EIS income tax relief: what is it and how does it work?

The Enterprise Investment Scheme (EIS) offers some of the most generous tax incentives available when investing in early stage companies. Among the most notable is EIS income tax relief.

1. What is EIS income tax relief?

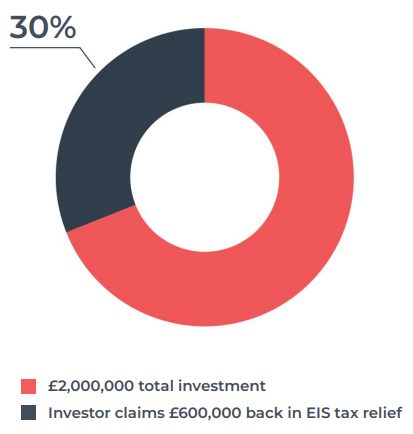

EIS Income Tax Relief Example

To claim the full 30% tax relief, an investor must invest in an EIS-eligible investment opportunity. They must also ensure they hold the EIS shares for at least the three-year minimum holding period.

2. Can I carry back EIS income tax relief?

EIS Carry Back Relief Example

3. Is there a limit to the amount of EIS income tax relief I can receive?

Any amount over £1 million must be for shares issued by one or more knowledge-intensive companies (KIC).

4. Who is eligible for EIS income tax relief?

-

UK residency (or UK tax commitments): investors must be a verified UK resident or have UK income tax liabilities against which they can claim relief.

-

Sufficient income tax liabilities: investors must have accrued a sufficient level of income tax in the year their EIS shares are issued. In the case of carry back relief, this applies to the previous tax year.

-

Not an employee: investors who are employed or are a partner of the company distributing shares are not eligible to claim income tax relief.

5. How can I claim EIS income tax relief?

-

Search for eligible opportunities: before claiming EIS tax relief, an investor must select an opportunity that qualifies for the scheme. These can be accessed either directly from the eligible company, via a co-investment platform or through an EIS fund.

-

Invest in the opportunity: this process will differ depending on the provider. Direct investments will require more personal due diligence before investing. However, reputable co-investment platforms and funds may research, facilitate and monitor opportunities on the investor's behalf.

-

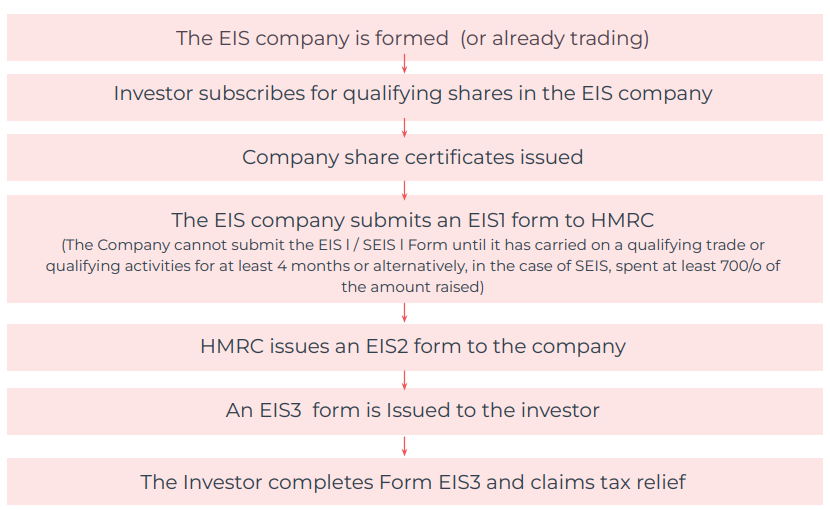

Claim the tax relief: Once shares have been issued, EIS3 forms will be distributed to investors. Those that pay tax via PAYE (pay as you earn) can claim income taxation relief by filling in the EIS3 form and sending it to HMRC to process, who may have already provided an advanced assurance.

Alternatively, individuals can complete this on their self-assessment tax return.

The below flowchart shows a typical EIS investment process for an investment into an individual company.

6. When should I expect to receive EIS income tax relief?

How long it takes for an investor to receive their EIS income tax relief can depend on several factors. One of the most obvious (but crucial) is when the EIS3 form or tax return itself is returned to HMRC.

Investors are eligible to make their tax relief claim up to five years after EIS share issue date. Subsequently, the date this is submitted will play a significant role in when the relief is received.

Outside of the investor's remit, it can be useful to note that HMRC's processing times on tax relief can vary depending on their backlog. As a result, investors may experience a longer wait for their tax relief than expected.

Once these steps have been fulfilled, HMRC will then provide tax relief accordingly. This will either be by reducing the investor's income tax bill for the following year or by providing an income tax refund.

7. Is EIS income tax relief available for overseas investments?

The EIS's income tax relief is only available for investments in UK-based companies.

This means that for overseas investors looking to utilise EIS tax benefits, UK start-up and scaleup opportunities should be explored.

Though the EIS tax incentives are only available for those that hold UK liabilities, in recent years the UK's reputation the start-up capital of Europe has been reason enough to attract global investment.

In 2023, UK start-up's and scale-ups raised nearly $22 billion in venture capital investment, marking a significant rebound and surpassing pre-pandemic levels. This total positions the UK as the leading tech ecosystem in Europe, attracting more venture capital than France and Germany combined.

8. Benefits of EIS income tax relief

From risk minimisation to impact investing, some of the most significant investor benefits associated with with EIS income tax relief include:

-

Increased potential return on investment: income tax relief allows investors to reduce their overall tax liability, effectively increasing their return on investment. For example, if an investor receives a 30% income tax relief on their investment, it reduces the effective cost of the investment by 30%, leading to potentially higher overall returns.

-

Risk minimisation: Investing in early-stage companies carries inherent risks. EIS income tax relief provides a form of risk mitigation by reducing the financial burden on investors by almost a third (30%).

-

Access to additional tax incentives: by claiming EIS income tax relief, investors can gain access to additional EIS tax incentives. These include capital gains tax (CGT) exemption, CGT deferral, inheritance tax exemption and loss relief. Together, these can support investors in minimising risk, maximising returns, managing tax plans and planning for later life.

|

EIS Tax Incentive |

Benefit |

|

30% income tax relief |

Effective investor spend of 70p in the £1 |

|

Capital gains tax exemption |

Zero CGT to pay when shares are realised (usually 20%) |

|

Capital gains tax deferral |

Ability to defer the payment of an existing CGT bill to later years |

|

Inheritance tax relief |

Zero IHT to pay on shares upon passing (usually 40%) |

|

Loss relief |

Offset any potential losses by rate of income tax or CGT |

- Flexible tax planning: The EIS's carry back feature enables investors to carry back all or part of their income tax relief to the previous tax year. This flexibility can be advantageous for individuals with considerable tax liabilities that are keen to manage their finances optimally.

-

No impact on personal allowances: some investments, such as those involving dividend repayments, are eligible for income tax. Some, such as listed equities, are eligible for capital gains tax. Neither taxes apply to EIS shares when sold. In turn, an investor's income tax allowance and CGT allowance will not be impacted upon the sale of EIS shares.

-

Fuels innovation into UK SMEs: EIS tax reliefs are designed to incentivise investment into the UK's early-stage, high-growth businesses. By investing in the EIS and claiming tax incentives, investors can fuel the development of some of the UK's most innovative, impact-driven early-stage businesses.

9. Risks associated with EIS income tax relief?

The benefits associated with EIS income tax relief are numerous. However, individuals should also consider the potential risks that the relief and scheme as a whole can pose. The key risks investors should be aware of before investing in the EIS are:

-

Risk to capital: EIS investments involve investment into early-stage, unquoted businesses. Though this can enable considerable growth, it can make investor capital more susceptible to risk than with investments into mature companies.

-

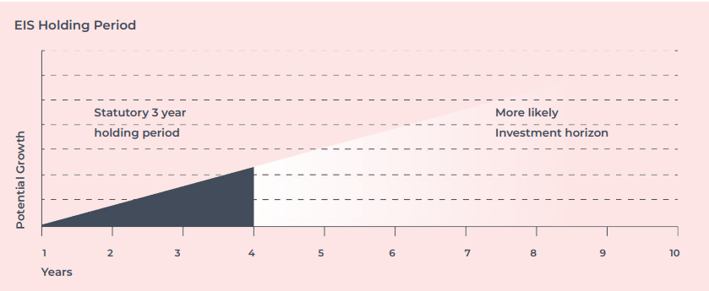

Lower liquidity: the EIS is a long-term investment product and has naturally low liquidity in comparison to asset classes such as listed equities. Whilst this means an investor could wait five to ten years for a return, the scheme's passive nature and often higher target returns can make it a preferable route for certain investors.

-

Regulatory Changes: the rules surrounding EIS reliefs can be subject to changes by the Government. There have been no negative changes to the EIS since its introduction in 1996, and none are currently forecasted. However, it is still important for investors to bear this caveat in mind.

-

Personal Tax Considerations: EIS income tax relief relies on the investor having accrued sufficient income tax liabilities in the year of – or prior to – share issue. If investors have not accrued sufficient income tax liabilities in either of these periods (or already utilised relief on them), they may not receive their full 30% income tax relief.

10. Accessing the most appropriate EIS investment

Income tax relief forms just one part of the Enterprise Investment Scheme, and several other factors are likely to play a role in an investor's decision outside of it. Many of these will depend upon investor attributes and ambitions.

Where experienced investors and high-net-worth individuals may prefer the ability to select their own individual EIS investments from a co-investment platform and benefit from the comparably higher returns they target, those with limited investment experience may prefer the less autonomous approach that EIS funds offer.

But regardless of growth goals, sector preference or tax plans, one task any individual considering EIS investments can benefit from is learning as much as possible about the scheme prior to investing – whether that be via online resources, a personal tax adviser, or both.

To support this process, we have created a comprehensive guide to the Enterprise Investment Scheme. Offering an extensive overview of the scheme, its tax reliefs, risks, rewards, routes for access and more.

You can download the guide for free here.

EIS Income Tax Relief FAQ

1. How do I know if a company qualifies as knowledge-intensive (KIC)?

A company qualifies as knowledge-intensive (KIC) if it focuses on innovation or research and development, meeting HMRC's criteria. This matters only if you plan to invest more than £1 million in a single tax year, as the additional £1 million must go into KICs to qualify for EIS income tax relief.

To verify, you can check with the company or review HMRC's approval.

2. Can I invest in multiple companies under the EIS in a single tax year?

Yes, you can invest in multiple companies under the EIS in a single tax year and still benefit from the income tax relief. The relief applies to the total amount invested across all EIS-eligible companies, up to £1 million per tax year, or up to £2 million if the excess above £1 million is invested in knowledge-intensive companies.

This means you can spread your investments across several companies while still claiming the 30% income tax relief on the total sum, provided the combined investment remains within the annual limits.

3. What are the tax implications if I sell my EIS shares before the 3-year minimum holding period?

If you sell your EIS shares before the three-year minimum holding period, the tax implications are significant. You will lose the 30% EIS income tax relief, and HMRC will require you to repay the relief that was originally claimed.

Additionally, you will no longer be eligible for other EIS tax benefits, such as capital gains tax (CGT) exemption and potential inheritance tax relief.

Selling the shares before the three-year mark essentially disqualifies the investment from all the associated tax advantages, making it important to adhere to the holding period.

Thankfully, thins doesn't not apply to EIS loss relief. If your shares are sold, before the 3 year period then you can still claim your relief is shares are sold at a loss.

%20(3)%20(2).jpg)