Sector

Fintech

Total Investment

Latest Investment

November 2021

Current Status

Growth Phase

Asset Class

Venture Capital

Funding Rounds

2

We bring together an online and offline investor network of experienced, private investors and institutional investors to access and co-invest in growth-focused investment opportunities.

Founded in 2015, GCV provides co-investment opportunities across venture capital, private equity and real estate to our network of private investors and institutional investors.

Firstname Lastname & Firstname Lastname

Position & Position, Company

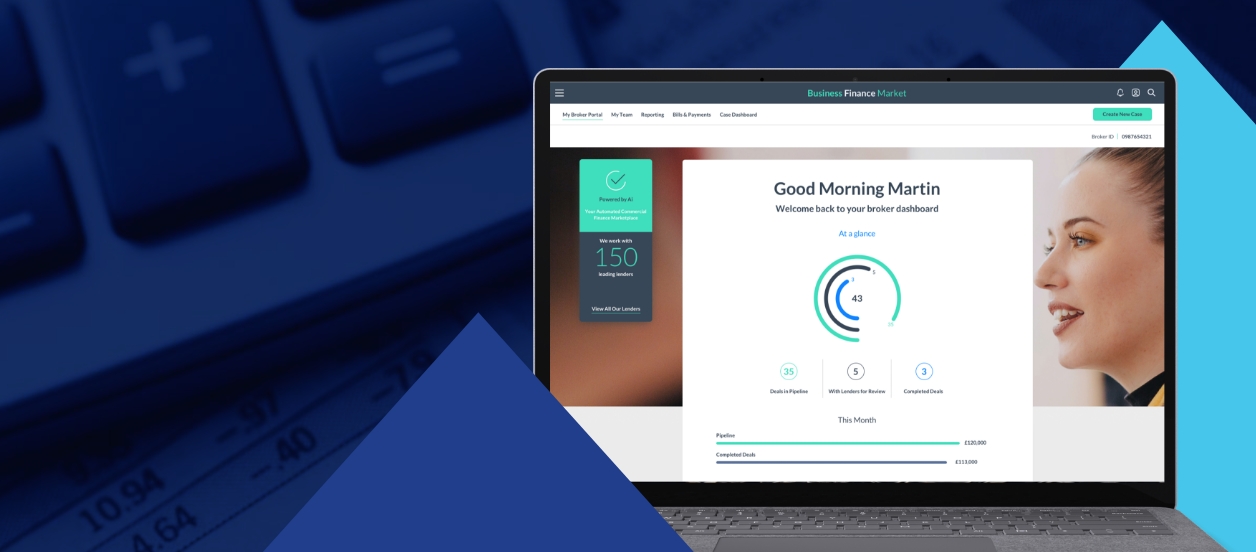

The Business Finance Market (BFM) team are developing a data-rich fintech platform that will stimulate the market for SME lending.

BFM intends to streamline the lending process through technology innovation and a re-engineered customer journey, to match lenders and SMEs together to help them secure finance.

Not only should this allow SMEs to experience quicker finance decisions based on true addressable market access, but also lenders and intermediaries will have a fintech platform which could help to manage the end-to-end application process, improve deal flow, and deliver faster credit decisions.

BFM has been founded by a team of senior banking specialists and SME business experts who have experienced the frustrations and failures of the current UK SME lending marketplace from both sides. Their combination of industry knowledge and expertise with a powerful fintech platform, will create a clearly differentiated approach to streamlining the SME lending process.

2

We always look for the businesses that can make an impact; the businesses that can make a difference. Since launch, we've built a portfolio of a dozen companies across banking to threat intelligence and each continues to thrive to this day.

| Sector: | SaaS |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 556,800 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Fintech |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 2,624,694 |

| Tax Schemes: | EIS |

| Sector: | SaaS |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 808,961 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Fintech & Banking |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 1,100,000 |

| Sector: | HR Tech |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 1,453,000 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Fintech & Banking |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 1,303,855 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Property |

|---|---|

| Investment Type: | Equity & Debt |

| Investment to Date: | £ 2,000,000 |

| Sector: | Property |

|---|---|

| Investment Type: | Equity & Debt |

| Investment to Date: | £ 7,000,000 |

| Sector: | Property |

|---|---|

| Investment Type: | Equity & Debt |

| Investment to Date: | £ 3,000,000 |

| Sector: | Property |

|---|---|

| Investment Type: | Equity & Debt |

| Investment to Date: | £ 6,000,000 |

| Sector: | Fintech |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 2,381,669 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Fintech & Banking |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 1,549,993 |

| Tax Schemes: | EIS |

.png?width=1128&height=594&name=Valius%20Group%20(2).png)

| Sector: | SaaS |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 248,299 |

| Tax Schemes: | SEIS |

From tax efficient investing to joint venture property investing, our blog is full of news, information and insights.

To keep up to date on news, events and investment opportunities, sign up to our newsletter here.

* You can unsubscribe at any point using the link provided in the footer of all emails, for more information about how we handle data you can view our privacy policy.

Growth Capital Ventures (GCV) is backed by funds managed by Maven Capital Partners, one of the UK’s leading private equity and alternative asset managers.