and Practices to accelerate B Corp movement in Asia

- B Lab Global and the Centre for Impact Investing and Practices (CIIP) will work together to establish the B Lab & CIIP Centre for Excellence for Asia, they announced in a joint statement on Monday 19th June.

- The centre aims to expedite the growth of the B Corporation movement (a global trend of enterprises using business as a force for good) across companies in Asia.

- It aims to provide businesses in the region with training and professional accreditation programmes using B Lab’s standards of verified performance, accountability, and transparency to achieve B Corp certification.

- Eleanor Allen, lead executive at B Lab Global, highlighted that the Asian economy is a “significant contributor” to the global economy and that it is “shaping the next phase” of globalisation.

- “We want to use this momentum to further catalyse the movement of business as a force for good,” she said.

- In addition, the centre will be used to develop research and share insights on stakeholder-focused business models, as well as hold workshops and gather input from companies to inform the new B Corp standards.

Venture capital

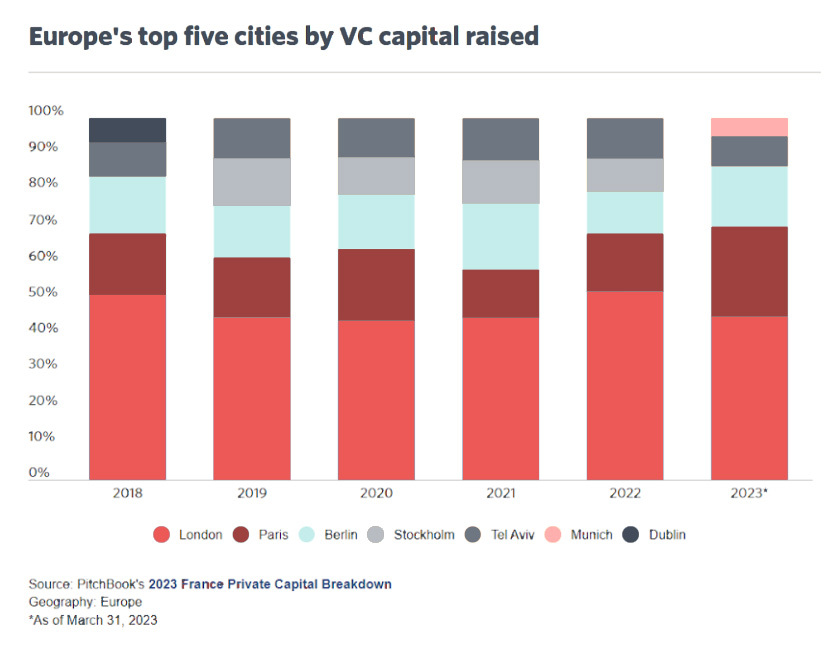

Europe's top five VC cities: Paris catching up with London

- With £2.3bn raised so far this year, according to PitchBook's 2023 France Private Capital Breakdown, London remains ahead of other European nations in terms of VC funding.

- Outsized rounds for late-stage companies and several unicorns have drawn plenty of capital to the city, despite the wider challenging economic environment.

- But while the UK’s capital city has held the top spot for more than a decade, other European cities have been growing their share of European VC investment.

- Paris has seen the most growth over the past five years, accounting for 25% of all capital raised in the first quarter of the year by the top five cities.

- In terms of VC, France has had a positive start to the year, with large rounds including crypto startup Ledger's €460.8m Series C in March, helping the city grow its share of European funding.

- Aside from briefly eclipsing Paris in 2021, Berlin has consistently remained Europe's third-largest venture hub in terms of funding, and it has also seen its share increase from 11.9% in 2021 to 16.7% in 2023.

- With over €300m invested in Q1, Munich has also joined the ranks of Europe's five largest cities for VC funding this year.

- The inclusion of Munich has knocked Stockholm out of the ranking for the first time since 2018. The Swedish capital has seen a significant fall in funding with only €242.9m invested in the first quarter of this year – a 70.2% decrease from the same period in 2021.

UK leads Europe in space investment, finds new report by PwC and UK Space Agency

- A new report released in May regarding venture capital and space investment – produced by PwC in association with the UK Space Agency – reveals the UK’s £17.5bn space sector is the most attractive destination for private investment in space after only the US, with the UK receiving 17% of global space investment.

- The report also outlines a near doubling of venture capital investments in revenue-generating space companies in the UK between 2015 and 2022.

- 95% of space investments were in revenue-generating companies in 2022, compared to 56% in 2015, demonstrating the growing maturity of the sector.

- Notably, 63% of investors were new to the sector in 2021.

- Craig Brown, Director of Investment at the UK Space Agency, stated:

Space has taken on an increased significance as a deeply embedded part of the global economy that is poised to grow at up to 11% per annum over the next decade.

- The industry contains asset-light and technology-driven businesses, as well as infrastructure assets and supporting services businesses, all of which stand to benefit from the significant growth of the global space industry.

- Matt Alabaster, Partner at PwC Strategy&, said:

This report shines a light on the substantial contribution that the space industry can make to solving some of our biggest global challenges, from decarbonising our economies to increasing food security and improving access to healthcare.

- The analysis calculates a median 400% increase in deal size for early-stage investments and highlights many fast-growing UK space organisations, from satellite communications firm, OneWeb, to Wales-based aerospace manufacturer, Space Forge, which raised Europe’s largest ever seed round for a space tech company in December 2021.

- UK space organisations have received investments from at least seven of the most active global investors, and nine of the largest UK-based venture capital firms, including University of Cambridge Enterprise, Octopus Ventures, and Molten.

- Space sector income increased by more than 5.0% into 2021, outpacing both the growth of the global space industry in the same period (1.6%) and the general UK economy, which contracted by 7.6%.

Private equity

HarperCollins and KKR appear as bidders for book publisher, Simon & Schuster

- Simon & Schuster (S&S) is pursuing a sale once again after the US government blocked its attempted merger with Penguin Random House.

- HarperCollins and private equity company KKR, are among the second round bidders for S&S, the Wall Street Journal reports.

- Analysts previously suggested that a non-trade buyer was the more likely option, as they are less likely to raise the same concerns around competition that caused the initial deal to fall through.

- However, HarperCollins president and CEO Brian Murray has previously expressed interest in a further attempt.

- The Wall Street Journal reported second bids are due by mid-July, and a deal could be completed by the end of the summer.

- Paramount Global, S&S’ parent company, has previously said that it expects to complete a purchase before the end of the year.

Property

Buy-to-let rules are changing: what are the alternative options for property investors?

- The Renters’ Reform Bill, introduced to Parliament on 17 May 2023, would end no-fault evictions and bans on tenants who claim benefits.

- Renters would also get the legal right to request a pet in their home, which the landlord cannot unreasonably refuse.

- Some campaigners warn it could lead to more landlords leaving the market.

- Due to the increasing levels of complexity associated with the buy-to-let market, many property owners are seeking alternative ways to access property investments without having to maintain a physical property themselves and remain up-to-date with changing legislation.

- As a result, options such as property bonds and joint venture property investments are becoming increasingly viable alternatives for those keen to gain access to the UK property investment market, outside of the buy-to-let route.

A final note

Overall, with the UK economy experiencing persistent inflation and record interest rates, investors may be seeking ways to ensure their portfolio is sufficiently protected and diversified.

To help with this, Government-backed schemes such as the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS), as well as a range of routes into property investment, can offer the potential to diversify your portfolio whilst targeting inflation-beating returns. In addition, the EIS and SEIS can provide investors with the opportunity to access significant tax reliefs – another factor becoming increasingly important in the UK’s ever-stricter tax environment – which can help to minimise the associated investment risks and maximise potential returns.

%20(3)%20(2).jpg)