Sector

Fintech

Total Investment

Latest Investment

September 2018

Current Status

Growth Phase

Asset Class

Venture Capital

Funding Rounds

1

We bring together an online and offline investor network of experienced, private investors and institutional investors to access and co-invest in growth-focused investment opportunities.

Founded in 2015, GCV provides co-investment opportunities across venture capital, private equity and real estate to our network of private investors and institutional investors.

Firstname Lastname & Firstname Lastname

Position & Position, Company

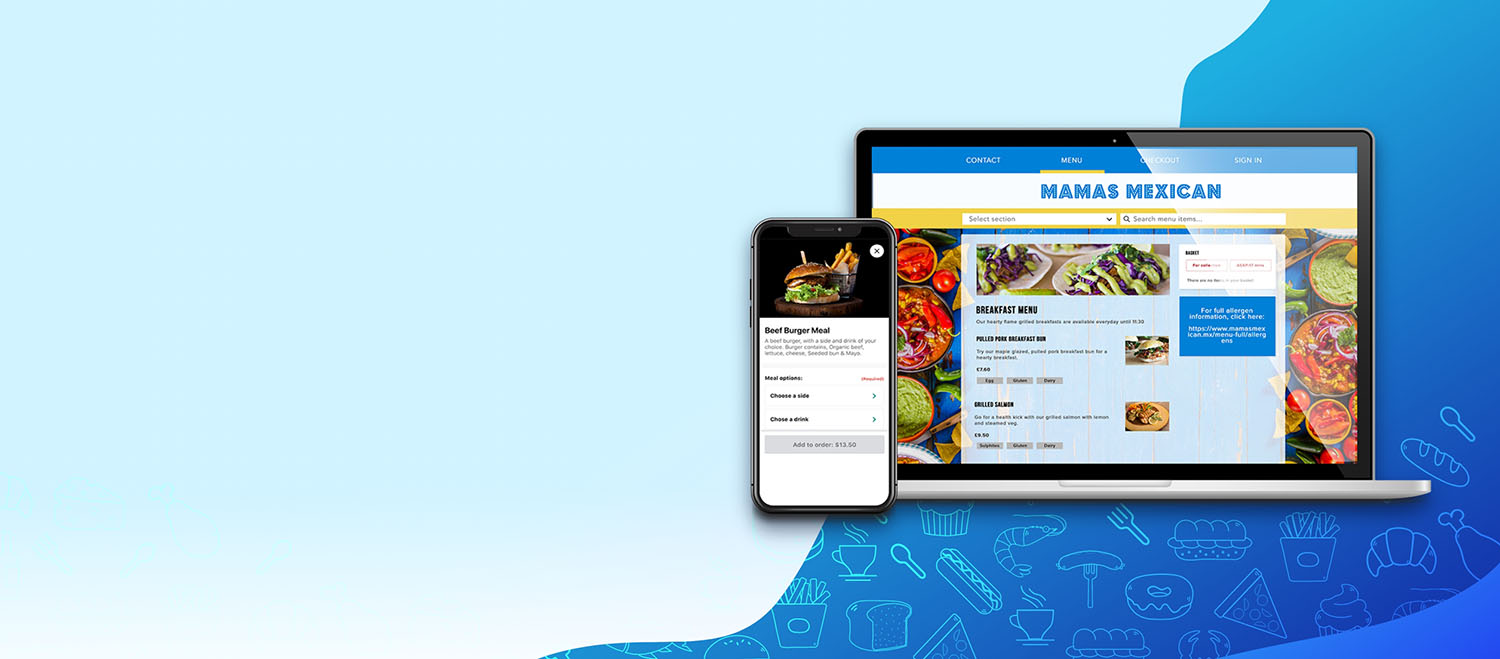

Multi-channel self-service order and payment solutions for the hospitality sector. Transforming the customer experience, reducing staff costs, and boosting sales.

Founded in 2011 by entrepreneurs Daniel Rodgers and Ronnie Forbes, QikServe is the enterprise platform for guest self-service in hospitality. Using any channel from kiosks and tablets to web and mobile apps, hospitality operators can provide powerful in-store solutions from ordering to payment, giving guests the convenience to order and pay for their food and drinks whenever and however they want.

In 2018 GCV co-invested into QikServe alongside Maven Capital Partners in a funding round that exceeded its initial target and resulted in a fundraise of £2.6 million.

1

We always look for the businesses that can make an impact; the businesses that can make a difference. Since launch, we've built a portfolio of a dozen companies across banking to threat intelligence and each continues to thrive to this day.

| Sector: | SaaS |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 556,800 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Fintech |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 2,624,694 |

| Tax Schemes: | EIS |

| Sector: | SaaS |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 808,961 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Fintech & Banking |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 1,100,000 |

| Sector: | HR Tech |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 1,453,000 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Fintech & Banking |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 1,303,855 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Property |

|---|---|

| Investment Type: | Equity & Debt |

| Investment to Date: | £ 2,000,000 |

| Sector: | Property |

|---|---|

| Investment Type: | Equity & Debt |

| Investment to Date: | £ 7,000,000 |

| Sector: | Property |

|---|---|

| Investment Type: | Equity & Debt |

| Investment to Date: | £ 3,000,000 |

| Sector: | Property |

|---|---|

| Investment Type: | Equity & Debt |

| Investment to Date: | £ 6,000,000 |

| Sector: | Fintech |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 2,381,669 |

| Tax Schemes: | EIS, SEIS |

| Sector: | Fintech & Banking |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 1,549,993 |

| Tax Schemes: | EIS |

.png?width=1128&height=594&name=Valius%20Group%20(2).png)

| Sector: | SaaS |

|---|---|

| Investment Type: | Equity |

| Investment to Date: | £ 248,299 |

| Tax Schemes: | SEIS |

From tax efficient investing to joint venture property investing, our blog is full of news, information and insights.

To keep up to date on news, events and investment opportunities, sign up to our newsletter here.

* You can unsubscribe at any point using the link provided in the footer of all emails, for more information about how we handle data you can view our privacy policy.

Growth Capital Ventures (GCV) is backed by funds managed by Maven Capital Partners, one of the UK’s leading private equity and alternative asset managers.