Weekly Briefing: average UK house prices fall, steady growth outlook for global private capital fundraising & Bank Rate reaches 4.5%

Interest rate movements have been a topic of discussion this week, with the Bank of England deciding to increase the Bank Rate to 4.5%, the highest level in 15 years. Furthermore, we assess some of the latest developments in the world of private equity and venture capital, with a focus on fundraising activity, allocation trends, and ESG developments. In addition, we discuss UK house price movements between March and April 2023, providing an insight into the property sector and associated investment opportunities.

UK economy

Bank of England raises Bank Rate for 12th consecutive time

- The Bank of England raised the Bank Rate to 4.5% – the highest level since late 2008 – as it continues to combat high inflation in the UK.

- The decision on Thursday by the Bank’s Monetary Policy Committee to lift its main interest rate by a quarter of a percentage point was the 12th consecutive increase.

- The Bank of England started raising interest rates in late 2021 (from a low of 0.1%) in an attempt to slow price rises that were first largely caused by bottlenecks in supply following the lifting of lockdown restrictions, and subsequently by Russia’s invasion of Ukraine.

Global economy

Further interest rate rises in the Euro area and US

- Euro area inflation rose to 7.0% in the 12 months to April 2023, up from 6.9% the previous month.

- As a result, the European Central Bank raised the main deposit rate from 3.0% to 3.25% and President Christine Lagarde stated “We are not pausing [monetary tightening].”

- Similarly, the US Federal Reserve raised interest rates by a quarter of a percentage point from 5% to 5.25%. Chair Jay Powell said, “There is a sense that we’re much closer to the end of this than to the beginning.”

- US inflation eased to 4.9% in April, a positive sign that the Federal Reserve’s cycle of interest rate rises is helping to control prices.

Global growth prospects from the IMF

- The International Monetary Fund (IMF) forecasts the global economy will expand by almost 20% over the next five years compared to its size in 2022 (using Purchasing Power Parity [PPP] measurements).

- This forecasted growth compares with a predicted 5.4% increase in the world’s population over the same time frame. So, despite an increasing world population, average GDP per capita is expected to grow by nearly 14% by 2028, with the strongest gains seen in emerging and developing economies.

- South Korea is one of the clearest examples of successful economic development. As recently as 1980, South Korean GDP per capita was just 20% of that of the UK. By 2024, the IMF expects South Korean GDP per capita to exceed the UK’s.

- Furthermore, many of the fastest-growing countries over the next five years are likely to be in sub-Saharan Africa. Uganda, Tanzania, Ethiopia, Rwanda, Kenya and Senegal are just some of the African countries which the IMF sees growing by an annual average of more than 5.0% between 2022 and 2028.

- Conversely, several advanced economies – including Japan, Italy and Germany – are expected to see very slow economic growth rates over the coming years, in part as a result of ageing populations.

UK tax update

What would a wealth tax mean for the UK?

- The potential introduction of a wealth tax has been reported by financial journalists throughout the UK.

- Wealth taxes are being proposed as a solution to address the UK's budget deficit and reduce inequality, but they can also have unintended consequences and challenges.

- In 1990 there were 12 countries with a wealth tax, but due to the fear of wealth flight, eight countries have since repealed it.

- Today, notably fewer countries levy a wealth tax. Some of the nations that do include Norway, Spain, and Switzerland (although Switzerland offers many other tax incentives that the wealth tax is relatively insignificant).

- Since the start of the 2023/24 tax year, the UK population now has one of the highest tax burdens since the end of the Second World War. Further additions to existing tax liabilities could have a significant impact on individual taxpayers, particularly high-net-worth individuals (HNWIs), thus highlighting the importance of tax-efficient investment strategies.

Impact investing

What are the main challenges of ESG investing? A review from abrdn

- The growing interest in ESG over recent years has raised important questions that the industry needs to address, including confusion around what ESG means, the role of fossil fuels and commodities in ESG portfolios, and whether funds deliver on their expected outcomes.

- Despite these challenges, ESG remains a highly relevant and important consideration for investors. abrdn states, “While scrutiny has intensified, we’ve not seen any change in tone from our clients, fund flows remain resilient even in volatile markets, while the opportunities, if anything, are clearer than they were in early 2020 (given, for example, the momentum of climate change).”

- Ultimately, abrdn has observed greater scrutiny of processes and outcomes, with stakeholders keen to see more evidence of approaches to ESG for strategies, particularly regarding the stated aim of a particular investment. The emphasis is on disclosure and verification; a positive market development.

Venture capital

Felix Capital becomes Europe’s first B Corp certified VC with over $1bn AUM

- Felix Capital Partners, a venture capital firm based in London, has received its B Corp certification, making it the first European venture capital firm with over $1bn in assets under management (AUM) to achieve this status. The certification was awarded with a score of 100.1.

- B Corp certification is granted to companies that meet certain social and environmental standards and is recognized globally as a mark of sustainability and ethical business practices.

- While Felix Capital is the first venture capital firm in Europe with over $1bn AUM to become B Corp certified, Bethnal Green Ventures holds the title of the first UK-based venture capital firm to achieve the B Corp status.

Private equity

Preqin April 2023 data

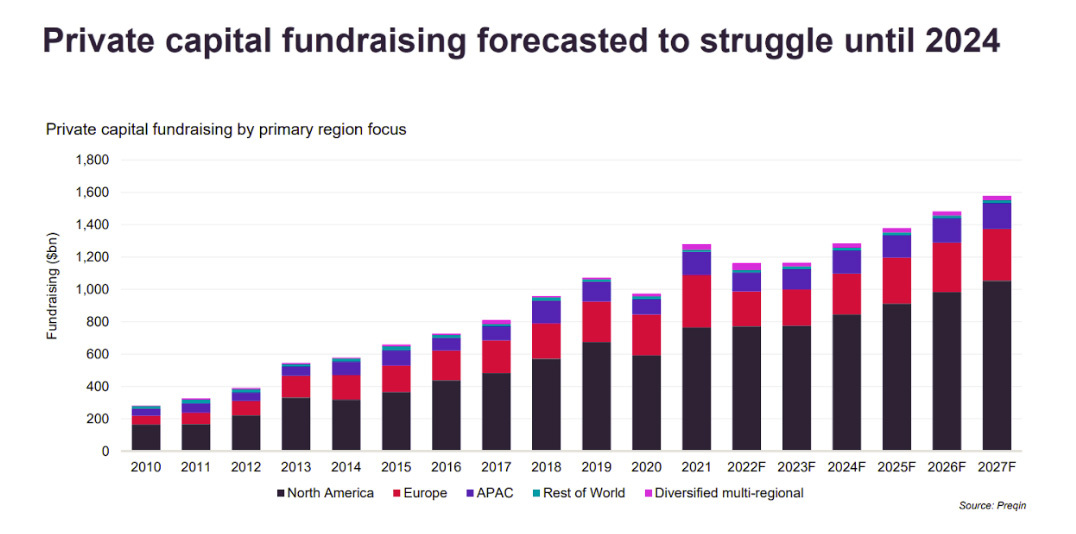

- Global private capital fundraising is expected to grow slowly but steadily, from $1.17tn in 2023 to $1.58tn in 2027.

- There is likely to be more room for wealth managers, family offices, and private banks to allocate capital in comparison to some institutional investors who are near or over their respective asset allocation limits.

- Public markets have become increasingly indexed, correlated, and volatile; there are far fewer listed companies and traditional 60/40 portfolios are becoming less effective. Therefore, private investors are attracted by the potential to diversify with alternative assets, and wealth managers are increasingly making alternative investments a strategic priority.

- Private equity secondaries and private debt (especially direct lending) are particularly attractive in the current market, with property investment opportunities also featuring prominently.

Property

Halifax House Price Index: after three months of growth, the average UK house price fell in April 2023

- After three consecutive months of growth, the average UK house price has fallen by -0.3% (or approximately £1,000) between March and April 2023.

- The rate of annual house price inflation also slowed further to +0.1% (down from +1.6% in March) meaning that average property prices are largely unchanged from the same time last year.

- A typical property now costs £286,896, which is around £7,000 below the peak of summer 2022, though still £28,000 higher than two years ago.

- Importantly, the impact of higher interest rates gradually feeding through to those re-mortgaging their current fixed-rate deals may mean some further downward pressure on house prices can be expected over the course of this year.

A final note

Overall, this week’s news, trends, and key developments in the alternative investment sector can provide investors with a cautiously optimistic outlook. Both private equity and venture capital are experiencing changing trends in fundraising activity and allocation levels, largely due to wider banking sector frailties and macroeconomic conditions. With these two factors expected to calm over the coming months, PE and VC activity could soon be operating in a more favourable external environment. Furthermore, expectations of coming towards the end of global interest rate hikes could provide some level of stability, particularly in the UK housing market, later this year.

%20(3)%20(2).jpg)