Over £4bn invested into Tech Start-Ups so far in 2020

A recent Government report with figures compiled from Dealroom and Technation has shown that investors are continuing to back some of the UK’s high growth tech companies, despite the challenges posed by COVID-19.

According to the research for the Digital Economy Council, over £4.2bn has been invested into young UK-based Tech companies since Jan 2020. Of the new capital being ploughed into the sector, Fintech accounted for 39% of 2020 fundraising, followed by enterprise software companies raising a fifth of money invested in the first five months of the year.

The findings also reported that the UK raised more than the rest of Europe combined, with London-based tech start-ups raising more than Paris, Berlin and Tel Aviv put together.

Commenting on the figures, digital secretary Oliver Dowden said the tech sector had:

“shown resilience in these challenging times and the levels of investment in the year to date have consolidated our Europe-leading position.”

“Government will continue to champion and support the sector as it navigates the months to come as we step up our coronavirus recovery plans.”

The UK Tech Sector Strengthening

2019 was a busy year for GCV portfolio companies including Intelligence Fusion and HIVE. HR, which saw considerable combined investment.

The GCV investor network is made up of experienced, private investors and institutional investors, who are increasingly looking to access and co-invest in growth focused investment opportunities in the tech sector.

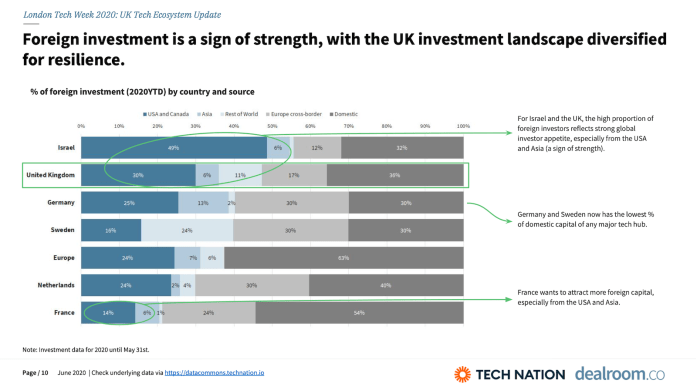

In recent years the UK has evidenced it’s strong position from both domestic and foreign investment. In the year to date, the US and Asia invested more into UK based companies than any other European country, accounting for 36% of all UK investment. Foreign investment shows a sign of strength, with the UK investment landscape diversified for resilience.

The UK also has a strong foundation of domestic investment, matching the amount from the US and Asia, UK investors also make up 36% of all investment into the country.

Since the pandemic broke out, more small, equity backed, tech businesses across the UK are proving to be vital in the economic recovery post COVID-19.

Black swan events such as pandemics evidence the need for the next wave of innovation with a heavy reliance on technology for survival, education and community.

Businesses are waking up to the fact they need to be digitally sufficient in order to grow into significantly more resilient, adaptable, and resourceful entities.

Whilst people in tech are excited about expanded opportunities and the ability to solve the challenges facing all of humanity, many of these businesses need further support and investment to withstand the impact of the Covid-19 crisis.

To ensure that they can survive and successfully continue to build and commercialise their innovations, more domestic and international investment is still required.

Driving force for employment

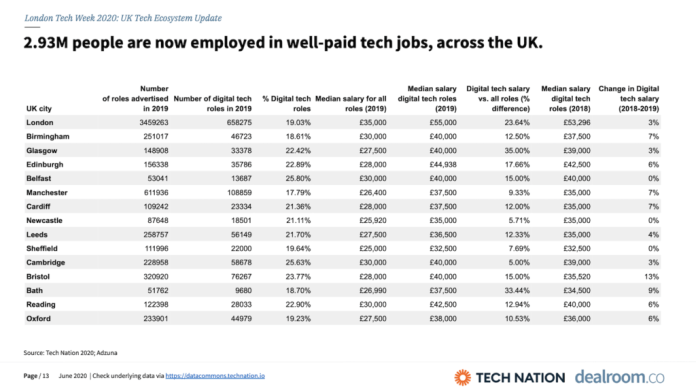

UK tech now employs more than 2.93 million people across the country with salaries that are, on average, £10k higher than other sectors. Even so, more than 90,000 tech sector jobs were being advertised at the end of April. This is twice the number of openings in accounting and finance, the next sector with the most vacancies.

Although London is still a key driver of digital tech jobs and growth – accounting for 53% of advertised roles in 2019 and offering the highest average salaries – tech hubs in Manchester, Newcastle and Leeds are continuing to thrive as evidenced in London’s Tech Week 2020 update.

Between 2008-2011 in the wake of the financial crisis, a generation of world-leading UK scaleups were born, creating innovative, high growth businesses and thousands of jobs nationally. One of these tech start-ups includes GCV portfolio company and guest self service platform QikServe.

Recovery from the recession including the changing consumer preferences and behaviours forced QikServe's customers to rethink not just their digital strategies but also their operations.

Just as QikServe saw an opportunity to provide an innovative solution to the hospitality industry, we will undoubtedly be seeing a new wave of tech start-ups that will help the UK bounce back from COVID-19.

However, whilst the foundations of the tech sector may be strong, this generation of entrepreneurs risk being chipped away if the right backing from investors is not secured.

Tech Sector Investment Opportunities in 2020

In 2020 GCV are delighted to be bringing it’s investor network, some high impact driven investments including Legal Tech Start-up “Transparently” and visitor experience platform “Fame Media Tech“.

Focusing on originating and structuring high growth investment opportunities, many of GCV’s 2020 investment opportunities offer attractive tax reliefs including the Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS).

%20(3)%20(2).jpg)