Weekly Briefing: UK VC investment is on the rise, falling mortgage rates trigger increased demand & Eurozone unemployment at record low

In our first weekly briefing of 2024, we take a look at the analysis by HSBC Innovation Banking and Dealroom on the performance of UK VC investment in 2023 and the outlook for this year, Savills’ update on movement within the housing market, and more.

Venture Capital

UK Venture Capital Investment is Growing Again

- HSBC Innovation Banking and Dealroom’s UK Innovation 2024 Forward Look predicts that there could be a “tentative recovery” for VC investment this year, as investment returned to growth in H2 2023.

- The report stated that VC investment was up 46% in the second half of 2023 when compared with the period from January to June.

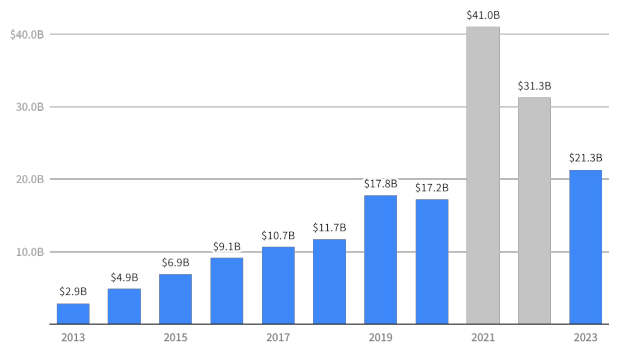

- UK startups raised $21.3 billion in 2023, the third-highest total on record behind the outlier years of 2021 and 2022.

- The UK also remains the #3 tech ecosystem in the world, behind only the USA and China, and the #1 tech ecosystem in Europe.

- HSBC Innovation Banking UK’s CEO Erin Platts said: “This data demonstrates a significant positive trajectory for the UK's innovation economy, despite what has been a challenging period globally. We should be proud of the resilience the UK innovation ecosystem has shown and should celebrate its commitment to solving some of our most intractable problems. We are hugely optimistic and excited about the ecosystem in 2024 and look forward to playing our part in fuelling this critical part of the UK’s economy.”

Annual VC Investment Into UK Startups

Source: Dealroom, HSBC Innovation Banking.

Source: Dealroom, HSBC Innovation Banking.

Property

House Prices Hold Steady As Falling Mortgage Rates Trigger Increased Demand

- According to Nationwide’s House Price Index, there was no monthly change in house prices in December 2023, putting the total value change over 2023 at just -1.8%.

- Savills state that this relative resilience in house prices has been supported by recent falling mortgage rates, as lenders cut rates in order to compete with low activity in the market and in anticipation of an earlier-than-expected reduction in the Bank of England (BoE) base rate.

- Demand in the housing market has also started to rise in response to falling mortgage rates.

- Sales agreed were at a nine-month high in December and new mortgage approvals also ticked up in November, to 76% of the 2017-19 average for the month.

Global Economy

Eurozone Unemployment Returns to Record Low

- There was an unexpected fall in Eurozone unemployment in November 2023, dropping to a joint record low of 6.4%.

- This figure is a drop from 6.5% in October and matches the record low previously set in June, with unemployment falling by around 99,000 to 10.97 million.

- After the economy shrank by 0.1% in the third quarter of 2023, economists had expected the Eurozone unemployment rate to remain unchanged in November.

- In the wider European Union, the unemployment rate slipped to 5.9% in November 2023, from 6% in October.

Events

Investment Sector Set to Take Centre Stage at UK’s Leading Investment, Development and Regeneration Event

- The UKREiiF 2024 (The UK’s Real Estate Investment and Infrastructure Forum) has been scheduled to take place in Leeds in May of this year.

- The three-day event is expected to attract almost 12,000 attendees, the majority of whom are involved in the investment and development of key areas such as property, advanced manufacturing, life sciences, technology, healthcare, energy, retail and high streets, infrastructure, leisure and hospitality, and industrial.

- Having garnered strong interest from some of the UK’s most successful private and institutional investors, a large number of household names in the UK investment scene, from Barclays to Blackstone, are set to attend.

- This event is poised to be a key platform for investment discussions, underlining the sector’s crucial role in the UK’s economic and infrastructural development.

- Alastair Campbell, Former Director of Communications for No.10 Downing Street, commented: “UKREiiF brings together all the different parts of the equation that are needed to regenerate regions and the economy successfully. And it’s changing people’s view of the industry world.”

- You can register for this year’s UKREiiF at: https://www.ukreiif.com/event/ukreiif-annual-event-2024/.

A Final Note

It’s particularly promising to see figures that suggest a tentative recovery has already begun within the UK’s VC ecosystem, with investment statistics from H2 2023 showing clear confidence in British startups.

At GCV, we remain committed to providing the latest insights into the investment and wider economic landscape in order to support investors in making well-informed decision when choosing where to allocate their capital.

If you would like to find out more about a number of tax-efficient investment strategies available to UK investors, discover our range of downloadable resources here.

%20(3)%20(2).jpg)