Alternative Investments Explained

An increasingly attractive option for investors looking to build wealth, alternative investments are renowned for their ability to target superior returns, reduce volatility and contribute to a diversified investment portfolio simultaneously.

Firstname Lastname & Firstname Lastname

Position & Position, Company

What are Alternative Investments?

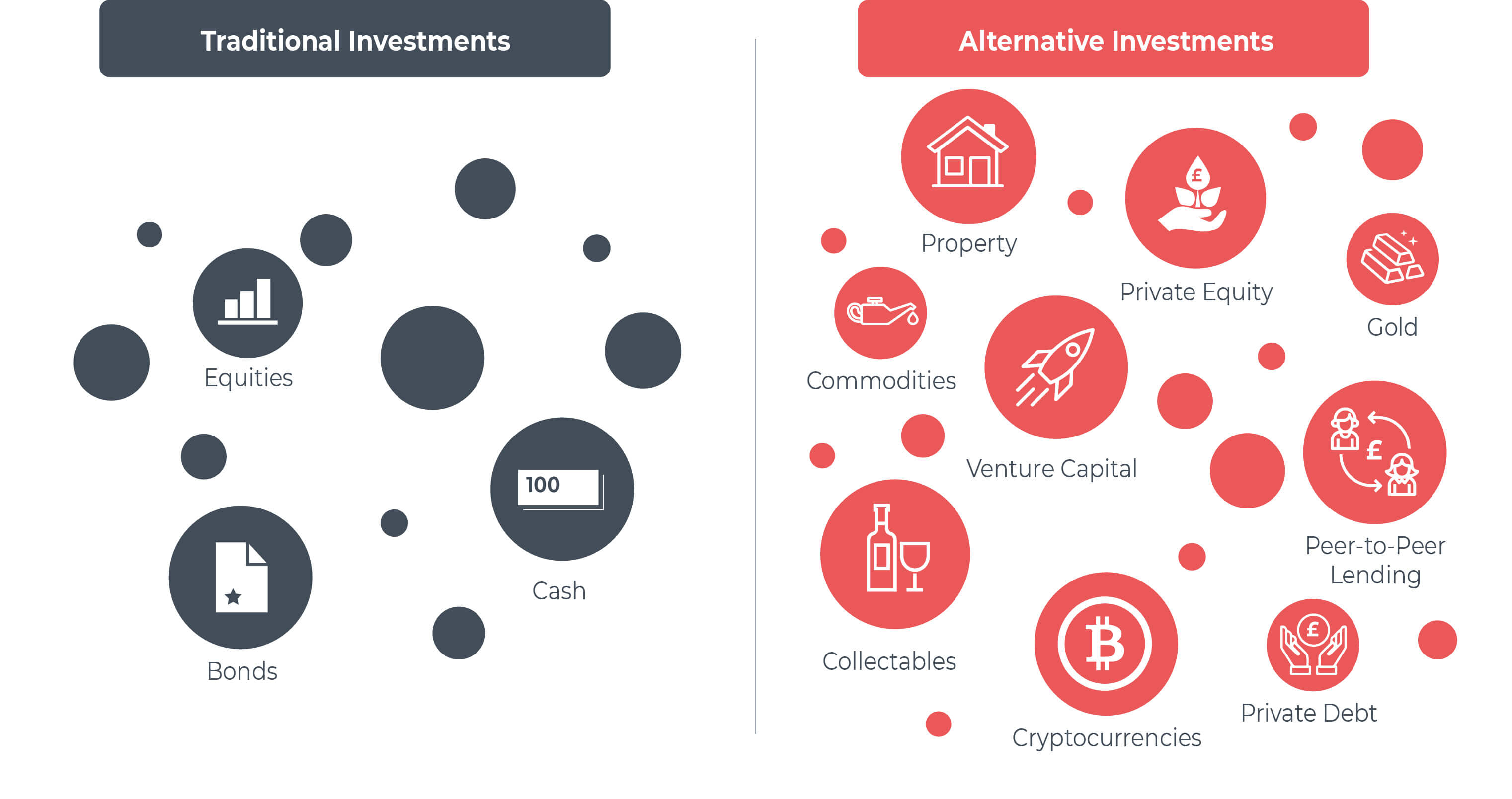

While the traditional diversified investment portfolio typically includes equities, bonds and cash, today many experienced investors are increasingly looking to bolster their asset allocation with investments that fall outside of these categories, also known as alternative investments.

On this page, we offer an introduction the alternative investment landscape, explore some of the most popular alternative asset classes available, outline the key benefits and risks associated with the space and explore how investors can access alternative investment opportunities.

Please Note:

The value of investments and any income from them can fall and you may get back less than you invested. Please note that this article has been prepared as a general guide only and does not constitute tax or legal advice.

1. Introducing

Alternative Investing

A Growing Demand

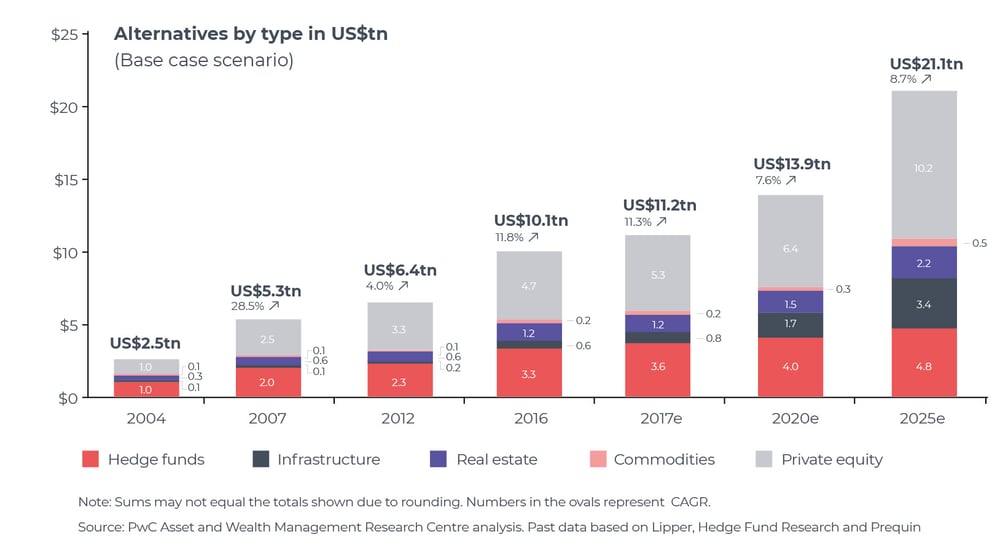

A long established space, alternative investments in their true sense have existed since the mid 19th century, but over the last two decades especially, have formed increasingly larger portions of investor portfolios.

Alternative investments are financial assets that do not fall into the categories of traditional equities, bonds or cash investments. Some examples of alternative asset classes include private equity (PE), venture capital (VC) and property investments.

Due to their lack of correlation with traditional markets, alternative investments are - by nature - associated with a range of investor benefits, generally not shared by traditional asset classes. These range from reduced correlation to external volatility to a wider scope for portfolio diversification and enhanced potential to generate financial returns.

2. Main types of

Alternative Investments

From Property to Private Equity

From property to private equity and venture capital, investors can access a broad range of alternative investments, varying in asset class, risk/return profile and investor suitability. Whilst the aforementioned remain three of the most popular options available to investors, recent years have also seen the rise of numerous emerging routes.

Venture Capital

Venture capital (VC) involves investments into early stage businesses, typically possessing high-growth potential. Whilst displaying a potentially high level of risk due to investments being made into smaller, unquoted businesses, the higher potential for growth and subsequent returns associated with VC makes it an a popular route for experienced investors. UK investors can further minimise the risk and maximise the returns of VC when accessed via tax efficient investment schemes such as the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS).

Private equity (PE) involves investing into mature companies that are not publicly traded on a stock exchange. Target returns for PE investments tend not to be as considerable as with VC due to comparatively less capacity for potential growth, but can possess a lower level of risk due to companies generally being more established.

Property

While the traditional cornerstones of any diversified portfolio typically include equities, bonds and cash, these days Institutional Investors and Private Investors are increasingly looking to ‘alternative’ investments to bolster their asset allocation.

Norman Peterson

Chief Executive Officer, Growth Capital Ventures

Peer-to-Peer Lending

An alternative asset class that has witnessed a particular growth in popularity and notoriety in recent years, cryptocurrency is a digital currency designed to function as a medium of exchange without governance from a central body. Investors in cryptocurrency can invest in a range of 'coins', the most renowned being 'Bitcoin'. Though recent years have seen the emergence of a number of cryptocurrency success stories, crypto is a notoriously volatile and difficult to predict asset class, and so is still classified as particularly high risk.

With the global alternatives industry expected to exceed $24 trillion in AUM by 2028, and the benefits of holding alternatives during periods of economic fluctuation becoming increasingly apparent, this growth shows no sign of slowing down.

Dan Smith

Venture Director, Growth Capital Ventures

Hedge Funds

Hedge funds are actively managed investment funds that use strategies like short selling, leverage, and derivatives to generate returns, often aiming for profits in any market condition. With greater flexibility than mutual funds, they offer high return potential but also significant risk. Typically requiring large minimum investments, hedge funds are mainly suited to institutional and high-net-worth investors seeking portfolio diversification.

Structured Products

Structured products are pre-packaged alternative investments that combine traditional assets with derivatives to create a specific risk-return profile. Designed to provide tailored outcomes, they can offer capital protection, enhanced returns, or exposure to alternative assets. While they can deliver attractive risk-adjusted returns, their complexity and limited liquidity make them more suitable for experienced investors.

Private debt and credit

Private credit and debt investments involve lending capital directly to businesses or individuals, typically through private lending funds or direct loans. These investments offer an alternative to traditional bank financing, often with higher yields in exchange for greater risk. As demand for non-bank lending rises, private credit has become an increasingly attractive option for investors seeking more predictable returns compared to the volatility of public markets. Although the risk level can vary depending on the borrower’s creditworthiness, private credit is often seen as a way to diversify portfolios and achieve consistent cash flow.

3. What are the benefits?

Superior Returns, Reduced Volatility

From generous tax reliefs to reduced market volatility, alternative investments, by nature, can provide investors with a range of additional benefits, generally not shared by their traditional counterparts.

Superior Returns

Whilst returns cannot be guaranteed, on the whole alternative investments have the potential to target considerably higher returns than their traditional counterparts. In part a result of their lower correlation to market fluctuations, less centralised nature and often more long term focus, this can make alternative investments especially attractive to experienced investors with less of a reliance on liquidity.

Reduced Portfolio Volatility

Largely due to their less centralised structure, alternative investments often display reduced sensitivity to traditional market fluctuations. As a result, alternatives can be more resilient when faced with external shocks, such as periods of inflation and recession.

Eligibility for Tax-Efficient Investment Schemes

Another benefit able to be accessed via the alternative investment space is the UK's range of tax-efficient investment vehicles. In the case of venture capital, these come in the form of the EIS, SEIS and VCTs, and can provide investors with up to 50% income tax relief, capital gains tax exemption, inheritance tax exemption and loss relief. Combined, these tax reliefs help to minimise the risk and maximise the returns associated with early-stage investments.

The table below illustrates three potential outcomes of a £50,000 SEIS investment for an additional rate taxpayer, in which the hypothetical company fails, breaks even and triples in value.

|

Company triples in value |

Company breaks even |

Company fails |

|

|

SEIS investment |

£50,000 |

£50,000 |

£50,000 |

|

Income tax relief |

- £25,000 |

- £25,000 |

- £25,000 |

|

Net investment |

£25,000 |

£25,000 |

£25,000 |

|

Proceeds on disposal |

£150,000 |

£50,000 |

£0 |

|

Income tax loss relief |

- |

- |

- £11,250 |

|

CGT payable |

- |

Nil |

Nil |

|

Net profit/loss including income tax relief |

+ £175,000 |

+ £25,000 |

- £13,750 |

Portfolio Diversification

Naturally, due to a vast range of asset classes existing in the alternative space in comparison to just cash equities and bonds in the traditional category, alternative investments allow for much broader, deeper level of portfolio diversification than traditional portfolios. Combining with this the range of sectors, geographies and levels of growth that can be targeted across the alternative space, this diverse nature of alternative investments allows for a more even and effective distribution of risk and returns in contrast to the comparably restricted limits of traditional investments.

Investing for Impact

Whether it is by backing transformative startups or contributing to the development of regional property projects, alternative investments can allow investors to contribute to significant social, economic and environmental impacts whilst building their wealth. Certain, schemes such as the EIS, also offer investors enhanced limits for investments into knowledge-intensive companies (KICs), furthering the potential for positive impact and returns.4. What are the risks?

Balancing Risks and returns

Though often associated with a range of benefits, equally, a number of risks are typically linked with the alternative space that should be considered prior to any investment.

Lower Liquidity

Many alternative investments may require a comparatively longer investment period before any return is realised. As a result, investors are likely to experience reduced liquidity. It is therefore crucial that sufficient funds are available to withstand this possibility.

Less Regulation and Transparency

Regulations differ for many alternative asset classes, meaning that navigating and understanding the relevant rules and restrictions can become a complex task. In addition, the underlying assets of alternative investments are often difficult to value, which can lead to challenges in pricing and price transparency.

Greater Complexity

With the alternative investment space accompanying a much broader range of asset classes, schemes, and vehicles - all of which possess their own set of rules and requirements - investing in alternatives can initially appear more complex than traditional investments. In turn, investors should ensure they conduct detailed research into the rules and structure of the investment route they follow before parting with capital.

Potential Loss of Capital

As with all investments, the risk of losing capital is present. Whilst investors can mitigate this possibility with thorough due diligence into opportunities and providers, and by mitigating risk with the reliefs and exemptions available under tax efficient investment schemes, the loss of capital is an eventuality every investor should consider prior to investing.

Higher Minimum Investments

Some alternative investment platforms aimed at more experienced investors possess higher minimum capital requirements and additional qualifying criteria then traditional routes. Though this has led to alternatives being perceived as less accessible than traditional markets by some, in recent years alternative platforms on the whole have been made more accessible to private investors than ever before.

5. How can I Invest?

Four Popular Routes

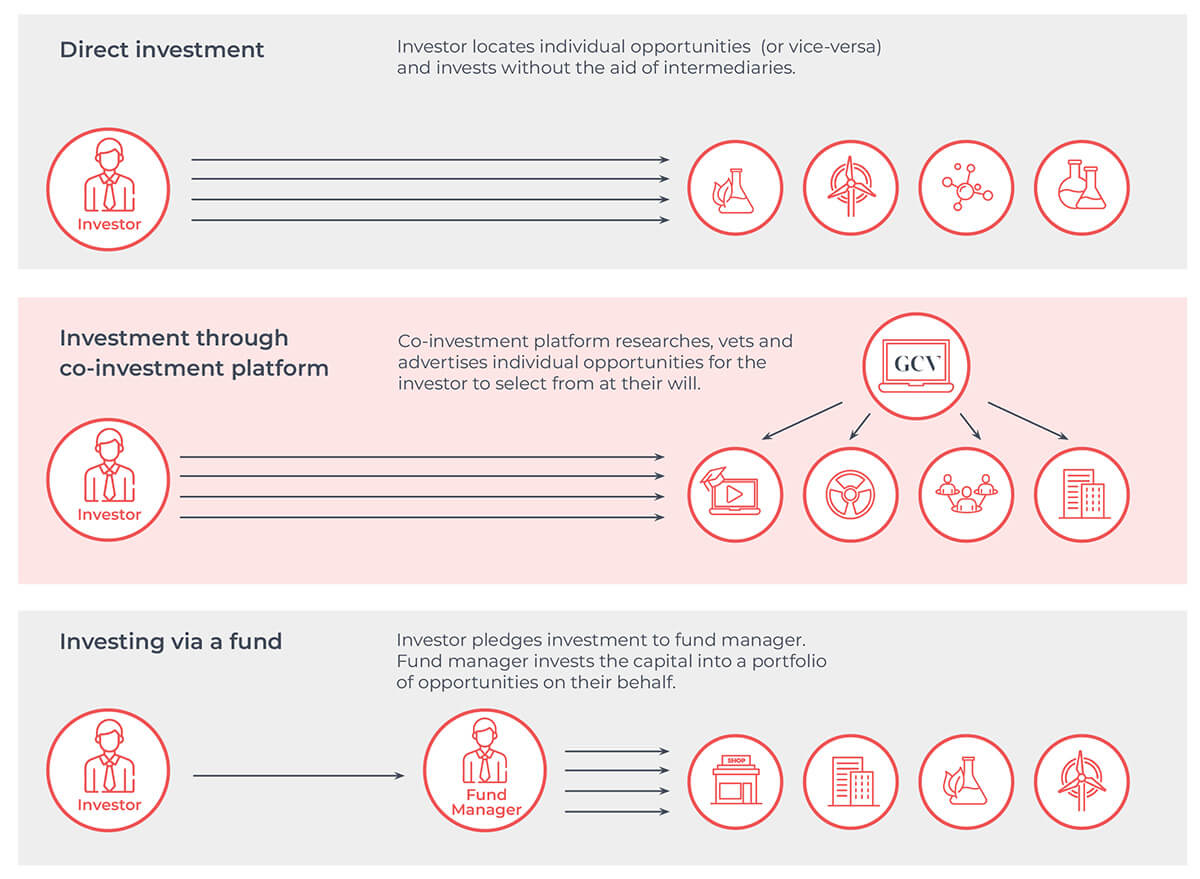

Alternative investments can be accessed via a range of routes, varying by asset class, investor experience and portfolio goals. Some of the most common methods are explored below.

Direct Investment

One approach to investing in alternative assets is via direct investment. This involves investing into an opportunity directly from the source, without any intermediaries. This approach, for example, can often be selected when a company approaches an investor or informal angel network to pitch for investment. This route is most-used by experienced investors who possess a strong background in the given field.

Co-investment Platforms

Unlike direct investments, co-investment platforms often source a number of opportunities for investors to select from at their will. Whilst platforms vary in their level of due diligence, more sophisticated platforms will employ a defined set of internal processes and benchmarks to qualify opportunities for growth potential and suitability. Co-investment platforms are usually fee-free.

Funds

An investment fund pools investor capital to invest in a set portfolio of predetermined companies/opportunities, decided by a fund manager. This route can be attractive for investors seeking less research-intensive, minimal-involvement investments. Funds charge additional fees for this service.

Online Marketplaces

An online marketplace, or online auction, is an e-commerce website built to connect sellers with buyers. Within the alternatives space, this is most relevant for collectables, such as art, wine, whisky and jewellery, or more recently virtual collectables such as NFTs (non-fungible assets).

Free Investor Guide Download

An Investor's Guide to Alternative Investments

For investors keen to enhance returns, reduce volatility and diversify their portfolio using alternative investments, this free guide offers an end to end overview of the space, exploring:

- What the term 'alternative investments' means and the history of the market

- Some of the most popular and profitable alternative asset classes available, from venture capital to property

- The risks and rewards typically associated with alternative investments

- The routes investors are able to access to invest in alternatives

Portfolio Diversification.

Superior Returns.

What we offer at GCV Invest

Alternative Investments with the potential to deliver superior returns.

GCV Invest is a private investor network and sophisticated co-investment platform, formed with the goal of connecting experienced investors with high-growth, impact-driven alternative investment opportunities that can form part of a diversified portfolio.

Join our Private Investor Network.

Our Latest Opportunities

Alternative Investment Opportunities

Residing in our three core asset classes of venture capital, private equity and property, below you can find GCV Invest's latest growth-focused, impact-driven alternative investment opportunities.

Growth Capital Ventures

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 750,000 |

| Round: | Round 4 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Hive.Hr

| Sector: | HR Tech |

|---|---|

| Target Sought: | £ 150,000 |

| Funds Raised: | £ 303,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Intelligence Fusion

| Sector: | SaaS |

|---|---|

| Target Sought: | £ 400,000 |

| Funds Raised: | £ 556,800 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Hive.Hr

| Sector: | HR Tech |

|---|---|

| Target Sought: | £ 300,000 |

| Funds Raised: | £ 1,150,000 |

| Round: | Round 2 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

QikServe

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 2,500,000 |

| Funds Raised: | £ 2,624,694 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

n-gage.io

| Sector: | SaaS |

|---|---|

| Target Sought: | £ 150,000 |

| Funds Raised: | £ 170,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Business Finance Market (trading as Finance Nation)

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 150,000 |

| Funds Raised: | £ 225,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Growth Capital Ventures

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 500,000 |

| Funds Raised: | £ 561,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Growth Capital Ventures

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 1,000,000 |

| Funds Raised: | £ 1,290,410 |

| Round: | Round 2 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Cathedral Gates

| Sector: | Property |

|---|---|

| Target Sought: | £ 400,000 |

| Funds Raised: | £ 2,000,000 |

| Investment Type: | Equity & Debt |

Middleton Waters

| Sector: | Property |

|---|---|

| Target Sought: | £ 2,200,000 |

| Funds Raised: | £ 7,000,000 |

| Investment Type: | Equity & Debt |

The Langtons

| Sector: | Property |

|---|---|

| Target Sought: | £ 700,000 |

| Funds Raised: | £ 3,000,000 |

| Investment Type: | Equity & Debt |

Thorpe Paddocks

| Sector: | Property |

|---|---|

| Target Sought: | £ 1,000,000 |

| Funds Raised: | £ 6,000,000 |

| Investment Type: | Equity & Debt |

Atom Bank

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 1,000,000 |

| Funds Raised: | £ 1,100,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

Business Finance Market (trading as Finance Nation)

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 1,000,000 |

| Funds Raised: | £ 800,000 |

| Round: | Round 2 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Finexos

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 500,000 |

| Funds Raised: | £ 695,456 |

| Round: | Round 3 |

| Minimum Investment: | £ 500 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Business Finance Market (trading as Finance Nation)

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 250,000 |

| Funds Raised: | £ 278,855 |

| Round: | Round 3 |

| Minimum Investment: | £ 1,000 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Growth Capital Ventures

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 1,000,000 |

| Round: | Round 3 |

| Minimum Investment: | £ 5,000 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Finexos

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 500,000 |

| Funds Raised: | £ 690,481 |

| Round: | Round 4 |

| Investment Type: | Equity |

n-gage.io

| Sector: | SaaS |

|---|---|

| Target Sought: | £ 500,000 |

| Funds Raised: | £ 638,961 |

| Round: | Round 2 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Finexos

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 1,309,999 |

| Round: | Round 5 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

.png?width=1128&height=594&name=Valius%20Group%20(2).png)

Valius Group

| Sector: | SaaS |

|---|---|

| Target Sought: | £ 249,999 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | SEIS |

Business Finance Market (trading as Finance Nation)

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 249,999 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

FAQs

Find out more about investing with GCV

Should you have any further questions regarding the alternative investment opportunities we offer at GCV, and how to invest with us, you can contact our Investor Relations Team at any point - but we have provided a selection of frequently asked questions below.

-

The central investment hub and co-investment platform for the GCV private investor network, GCV Invest brings together a cohort of online and offline, private and institutional investors who all share one common mission - to access growth-focused, impact-driven alternative investment opportunities.

-

GCV Invest was launched to help experienced investors build a more diversified growth-focused investment portfolio.

The GCV Invest co-investment platform has been built for clients that meet the following criteria:

Is a Family Office, Institutional Investor, HNWI or Sophisticated Investor, seeking to invest alongside like-minded individuals and connect with the alternative investment ecosystem. Is looking to deploy over £10k in alternative investment opportunities per annum. -

You can sign up to the GCV Invest co-investment platform directly here, but if you have any further queries, or would like to register your interest first person with our Director of Investor Relations, Dan Smith, you can contact him via this email - dan.smth@growthcapitalventures.co.uk

-

At GCV Invest we target growth-focused, impact-driven alternative investment opportunities that reside across the three core asset classes of venture capital, private equity and property. We source, vet and select opportunities via a number of strict internal processes, ensuring each has the potential to deliver growth, impact and tax efficiencies where possible. Ultimately this allows us to provide our investors with a convenient and effective route to building their wealth and diversifying their portfolio.

-

Yes, we specialise in sourcing carefully selected SEIS and EIS Eligible Investment Opportunities.

We look for companies that have the potential to transform an industry. Our Investment Team will assess over 300 opportunities per annum and only select those we believe have the potential to create significant value.

These are ambitious, agile businesses led by talented and highly-motivated teams, who can demonstrate a clear vision, mission and credible growth strategy, alongside a differentiated and competitive business proposition.

-

GCV uses its embedded presence in the key UK corporate finance regions to access a range of investment opportunities in private companies with significant potential for growth. These are often introduced on an off-market basis, on the strength of longstanding personal relationships, or by professional advisers who are aware of our expertise and ability to work constructively with an entrepreneurial management team to accelerate business growth.

-

Our free Guide to Alternative Investments provides an end-to-end insight into the alternative space. Answering some of the most frequently asked questions and covering the core topics surrounding the field, you can download the guide here.

Have a query that you can't find an answer to? Please leave us a message via our Contact us page.

Latest Updates

From tax efficient investing to joint venture property investing, our blog is full of news, information and insights.

VCT Tax Relief Cut: How the Change Could Reshape Early-Stage Investment

Portfolio Diversification Strategies Explained For Investors

Subscribe

Let's keep in touch

To keep up to date on news, events and investment opportunities, sign up to our newsletter here.

* You can unsubscribe at any point using the link provided in the footer of all emails, for more information about how we handle data you can view our privacy policy.

%20(3)%20(2).jpg)